By Sherry Bunting, Milk Market Moos in Farmshine, Aug. 9, 2024

USDA’s weekly National Dairy Product Sales Report (NDPSR) is out of whack on whey. The NDPSR is the mandatory processor survey of prices on the four commodities used in Federal Milk Marketing Order (FMMO) end-product pricing formulas.

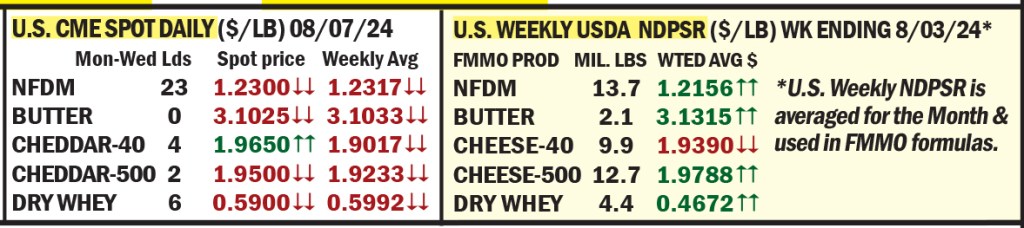

The NDPSR price for dry whey for the week ending Aug. 3 was $0.4672/lb, a modest improvement of a half penny over the previous week’s NDPSR, but still 10 to 14 cents lower than the past three weeks of weighted average spot prices, and a nickel lower today than even at the start of the spot market rally six weeks ago.

The NDPSR should have caught up closer to the spot market by now, considering that only sales that are forward priced within 30 days can be reported.

The CME spot market is what processors touted during FMMO hearing testimony as the ‘market clearing’ price that they use as a baseline to price commodities for export and non-formula, non-reported ‘value added’ products.

They also lamented — at length — that USDA is setting producer minimum prices too high, some threatening to modify future expansion plans if they don’t get to ‘market clearing levels’ with higher make allowances deducted for their rising costs — including ‘sustainability costs’, they want covered.

If these dry whey ‘market clearing’ CME spot values we have been seeing of late are not translating to the NDPSR used in FMMO class and component price formulas over a three to six week period, then maybe we should all be questioning the 33.3% raise the processors will be getting from dairy farmers’ milk checks in the dry whey make allowance that USDA proposes to increase from the current $0.1991/lb to $0.2653/lb. That is, if the proposed rule announced July 1st survives the 60-day comment period, 60-day review, and producer referendum early next year.

I wonder if USDA underestimates how fed-up the farmers are in the Upper Midwest with being the worst-paid in the nation seeing the biggest make allowance bite coming right at them in this proposal — and very little Class I benefit to offset it. After 5 years of disrupted pooling by the ‘average of’ method, Order 30 has developed some bad pool-jumping habits that could linger in that region — even when fluid milk pricing returns to the higher of. Who knows?

If a two-thirds ‘yes’ vote is not achieved in Order 30, or any Order for that matter, the Market Administrator’s office there closes, immediately.

There is so much value in whey today, and it’s a byproduct of the cheesemaking process to begin with. It’s hard for this observer to resolve conflicts of logic in the size of this raise that USDA justifies based on voluntary surveys in which only a fraction of the plants that price report would offer their cost of processing data to determine.

In fact, even Dr. Mark Stephenson said it was more challenging this time to separate-out the costs for other products that are not price reported, but made in the same plants. He said today’s plants are more complex than in 2006 when the model was used on voluntary data to set the current make allowances that were implemented in 2008, the last time they were raised.

But folks, there’s no snubber, and for dry whey, that’s a problem. When farmers were losing their shirts last summer, they would have been giving away the ‘other solids’ in their milk for free — or paying processors a small fee to take them as though worthless — because the dry whey price at that time was equal to or fractionally less than what the new proposed dry whey make allowance would be!

It happened the last time make allowances were raised in 2008, just ahead of the 2009 dairy crisis. I’ll not soon forget farmers asking me if there is some way to avoid sending the ‘other solids’. Of course, that’s silly, but we get the point, and it’s sharp.

This is significant in the Upper Midwest, where it impacts over 90% of the milk because it’s a Class III market. But this also affects all Orders to some degree, depending on pool composition. With new processing capacity coming online, much of it cheese, in the next 12 to 24 months, other milk marketing areas will see Class III growth change their blend prices too.

The other thing to think about is USDA proposes to implement the new make allowances for all four commodities right away after the referendum in early 2025, but some of the other parts of the proposed rule will be delayed because of risk management impacts. Yet make allowances also impact risk management. They are also part of the formula for the Class III and IV milk prices — so this change also would immediately affect the futures board. In fact, that’s part of what happened in 2008.

Can you imagine an immediate $0.75 to $1.00 drop on the futures board due to higher processor credits? What’s the calculus there? The make allowance for dry whey affects the ‘other solids’ value as well as the Class III price.

And then we have the added insult of ‘pizza cheese’ being billed as ‘like mozzarella’ just moister because it’s a second process of the whey and water to congeal some secondary curd. It is essentially whey cheese with a different melting texture (I notice it browns cardboard-flaky on frozen pizza before the dough is done, but keeps some moisture. I don’t buy my once favorite frozen pizza brands anymore suspecting that’s the problem). It’s also used as a crust filler.

So, how much real mozzarella is being displaced, and how much near-mozz value are they selling this whey product for? That’s a price that never gets reported because it’s — well — not dry whey. It’s a proprietary value-added product.

The ubiquitous whey protein concentrates and isolates found in so many high protein drink and snack preparations are another hot ticket not getting price reported. And yet, here’s dry whey at 50 to 60 cents/lb for 6 weeks on the market-clearing CME, and the price going into the FMMO formulas is hanging back at 43 to 47 cents/lb over the same 6 week period.

Spot market red, not as bad as it looks

The whey market traded 6 loads on the CME spot sessions this week with a penny loss at 59 cents/lb Wed., Aug. 7 vs. the prior Wednesday. The weighted average for the week is still at just about 60 cents/lb.

The CME spot cheese market was mostly quiet again this week, but prices for blocks moved higher Wed., Aug. 7, when 40-lb block Cheddar was pegged at $1.9650 — up 4 cents from the prior Wednesday, with 4 loads trading the first three days. The 500-lb barrel cheese price, pegged at $1.95/lb was down 2 1/2 cents compared with a week ago; 3 loads traded. The NDPSR for week ending Aug. 3 was reported in reverse with a 4-cent barrel over block advantage at $1.9788/lb and $1.9390/lb, respectively.

Butter melted off 2 cents after last week’s 39-load haul came to a grinding halt Aug. 1st. Nothing traded from Aug. 2 through 7, and the spot butter price remained at $3.1025/lb Wed., Aug. 7. The weighted average was steady at just over $3.10/lb, off 3 cents from the NDPSR price of $3.1315/lb for week ending Aug. 3.

Grade A nonfat dry milk trade remained active the first three days this week with a whopping 23 loads changing hands, and the spot price pegged at $1.23/lb Wed., Aug. 7, down a penny and a half from the prior Wednesday. The weighted average for stood at $1.2317, and the NDPSR price continued to lag the past few weeks of spot market levels by three cents.

We see these headlines that the recent gains in farm milk prices are taking away the U.S. competitive advantage on the world market. Don’t believe them, folks. While it is true that nonfat dry milk is running above the global skim milk powder price, the reason is because we are not making nearly as much milk powder in the U.S. because milk is tight, cheese capacity has expanded, and cheese-vats are pulling in the available milk. Fluid milk sales are also up year over year. We are also not building powder inventory, so of course this means we’ll export less.

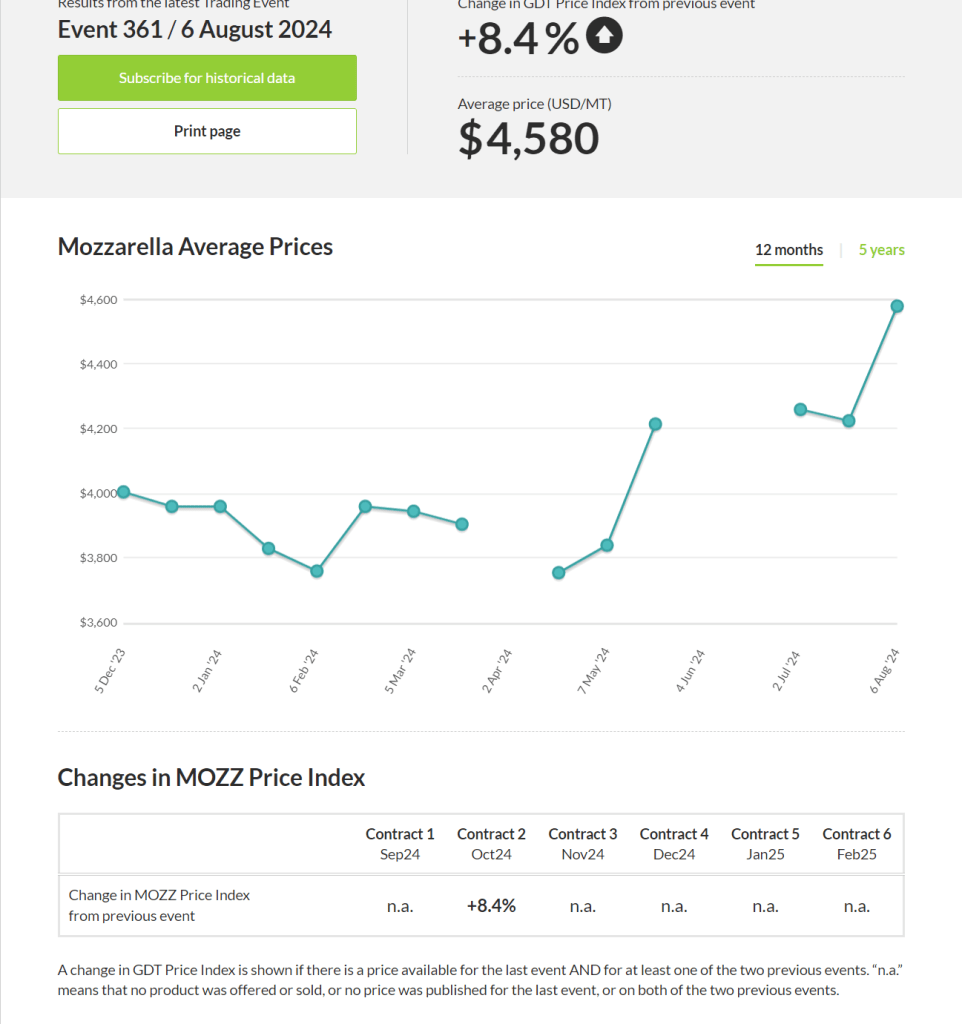

On the cheese and whey, there’s plenty of wiggle room between U.S. and global prices, judging by the recent Global Dairy Trade auction.

Global Dairy Trade index up 0.5%

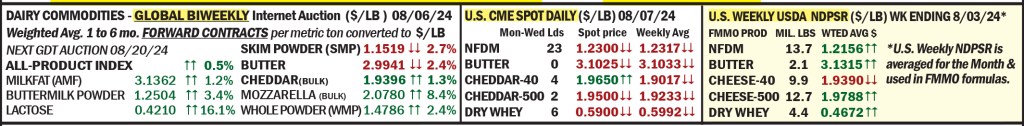

The GDT biweekly internet auction on Tues., Aug. 6 added value to the mid-July gain — up 0.5% vs, July 16.

Here’s the kicker. The cheese index for Sept. 2024 through Feb. 2025 delivery was higher than the current U.S. market-clearing block and barrel prices. Meanwhile, lactose outpaced the current NDPSR drag on whey.

The big story is bulk mozzarella was up a record 8.4% with all sales contracted for delivery October 2024. The bulk mozzarella contracts are new. They have only been trading on the GDT since December 2023. Tuesday’s sales — all for Oct. 2024 delivery — are, by far, the highest yet of the 15 sessions in which bulk mozzarella was offered. The CME does not have a U.S. ‘clearing market’ for mozzarella. Furthermore, USDA does not include bulk mozzarella in the mandatory NDPSR weekly survey because mozzarella prices are not used in the FMMO milk pricing formulas. A proposal to add this was rejected by USDA in its recommended decision July 1st.

The GDT Industrial bulk cheddar index was up 1.3% compared with three weeks ago at an average $1.94/lb — 2 cents higher than the weighted weekly average on CME barrels and 4 cents over CME blocks. September delivery cheddar averaged $1.90/lb and October dipped to $1.89/lb, but product for delivery Nov. through Feb. moved toward $1.98/lb.

Meanwhile, USDA agreed with NMPF’s proposal to remove the 500-lb barrel cheese price from the weighted average used in the FMMO formulas. This will mean only the 40-lb block cheddar price will be used in the future to calculate the protein and Class III milk prices. Barrels have been trading over blocks recently, and during the FMMO hearing, IDFA witnesses (opposing the change) said they use the barrel price and dry whey price as the basis for pricing U.S. mozzarella for export sales.

Higher GDT indexes were also achieved Tuesday on the following products: Whole milk powder up 2.4%, averaging $1.48/lb; Anhydrous milkfat powder (AMF) up 1.2%, averaging $3.14; Lactose up a whopping 16%, at 42 cents/lb. Lower indexes were reported on Skim Milk Powder (SMP) down 2.7%, averaging $1.15/lb; and Butter down 2.4%, averaging $2.99/lb.

Milk futures mixed

Class III milk futures were generally steady this week, except near-term September took a 45-cent hit and 2025 contracts were mostly firm to a nickel higher, spots up 15 cents. Class IV futures were steady through 2024, but 10 to 30 cents lower on 2025 contracts. On Wed., Aug. 7, Class III milk futures for the next 12 months (Aug24-Jul25) averaged $19.41, down 3 cents from the same 12 months averaged on the previous Wednesday. The 12-month Class IV average at $20.82 was down a dime.

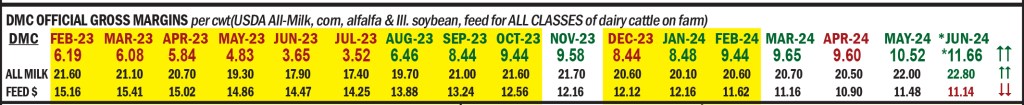

June DMC margin $11.66, up $8.00 above year ago program lows

As expected, the June DMC margin came in at $11.66, which is $2.16 above the highest tier one coverage level of $9.50/cwt. Announced August 2nd, the June margin was based on an 80-cent higher All-Milk price at $22.80/cwt and a 34-cent drop in feed cost at $11.14/cwt for a DMC margin that was deemed $1.14 higher than May and up by a whopping $8.00/cwt above year-ago program lows set in June and July 2023 at $3.65 and $3.52.

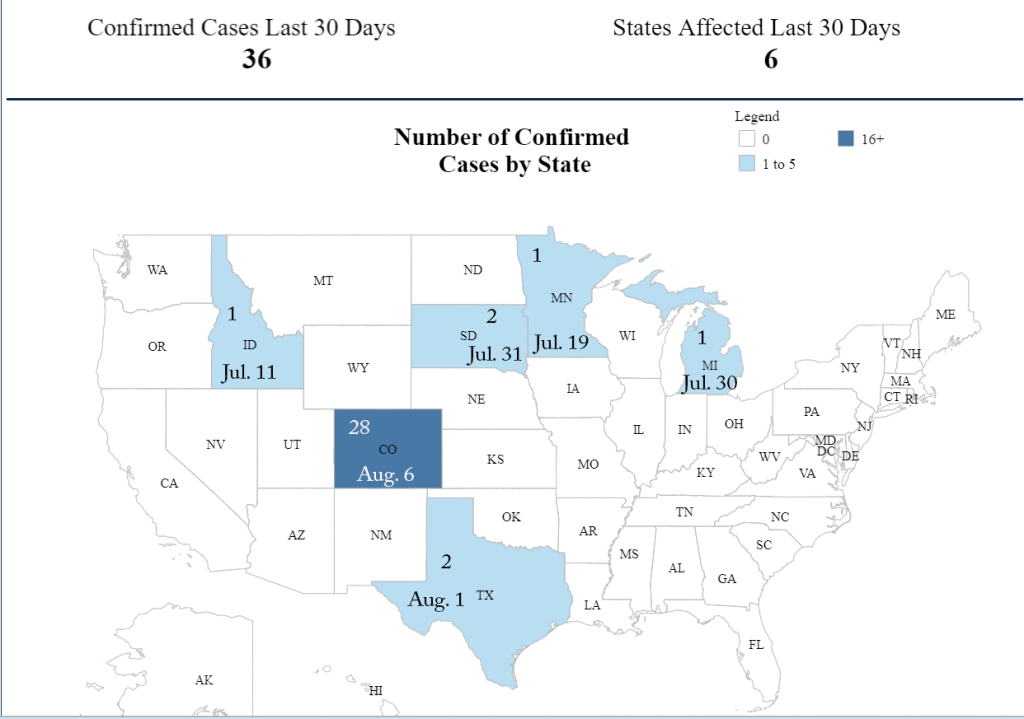

30-day H5N1 detections at 36 in 6 states, Colorado continues to be a breaking hot-spot, Iowa drops from the list, South Dakota returns

As of August 9, 2024, the current confirmed cases of H5N1 in dairy cows within the past 30 days stand at 36 herds in 6 states. Of these, 28 are in Colorado, where the most recent slew of 12 detections were reported for Aug. 5 and 6. Colorado remains the hot spot by a long shot. The state issued an order July 22nd to require mandatory bulk tank milk testing.

Iowa dropped from the 30-day list this week, but South Dakota returned to the list with 2 detections. Other states with confirmed cases within the past 30 days are: Minnesota (1), Idaho (1), Texas (2), and Michigan (1). Cumulatively, since the beginning of the outbreak on March 25, 2024, there have been 190 detections in 13 states.

Enrollments in the national voluntary dairy herd status bulk tank testing include 24 herds: Michigan (10), New Mexico (4), Pennsylvania (3), and 1 herd each in Kansas, Nebraska, North Carolina, Ohio, South Dakota, Tennessee, and Texas. Colorado herds (110) are now all being bulk-tank tested due to the state’s mandatory ruling on July 22.