AUTHOR’S NOTE: There is no single “reason” why farmers are being forced to dump their milk and why stores are largely still limiting the amount that consumers can purchase this week. The situation is complex, and two rumors are confirmed to be untrue. First, there is no health problem or health-related plant closure, nor is there a shortage of gallon jugs, according to Department of Agriculture sources. And no, milk jugs are NOT made in China. Most milk processing plants have their own plastic blow-molds and U.S. companies produce them as well.

Now that a few rumors are out of the way… Here is the industry narrative for plunging farm-level milk prices and farms being forced to dump their milk. It goes something like this: “Schools are closed, foodservice demand is stalled and exports are drying up. The first two weeks of so-called “panic buying” at supermarkets settled into a third week into the COVID-19 national emergency finding consumers continuing to ‘buy’ more milk and dairy products, but “not buying enough to overcome” the aforementioned sales losses…”

It’s difficult to buy something that is not available or has store-level restrictions enforced on how much to buy. Schools account for 8% of fluid milk sales under normal conditions, and children are still served milk with grab-and-go meals offered, which keeps a portion of that 8% going. It is not a ‘panic buy’ when a family of four wants to buy 8 gallons of milk a week because all family members are home due to COVID-19. Interestingly, one week earlier, before store purchase limits were set, USDA reported Class I beverage milk usage quite differently and Nielson Global insights showed sales up exponentially (See more here and here)

While a full report is still in process, here’s my take below as filed for the midnight April 1 press deadline for Farmshine after exhaustive calls, emails, texts, messages, reports, and analysis of letters and forms that I am still pouring over for a more complete report for next week’s edition… One late breaking detail not found below, is that some farms were able to find private food pantries such as Blessings of Hope to take milk that was destined for dumping. In order to go to food banks, the milk needs a processor to pasteurize and bottle it or turn it into something like cheese. Another late-breaking detail not found below is the unofficial tally of milk dumped in the Northeast and Mid-Atlantic region north of 200 loads, and the Southeast could approach 150, meanwhile sources indicate large national footprint cooperatives handling nationwide farm milk supplies met a weekly demand increase in the East of twice that amount. The math isn’t adding up.

Stephanie Younker of Mohrsville, Berks County, Pa. watches as her family, along other farms shipping to Clover Farms Dairy in Reading, dump two days worth of milk early this week. According to the Northeast Market Administrator’s office, six to eight different milk ‘handlers’, many of them cooperatives, reported dumping milk at the end of March and that more reports are expected into the first week of April as stores continued limiting purchases with varying availability.

March ends with dairy supply chain bottlenecks, utilization management; Farmers forced to dump milk while stores limit dairy purchases

By Sherry Bunting, Farmshine, Friday, April 3 edition (updated)

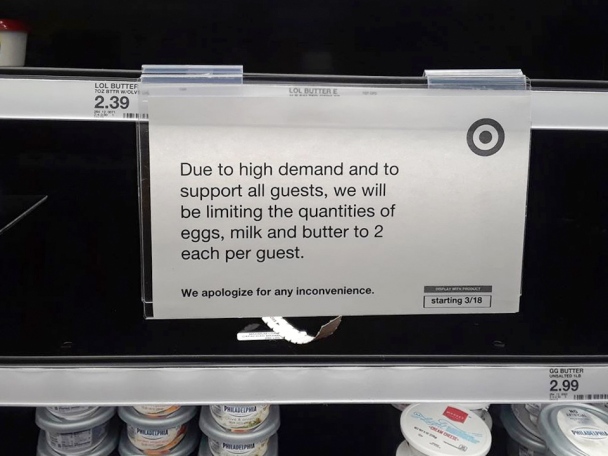

BROWNSTOWN, Pa. — While most supermarkets placed limits on consumer purchases of milk, butter and other dairy products — with the majority still enforcing those limits through April 1 at this writing — dairy farmers were forced to dump unprecedented amounts of milk throughout the Mid-Atlantic, Northeast and Southeastern states. Reports late Wednesday indicate some dumping also began in Wisconsin this week.

On Wednesday, the Northeast Market Administrator’s office confirmed six to eight different handlers, principally cooperatives, had reported dumping milk at the end of March in the Northeast Federal Milk Marketing Order. (Payment, pricing and utilization of Class I beverage milk is regulated by the U.S. Department of Agriculture (USDA) under 11 Federal Milk Marketing Order regions across the country. Prices paid to farmers are based in part on the receipts and utilization reports that are filed by milk “handlers” at the end of each month — dividing the milk by how it was used into four classes of which Class I beverage milk is the highest priced, Class II is frozen and soft products, Class III is cheese, and Class IV is butter and powder and is typically the lowest class.)

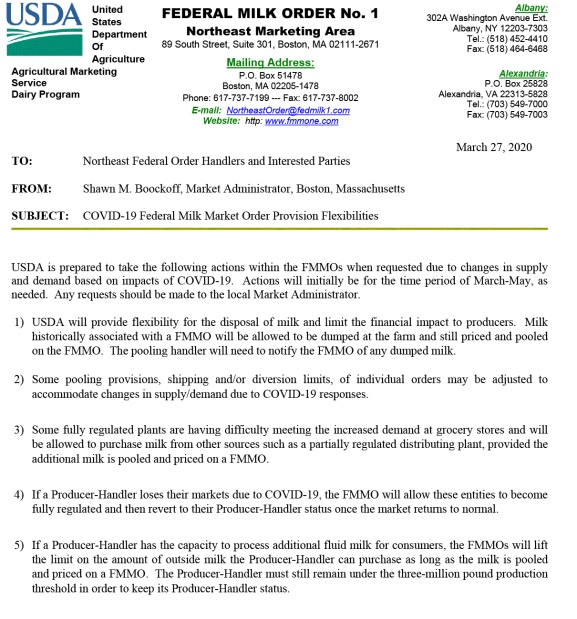

USDA Dairy Programs in Washington had received numerous phone calls and inquiries from milk handlers (processing plants and cooperatives) last week and issued a notice late last Wednesday, March 25, stating that, “In response to questions from the dairy industry, USDA will be implementing allowable flexibilities … to meet the changing consumer demand within the Federal milk marketing order program. The flexibilities will meet changing needs of both the dairy farmer and dairy processor and manufacturing communities to ensure efficient milk movements from farm to table. USDA wants the public to feel reassured that retail outlets will have milk available.”

This was followed by a letter (above) from the Northeast Milk Market Administrator, allowing flexibility for milk to move from unregulated non-pool dairy product plants into regulated Class I beverage or pool plants and between Milk Marketing Order areas to serve “increasing demand” for fluid milk. The same document states that milk disposal on farms that are “historically associated” with the Order can be dumped, pooled and priced on the Order as “other use” at the lowest Class value. (Clarification: Outside milk from other Orders going into Class I use would be pooled and priced on the Order from which the milk came.)

This was followed by a letter (above) from the Northeast Milk Market Administrator, allowing flexibility for milk to move from unregulated non-pool dairy product plants into regulated Class I beverage or pool plants and between Milk Marketing Order areas to serve “increasing demand” for fluid milk. The same document states that milk disposal on farms that are “historically associated” with the Order can be dumped, pooled and priced on the Order as “other use” at the lowest Class value. (Clarification: Outside milk from other Orders going into Class I use would be pooled and priced on the Order from which the milk came.)

For March 2020, Class IV is the lowest value, with the price announced for all Federal Orders Wednesday, April 1 at $14.87 per hundredweight (100 pounds) or $1.27/gal. compared with the Class I beverage milk price in the Northeast for March at $20.71 ($1.78/gal). The more Class IV or dumped ‘other use’ milk priced on the order for March, the lower the blend price paid to all farmers for all uses combined. It is already looking like prices paid to farmers for the next three months could fall into the $13 to $14 / hundredweight ($1.16/gal) range or lower. Average breakeven price for farms to produce milk is $17/hundredweight or $1.45-$1.50/gal.)

What started with the news that Mount Joy Farmers Cooperative and the greater DFA cooperative would be forced to dump eastern Lancaster County milk into manure pits for lack of a plant to process it over the weekend (March 28-29), grew to include confirmation of farmers in Berks, Lebanon, Cumberland, Franklin and Perry Counties being forced to dump milk into early this week. And reports from western Pennsylvania indicate the same.

By Monday, all independent dairy farm producers for Clover Farms Dairy in nearby Reading, Pa. were receiving notices that they would have to dump 48 hours worth of month-end milk between Monday and Wednesday (March 30-Apr. 1).

Add to this, confirmation that DFA members were having to dump milk in New York and Vermont, and that small independent cooperatives in New York were either having to dump some of their milk or were being shut out of the ‘spot’ market and having to dump all of their milk. Farms in the Southeast states began reporting they, too, were being notified they would have to dump milk with no where for it to go.

Furthermore, Land O’Lakes member farms in Pennsylvania’s mid-state reported dumping significant milk loads Tuesday, after shipments to the Weis Markets bottling plant in Sunbury, Pa. were turned away despite the Weis Markets stores throughout the region having scant supplies of milk and still enforcing 2-gallon per shopper limits as of Wednesday, April 1.

Walmart’s milk cooler in Hamburg, Berks County, Pa. on April 1, 2020

As Walmart, Weis, Aldi’s, Target, some Giant stores, and others were confirmed to have sparse or empty dairy coolers — and a few chains and small town stores reported good stocks of milk and some dairy products — farmers continued to be forced to dump their milk, being told the dairy plants were full, the stores were not ordering, and consumer demand had shrunk after being described by USDA the previous week as “exponentially higher” than a year ago and “extraordinary”, “haywire” and “overcoming inventories” the week before that.

Signs like this one at Target were the rule, not the exception among many store chains this week, while nearby dairy farmers were forced to dump milk.

Adding to the complexity of the issue is milk silos and tanks full of cream that could not be moved as candy makers and bakeries closed or cut back, and foodservice and institutional trade came to a standstill.

As the industry supply chain adjusts product lines from schools, restaurants and other foodservice products to retail-packaged products, some plants reported not being able to process milk fast enough for two weeks of surging demand, bringing outside milk in — only to find the stores had started limiting consumer purchases or were spreading their risk of running out by stocking other brands. Difficulties unloading milk to stores in New York City was also cited.

In store dairy cases where milk was most scarce this week, store managers indicated issues with getting supplemental milk from other processors in other areas due to regulatory pricing “zones”, which they interpreted to mean that milk was being rationed so a more uniform distribution of available supplies would occur.

In terms of retail manufactured products, butter continues to be mostly unavailable at stores checked throughout the Mid-Atlantic region, and reports coming in from other areas indicate similar scant supplies and restricted purchases.

By Wednesday, April 1, some stores were re-stocked with milk and dairy products, and a few chains were lifting restrictions on gallons of milk, but they were the exception, not the rule. Almost universally, however, butter was absent or limited at retail outlets despite a cold storage bulk inventory report by USDA last week stating there was 25% more butter in storage than a year ago. Still, last week, processors made more bulk butter for foodservice that ended up in inventory, doing ‘print’ butter for retail on more of a hand-to-mouth basis, and the result is obvious in the lack of butter available to consumers seeking it at retail.

Jennifer Huson, senior director of communications for DFA Northeast reports that anyone having to dispose of milk should take measurements.

According to USDA Dairy Programs, producers should also collect an agitated sample. If not available, it is possible that missing samples can be quantified using previous and next samples in order to calculate protein and butterfat levels for the volumes of discarded milk that in most cases officials say will still be pooled and priced on the Federal Orders.

It is also apparent — according to Federal Order rules and the announced flexibilities — that Class I handlers have a clear financial incentive to price and pool this dumped milk on the Order because it will be priced at the lowest class value ($14.87 instead of $20.71), allowing them to draw from the pool while diluting the previously exponentially higher Class I utilization percentage experienced across the entire Northeast Federal Order the previous two weeks in terms of reducing the USDA blended price based on the milk handlers’ reports of receipts and utilization for March due around April 10 to the Market Administrator’s office.

While there are conflicting reports from some plants and handlers about whether farmers will be paid for the milk they are forced to dump, DFA says dumped milk will be pooled and paid, but they are tracking and looking at it from a comprehensive standpoint to see how to handle and aggregate it going forward.

“We want to make sure we are doing everything we can to fully understand our best opportunities moving forward through dynamics that are changing day by day and hour by hour,” said Huson. “Most importantly, in these uncertain times, we are working to make sure milk continues to be picked up, plants continue to operate, and wholesome dairy products continue to be available to consumers. We are not sure what is coming at us, and we want to make sure as this is evolving that we are doing all of those things.”

Look for a full and ongoing report next week in Farmshine.

Want to learn more or find out how to help? For an informative FAQ click here

Pingback: April 2, 2020 | Andy Arthur.org

There is no EXCUSE FOR THIS! Our dairy farmers ere struggling before !! Let the farmers open road side stands!!

LikeLike

This is terrible 😥

LikeLike

The stores are limiting because we are being shorted on the amount that is ordered , for example when you order 30 cases of a product and only received 10 cases then you have to limit so greedy people don’t take it all . That way more people can receive milk ECT.

LikeLike

Sadly, the farmers have no control over this. I suspect there is a farm-level pricing aspect to this end or beginning of month dumping as explained in the article. But again, farmers have no control over that either. The industry between farm and consumer is not prepared for consumers now feeding their families at home. Hopefully this will settle out as plants that produced products for foodservice adjust their lines to do more consumer packaged goods. At least that is my hope.

LikeLike

I think this is probably true of other food stuffs as well. It’s a matter of changing packaging over from restaurant style to supermarket type.

LikeLike

Too bad they couldn’t donate the excess to the homeless shelters, dog/cat rescues. They’re low on donations and could use it, especially right now. It would probably be tax deductible on top of that

LikeLiked by 1 person

If the milk is not picked up by a truck and taken to a processor for sale OR donation, it must be dumped because on-farm tanks only hold one to two days of milking and the cows keep milking.

LikeLike

Is there a ways and would it be feasible for the excess milk to be donated to homeless shelters, animal shelters? They are low on funda especially right now and milk would go a long ways towards feeding humans and dogs/cats.

LikeLike

The problem is finding a processor to package it or make cheese. A whole truckload of milk can’t just be delivered from the farm to the homeless shelter. The breakdown and bottleneck is between the farm and the consumer

LikeLike

4/2/2020: Shocking!!! This is truly a national disgrace!!! I’ve been having trouble finding even one container of skim milk in Bethesda, Maryland. And what about food banks, etc. So-called “journalists” at the daily WH briefings are failing to do their jobs, obviously!!!!!

LikeLike

The food pantries would of loved to receive that milk to be able to distribute it to families in need.

There are plenty of food pantries through out each state having to do this.

I would see that as a better way to go than to just dump it and be at a total loss.

LikeLike

Wherever a processor could be found to pasteurize, bottle or make cheese with the milk for FOOD PANTRIES, this was done, but these farmers had no warning and the food pantries largely could not find a processor with the capacity or ability to do this as their onsite receiving silos are full. Everything possible is being done by the farmers to donate instead of dump, but they are not the haulers or the processors, they are stuck if a truck won’t pick it up and take it to a processor, the problem is in the middle

LikeLike

They also cannot hold onto the milk because their tanks hold two days worth and the cows keep milking.

LikeLike

I know of 3 loads of milk that DID go to processors for food bank or pantry donation. But we are talking about hundreds of loads all of a sudden with no where to go.

LikeLike

This is infuriating. As our grocery store has been completely out of milk the last few weeks. Where is the disconnect. Why are the farmers suffering? And the consumers? This is so wrong.

LikeLike

Even before the virus, Co-ops CEOs and boards refused to even ask their producers to reduce production. USDA and NMPF/DMI, USDEC (Vilsack check off salary $999,421) all wanted an ocean of milk to keep prices down for exports, to make money on Co-op processing and grow market share. Producers are at the bottom and must take what is left. Co-op Boards and all Dairy Leadership leave ignored the farmers. The virus just accelerated their failure. Co-ops MUST be returned to the farmer/owners–with one goal, PRODUCER PROFITABILITY !!!!

LikeLike

Pingback: Industry, government follow grassroots donations lead, CFAP adds to dairy demand driving markets higher | Ag Moos