Milk pricing formulas and ‘make allowances’ can feel like rocket science, farmers point out the pitfalls in ignoring the impact of mozzarella and the rising costs on dairy farms. Georgia and California producers among those testifying on make allowances, along with economists, including Dr. Mark Stephenson

Previous FMMO hearing updates can be found here and here

By Sherry Bunting, Farmshine, September 15, 2023

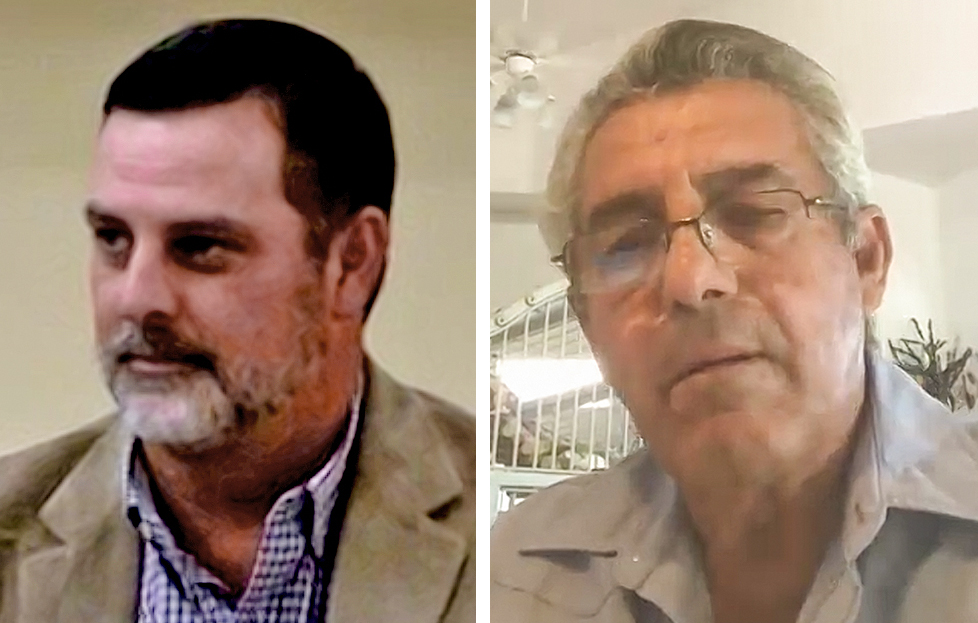

CARMEL, Ind. — “It’s really simple. We made it to the moon back in the late 60s… if you tell me that we can’t figure this little (mozzarella) equation out, we got something wrong,” said Joaquin Contente, the son of Portugese immigrants and a lifelong dairy farmer near Hanford, California as he gave virtual testimony Friday, Sept. 8 during the ongoing USDA Federal Milk Market Order (FMMO) hearing in Carmel, Indiana.

Contente serves on the California Dairy Campaign (CDC) board, which is a member of California Farmers Union (CFU) and National Farmers Union (NFU) as well as Organization for Competitive Markets (OCM). His son and daughter today run the 1100-cow multi-generational dairy farm in California’s San Joaquin Valley.

“Mozzarella should no longer be ignored. This issue was raised in 2000, and the volume and demand have grown dramatically since then,” he said, referencing CDC’s proposal and citing USDA data showing mozzarella production last year was nearly 5 billion pounds while cheddar was short of 4 billion pounds, and all cheeses totaled just over 14 billion pounds.

“I represent myself and many other producers who are reluctant to step up and speak out in opposition to what is being said by milk handlers, out of fear of retribution,” he reported. “It is essential to include the largest cheese category – mozzarella. The volume has significantly exceeded cheddar, and the Class III price should be modified to reflect these market conditions.”

Contente noted comments about the change in the Class I base price from ‘higher of’ to ‘average of’ costing farmers $1 billion over four years’ time.

“This mozzarella issue, if you understand the formulas and yield factors, is costing dairy farmers more, annually, well over $1 billion — and that’s a conservative number I am using,” he said.

“We have situations where the milk price drops dramatically, 30 or 38%, so you have to look at this discrepancy going on over a couple of decades. Nobody is talking about it… you’ve got to be a little bit quiet about mozzarella because you don’t want to upset ‘the mozzarella people,’” said Contente, noting that mozzarella production is 12% larger than cheddar with very high yields.

“There is information that needs to be collected, and that is the roadblock right now. It’s the largest category, and yet there is no reference to it, and the yields are so high that these cheesemakers are making product that they’re not getting charged for. It’s for free — off our backs,” he said. “We are in a system that requires price discovery of the uses of milk, and here we have the highest (volume of cheese) use in mozzarella, and we just turn the other way… why?”

The past two weeks of the daily 8 to 5 hearing sessions have been quagmired in the nuts and bolts of multiple proposals on what’s included or excluded from the pricing surveys as well as the corresponding make allowances as the hearing moved into its fourth week Wednesday (Sept. 13).

Like other producers testifying so far, Contente detailed the loss of dairy farms around him and the discrepancy between milk prices and cost of production leading to mass exodus of dairy farms currently.

Economists from academia and from cooperatives later showed numbers revealing the hard reality that the farm-well for pulling out more processor investment money is running dry.

In fact, Contente pointed out that the processor make allowance cost surveys include “return on investment,” something he said is lacking for dairy farmers in their milk prices. This was corroborated in later testimony by Cornell’s Dr. Chris Wolf and DFA’s Ed Gallagher.

During Dr. Mark Stephenson’s testimony Tuesday (Sept. 12), we learned that the current voluntary make allowance cost surveys include “opportunity cost” for plant assets used to make the products included in the survey.

“As farmers, we don’t get a return on investment,” said Contente. (And the numbers put up by expert witnesses show farmers don’t get ‘opportunity cost’ either.)

In fact, Gallagher said it’s important for USDA to consider the impact of its hearing decisions on farmers because if they can’t reinvest in their operations, it affects the infrastructure, the lending and the farmers’ access to capital — putting the milk supply at risk.

While Contente’s testimony focused on the mozzarella proposal supported by CDC, CFU, NFU and OCM, he also voiced their opposition to any increase in make allowances for processors.

On the latter, American Farm Bureau Federation agrees. AFBF also opposes any increase in make allowances based on voluntary surveys without first seeing results of a mandatory and audited processing cost survey.

AFBF’s chief economist Roger Cryan on cross-examination asked Contente if NFU opposes the make allowance increases due to the voluntary and unaudited nature of the cost surveys. “Yes,” was his response. “Very good,” said Cryan.

The IDFA make allowance proposal would reduce farm milk prices by $1.25 per hundredweight initially and even more down the road.

For Class I producers, the net result is an embedded make allowance deduct as large as $3.60/cwt at current make allowance levels, which could rise above $5.00 in a few years if the IDFA proposal is approved.

This producer loss is embedded in the Class I price even though Class I processors are not even asked by USDA to provide their cost data.

Georgia milk producer Matt Johnson testified in support of NMPF’s various proposals, which include returning to the ‘higher-of’ Class I base price and increasing the differentials. On the issue of make allowances, he said the NMPF proposal is preferred because it makes smaller adjustments.

“I understand that make allowances are an important aspect in determining Federal Order class prices, and from time to time, there is a regulatory need to adjust them,” said Johnson; however, “my milk price will go down when make allowances go up. I ask that when increasing make allowances, the Secretary consider the impact on dairy farm milk prices… and profitability. NMPF has proposed more modest changes to the make allowances, which are projected to lower farm milk prices by about $0.50 per hundredweight (not $1.25).”

During cross-examination, Johnson was specifically asked by USDA AMS administrator Erin Taylor to explain how the make allowances affect him as his farm’s milk goes mainly to Class I markets in Florida and the Southeast, not to manufacturing.

“It’s all negative,” he replied. “The make allowances are used in the prices used to figure the base Class I milk price. I don’t know who gets that draw, but for me, it’s all negative.”

In addition to CDC’s proposal to add mozzarella, American Farm Bureau defended its proposal to add 640-lb block cheddar and bulk unsalted butter, and NMPF defended its proposal to remove 500-lb barrel cheddar.

Several days of detailed accounting testimony were heard, and the kicker was when representatives for Leprino and IDFA stated that barrels should be kept in the survey as a ‘market clearing’ product that is ‘storable’, but that bulk mozzarella should not be added because it’s a higher moisture, fresh cheese, not storable like cheddar, making it a product that is not a ‘market clearing’ product. (This idea of ‘what is market clearing’ was further explored this week as needing a new definition now that there is no dairy price support program or government storage of dairy products).

Interestingly, in cross examination, we learned that barrel cheese — which Leprino and IDFA want to keep in the survey — is also a relatively fresh cheese, not all that different from bulk mozzarella, as only 4- to 30-day-old barrel cheddar is reported.

At one point, cheese industry representatives suggested the spread between blocks and barrels is used to price ‘basis’ and to price exported products, while block cheddar is mostly used to price other cheeses. Witnesses indicated some processors use barrel movement to price cheeses, such as mozzarella.

Some expert witnesses contended that other products can’t be added to the FMMO pricing formula because they are not traded on the CME. AFBF’s Cryan retorted that the CME should not be running this show, and he noted that dry whey wasn’t traded on the CME until after it was added to the FMMO formulas.

In fact, CME futures hedging, CME cash spot markets and the risk management tools that use these exchanges were a contentious point. Some witnesses said USDA formula changes will ‘disturb’ risk management contracts, and must be delayed 15 additional months after a USDA final decision to avoid such disturbance.

On a similar note, economist Dr. Stephenson, while providing academic processor cost survey information this week, was cross-examined by economist Dr. Marin Bozic for Edge cooperative. Bozic asked Stephenson if the disturbance of risk management practices would ‘fit’ his understanding of ‘disorderly marketing’.

Stephenson replied: “No… I am not sure hedgers or speculators should be first or foremost in the minds of FMMO personnel. That’s not what we are here to do.”

-30-

Pingback: Editorial: What was really behind ‘rockier road’ this summer? USDA revisions show fewer cows, less milk June-August | Ag Moos