Farm Bureau economist Danny Munch closes FMMO hearing Jan. 30, 2024 with emergency request for USDA to return Class I ‘mover’ formula to ‘higher of’

By Sherry Bunting, Farmshine, Feb. 2, 2024

CARMEL, Ind. – Over 5 months and 500 exhibits have gone by in the nearly 50 hearing days since the long-awaited national hearing on Federal Milk Marketing Order modifications began Aug. 23, 2023. It ended Tuesday, Jan. 30th with a last-minute witness bringing forward American Farm Bureau’s request for an emergency decision by the USDA Secretary to restore the ‘higher of’ method for calculating the skim portion of the Class I ‘mover’ price.

This hearing went on longer than expected, and the implementation of any final decisions from a multitude of proposals in various areas of FMMO milk pricing are at least 12 to 18 months away under ordinary post-hearing processes, hence the AFBF request for emergency decision-making on the Class I mover to go back to the higher of.

“If USDA would implement this on an emergency basis, it helps with the confidence and perception piece of it. So, if there is a whisper of hope, to see that there will be a positive outcome coming soon, an optimistic change that is coming that fuels them. Do they see things getting better? Or are things going to stay the way they are? ” said AFBF economist Danny Munch while being cross-examined after reading into evidence the letter signed by Sam Kieffer, AFBF vice president of public policy.

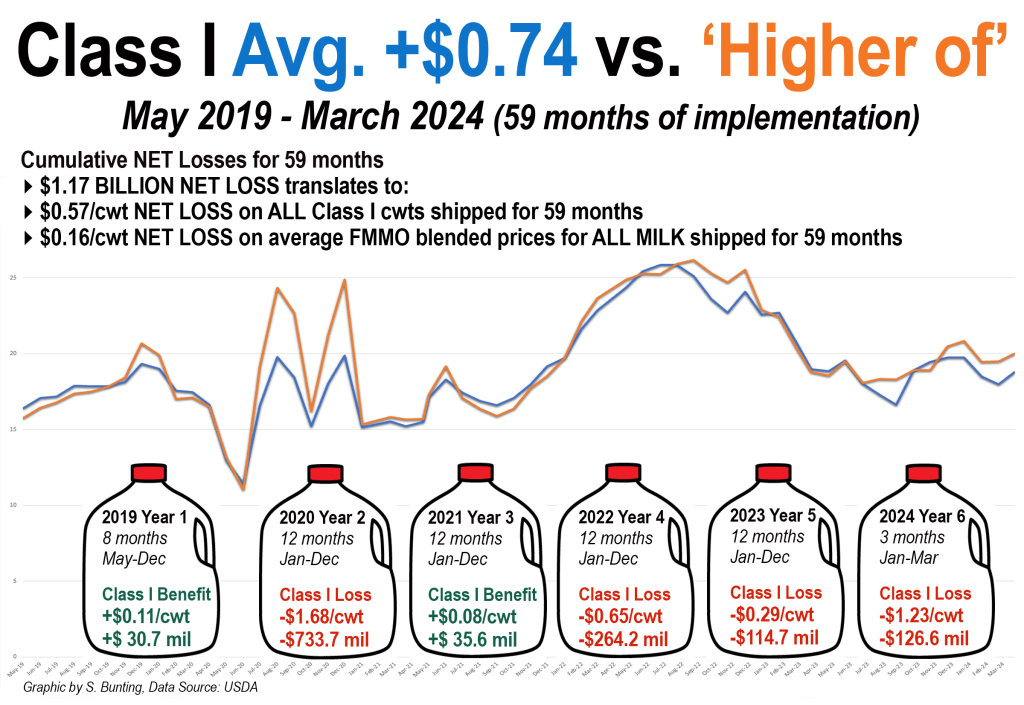

The letter stressed that FMMO reform is in step 5 of a 12-step process and a long way from a final rule. Meanwhile, the change in the Class I mover formula was intended to be revenue neutral to farmers, but farmers have lost over $1 billion in 56 months of implementation. This does not even include further losses from depooling of manufacturing milk when the Class I fluid milk price has been out of alignment in FMMO revenue-sharing pools.

“The comprehensive process of amending federal orders, though important, means dairy farmers remain stuck with current pricing regulations until USDA publishes a final rule,” Kieffer wrote in the letter Munch read into evidence. “The current Class I mover was a well-intentioned policy misstep that has reduced dairy farmers’ checks, with little relief in sight. Emergency implementation of the ‘higher-of’ Class I mover formula will help buffer against persistent losses associated with mistaken and outdated policies that have left dairy farmers struggling to make ends meet.”

Munch noted that members re-affirmed going back to the ‘higher of’ calculation in policy meetings during the AFBF National Convention last week, and they voted to make it a priority of urgency.

“Dairy farmers are facing closure. A lot of our members are facing the hard decision about whether to sell their cattle or not. That’s a little window into what our members mentioned last week,” said Munch.

The other reality that is setting in is the fact that large losses are mounting quickly again. The Class IV over III divergence is quite wide – ranging $3 to $4.00 per hundredweight – and the futures markets show it could be above the $1.48 per cwt threshold through the end of 2024.

In fact, the Class I mover prices announced for January and February 2024 could produce well over $80 million in losses in just the first two months of 2024 once the pounds of Class I milk are sold and counted.

Munch also took the opportunity to remind everyone that when AFBF held the dairy stakeholders forum in Kansas City in October 2022, returning the Class I mover calculation to the ‘higher of’ was the main item that got consensus from every table in the room.

When the difference between the manufacturing classes exceeds $1.48 per cwt, then pooled producers receive less money for their milk under the averaging formula compared with the previous ‘higher of’ formula. When the difference between Class III and IV is $3.48, for example, that lowers the Class I price by $1.00 per cwt. In an FMMO with 75% Class I utilization, that’s a 75-cent loss on all of the milk, not just Class I. In an FMMO with 25% Class I utilization, that’s a 25-cent loss on all of the milk.

Even members of Congress have been doing the math and have talked about putting reversion language in the Farm Bill. They are aware of their role in putting what they were told was a “revenue neutral” change into the 2018 Farm Bill that IDFA and NMPF at the time agreed upon, while adding language that USDA could hold a hearing in two years to vet it for the future.

We are now nearly five years into this change, and it is just one piece of the hearing that just concluded, which included many proposed modifications from milk composition and price surveys, to make allowances and differentials.

Without emergency decision-making by USDA on the Class I mover piece, any potential changes from this hearing are a good 12 to 18 months away, depending on how the post-hearing processes move along, from post-hearing briefs due April 1st to rebuttles, draft decisions, comment periods, referendums, final decisions, and there are proposals that have asked for further delays after the process plays out to avoid “affecting” exchange-traded risk management instruments.

Dairy farmers are just looking for some relief and transparency for the future, according to Munch.

Meanwhile, IDFA and Milk Innovation Group (MIG) have opposed returning to the ‘higher of’ and have proposed several averaging methods for the Class I mover that would continually look backward to compare and change adjusters to make up past losses gradually out into the future.

Farmers have testified that this doesn’t help if it takes two to three years to get that money back after they’ve already lost the farm.

What it boils down to on the Class I mover is the industry wants to move toward more fractionation of milk, more aseptic and shelf-stable beverages, and away from fresh fluid milk. These are the products that can sit in a warehouse for 9 months and for which processors testified they do 9-to-12-month pricing contracts largely with foodservice and convenience stores. Fresh fluid milk already has advance pricing that aligns with the turnaround of that product so hedging on the futures markets is not typically done, and averaging is not needed.

When asked whether AFBF has looked at how the spread may continue in the future to make the averaging formula a loser for farmers, he said Class IV will likely persist above Class III, and yes, they expect the spread to remain large.

Earlier testimony by processor witnesses blamed these Class I formula losses on Covid disruptions, food box programs and large government cheese purchases, but as Munch pointed out, the driver of these losses is something else. When Class IV is over III, we don’t see it in a negative PPD, but milk is depooled, and the full extent of the depooling losses are incurred by farmers, they just aren’t easily enumerated.

“In 2020, the losses (in Class I value, alone, without including the impact of depooling) were over $700 million. In December 2023, the losses crossed over $1.05 billion as they have continued to add up,” said Munch. “The financial detriment is not solely due to a ‘black swan’ event. Some of our farmers were waiting to see if it showed markets shifting. Now, years later, this is still an issue.

“That’s another reason why we are asking for an emergency decision on this right now, and why it came up at our meeting at the convention last week,” Munch testified. “It was intended to be revenue neutral, but it has turned out not to be.”

During cross-examination, Munch also confirmed there hasn’t been much trust by producers to believe processors will replace the dollars they are asking to be removed from FMMO pricing by paying over-order premiums, instead.

“There is a lack of trust and not knowing where their price comes from. There has been a lot of concern about how their milk checks are calculated,” Munch related. “That’s one of the proposals that the American Farm Bureau put forward is more uniform, clear milk checks. There is a perception that things in milk checks have been manipulated. There is a perception of mistrust.

“If there are ways we can build back the trust, and if one of those ways that our farmers have targeted is switching back to the ‘higher of,’ then it’s easier for farmers to understand that calculation, and it has shown, in the most current of times, to be more advantageous to them.”

-30-