By Sherry Bunting, Farmshine, March 26, 2021

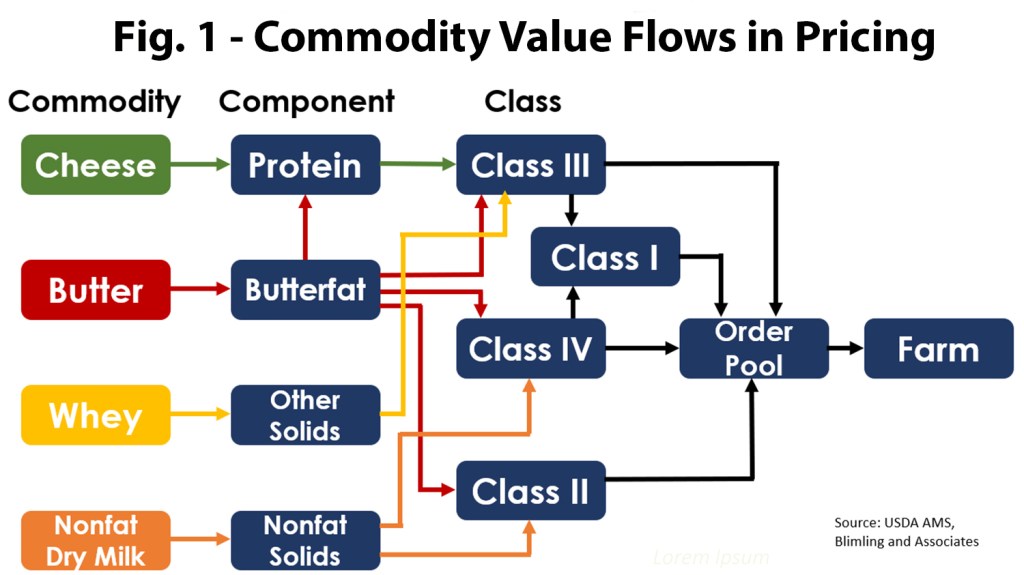

I challenge anyone to find a pricing system on anything in the universe as complicated as the pricing of a hundred pounds of milk (See Fig. 1).

The Federal Milk Marketing Order (FMMO) system goes back to the 1930s Ag Marketing Law. In 2000, changes were made to use end-product pricing formulas for four base commodities – Cheese (block and barrel Cheddar average), Butter, Nonfat dry milk (NDFM) and Dry Whey.

Today, these four commodities trade daily on the spot cash market at the Chicago Mercantile Exchange (CME), where less than 1% of volume, closer to 2% on butter, is sold. Since 2018, this 10-minute daily spot auction is done completely as an electronic auction.

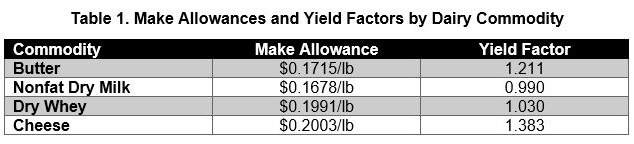

The CME spot market sets the pace for actual sales reported weekly to USDA by around 100 processors. From these weekly-reported prices, a weighted average for each of the four commodities is calculated by USDA. The weighted averages are used in formulas that account for yield and deduct specific “make allowances” (See Table 1) to then calculate Class and Component prices.

But first, these weighted price averages for just the first two weeks of each month are plugged into a multi-step formula to determine an Advanced Skim Pricing Factor for Class III (cheese/whey) and Class IV (butter, NFDM). The adjusted butter price is also used to calculate the Advanced Butterfat Pricing Factor.

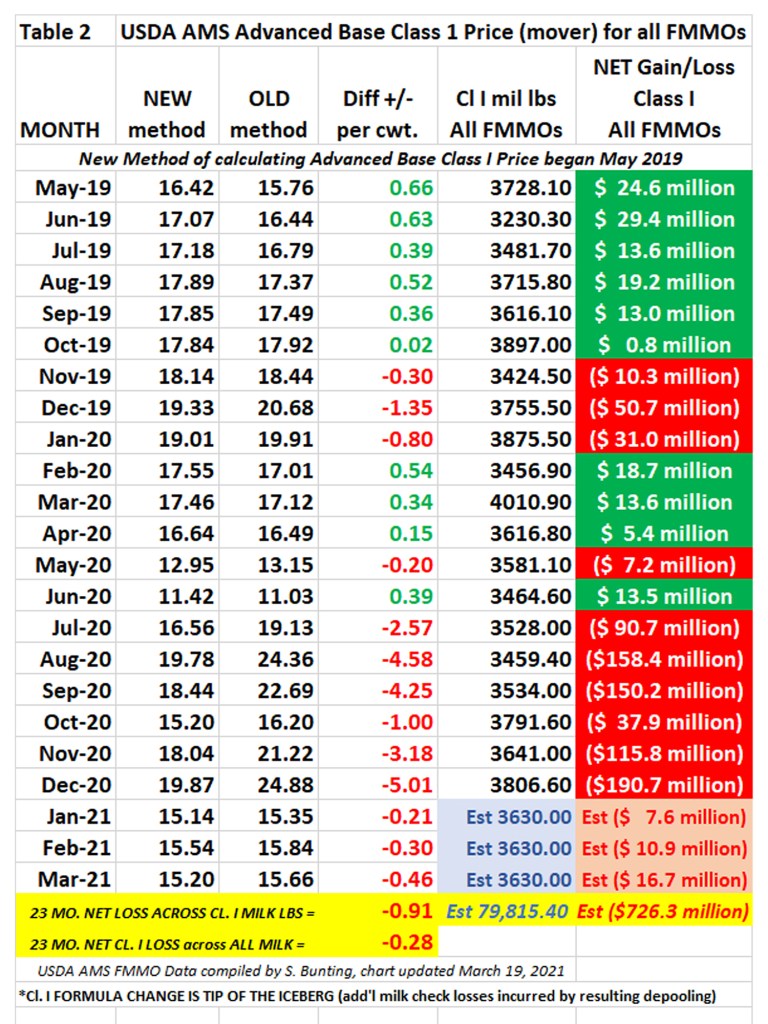

Effective May 2019 — as a result of a change agreed to by National Milk Producers Federation and International Dairy Foods Association and then passed by Congress in the 2018 Farm Bill — the 2-week Class III and IV Advanced Skim Pricing Factors are averaged together, plus 74 cents to calculate the Base Skim Price.

Prior to May 2019, the Base Skim Price was simply the “higher of” either the Class III or the Class IV Advanced Skim Pricing Factor.

(Author’s Note #1: The previous ‘higher of’ method was the way the FMMOs could make sure Class I always brought the highest price to fulfill the purpose of the Federal Orders – assuring fresh milk supplies – and to keep other handlers invested in pooling their milk. We can’t lose sight of the fact that the fluid milk sales (Class I) have no market transparency as to their value – at all. In some states there are loss-leader laws or minimum pricing provisions, but in most states, Class I fluid milk sales are treated as a base commodity by large retailers like Walmart and Kroger. They loss-lead the retail consumer price of fluid milk to extreme low levels, even as low as $1 per gallon, to win shoppers. They do this because supermarket data show fresh fluid milk is in over 94% of consumer shopping carts! Because it is treated as a loss-leader in some states, and regulated with minimum pricing in other states, it’s impossible to know the real market value of Class I fluid milk apart from the value of its components in making other products.)

Next, the Base Skim Price is multiplied by a yield factor of 0.965 and the Advanced Butterfat Pricing Factor is multiplied by a yield factor of 3.5 and then added together to become the Base Class I Price. This price, known as the Class I ‘mover,’ is announced before the 23rd of each month but is used in the following month.

The various location differentials throughout the 11 FMMOs are next added to this Base Class I Price.

Whew! Now back to those weekly-reported commodity prices, yield factors and make allowances… Announced around the 5th of the next month, the other class prices are a function of the component values based on average weekly prices for the four commodities for four weeks: Component Value = Yield x (Commodity Price – Make Allowance).

In Multiple Component Pricing FMMOs like the Northeast (FMMO 1) and Mideast (FMMO 33), a Statistical Uniform Price (SUP) is calculated from these Class and Component prices according to how the milk in the FMMO was utilized. The SUP is announced around the 11th of the next month before settlement checks are paid for the previous month’s milk.

(Author’s Note#2: Another wrinkle… did you know that an uptrending cheese and butter price can leave producers with a lower protein price? It happened in March 2021. Every end-product — butter, cheddar, nonfat dry milk and dry whey — was higher in March than February, and Class III, IV and II pricing were also higher, but the uptrending butterfat portion of the cheese price creates a ‘snubbing’ effect on the ability of protein to rise within the skim portion. Yes, it’s complicated, and the answer from USDA is a story of its own in the future.)

The FMMO SUPs are based on a 3.5% Butterfat test, but the FMMOs also report for information purposes a uniform price based on the average actual fat test. Your price will differ in your milk check based on your fat, protein, and other factors. In general, producing protein and butterfat above the statistical level nets a higher price, under normal conditions. Lately this has not held out because of negative PPDs.

What are PPDs? Along with the SUP, the FMMO calculates a Producer Price Differential (PPD). This shows how money remaining in the producer settlement fund is divided across the qualified hundredweights of milk, after all components are paid. Sometimes this is a negative number, meaning there was not enough money in the producer settlement fund to pay all of the actual component value after the location differentials on Class I were paid. A negative PPD represents spreading the shortfall across qualified milk in the pool. Severely negative PPDs represent unpaid component value.

The PPD is calculated by subtracting the Class III price from the average of all classes together: PPD = SUP – Class III. In the Northeast and Mideast FMMOs, this PPD has typically been a positive number but has been shrinking in recent years and has been negative for 13 of the past 23 months.

Negative PPDs happen for any or all of four main reasons:

1) When a rapid rise in commodity price(s) is not captured in the 2-week Advanced Pricing Factors.

2) When Class II and IV are far below Class III.

3) When Class I price falls below Class III because of the new averaging method when the spread between III and IV is greater than $1.48/cwt. Half of the months from May 2019 through December 2020 had a lower Class I Base price under the new method, representing a net loss of over $700 million on Class I pounds across all FMMOs. (See Table 2)

4) When handlers de-pool Class III milk because it is higher — to avoid paying into the pool.

Only Class I handlers are required to pool all of their milk. Other handlers can choose what non-Class I milk to pool or not pool based on what is financially advantageous. De-pooling is more likely when multiple months have negative PPDs because of wait times to re-qualify milk for the pool. Some FMMO pool-qualifying requirements are more stringent than others, and the rules have been loosening in recent years because handlers say they need more flexibility to meet fluctuating fluid milk needs.

Occasionally, when cooperatives or plants de-pool Class III milk, some will pass the higher value they withheld from the pool directly to their own producers. In most cases, however, this did not happen in 2020. Additionally, the severity of negative PPDs across FMMOs varied and this created a wide range of milk check pricing of $8 to $10 from top to bottom, when normally this range is $2 to $3, maybe $4. USDA relates that the value is still in the marketplace, so even when the PPD goes negative, some of that value is attributed to the All Milk price used in Dairy Margin Coverage margins because the value is in the market even if it is not in the “pool.”

In addition, for Pennsylvania dairy producers, all Class I milk from Pennsylvania farms that is bottled in Pennsylvania and sold in Pennsylvania stores receives the Pa. Milk Marketing Board (PMMB) over-order premium, which currently stands at $1.00/cwt. Processors can reduce this obligation by selling and sourcing milk from in and out of state as well as other methods.

Cooperatives are producers under the Pennsylvania law, so they collectively receive this premium also, where applicable, and have the ability to disburse the premium to members as they see fit.

Every farm’s mailbox price is further affected by premiums, such as quality bonuses, and deductions, such as trucking cost and marketing fees, which all vary across cooperatives and milk buyers.

This ‘primer’ just scratches the surface of current milk pricing issues. A related topic affecting many producers since May 2019 is how the new Class I pricing method, and the negative PPDs and depooling that can result when Class III and IV are so divergent, affect the way price risk management tools work, creating additional losses in many cases.

(Author’s Note #3: This article has been updated since it was previously published in R&J Dairy Consulting’s customer newsletter.)

-30-

Pingback: Time is short for short-term fix of failed Class I pricing change | Ag Moos

Pingback: Covington: Class I change cost producers ‘real money’ | Ag Moos

Pingback: Proposals, hearing requests, grassroots outreach to lawmakers as Class I ‘mover’ debate heats up | Ag Moos