By Sherry Bunting for Farmshine, Aug. 2, 2024

WASHINGTON, D.C. — The extended 2018 farm law will expire Sept. 30 in the throes of a tumultuous election year while farm liquidity and cash flow decline in the face of an eroded farm bill safety net.

Witnesses in a July 23 House Ag Committee hearing expressed support for the House bill and made it clear that another extension is a non-starter, with one witness describing the current law as facing a category-five hurricane with no protection.

“Unprecedented challenges are facing the entire agricultural sector, threatening to ignite another farm financial crisis,” said House Ag Chairman Glenn ‘GT’ Thompson (R-Pa.) as he opened the hearing on financial conditions in farm country.

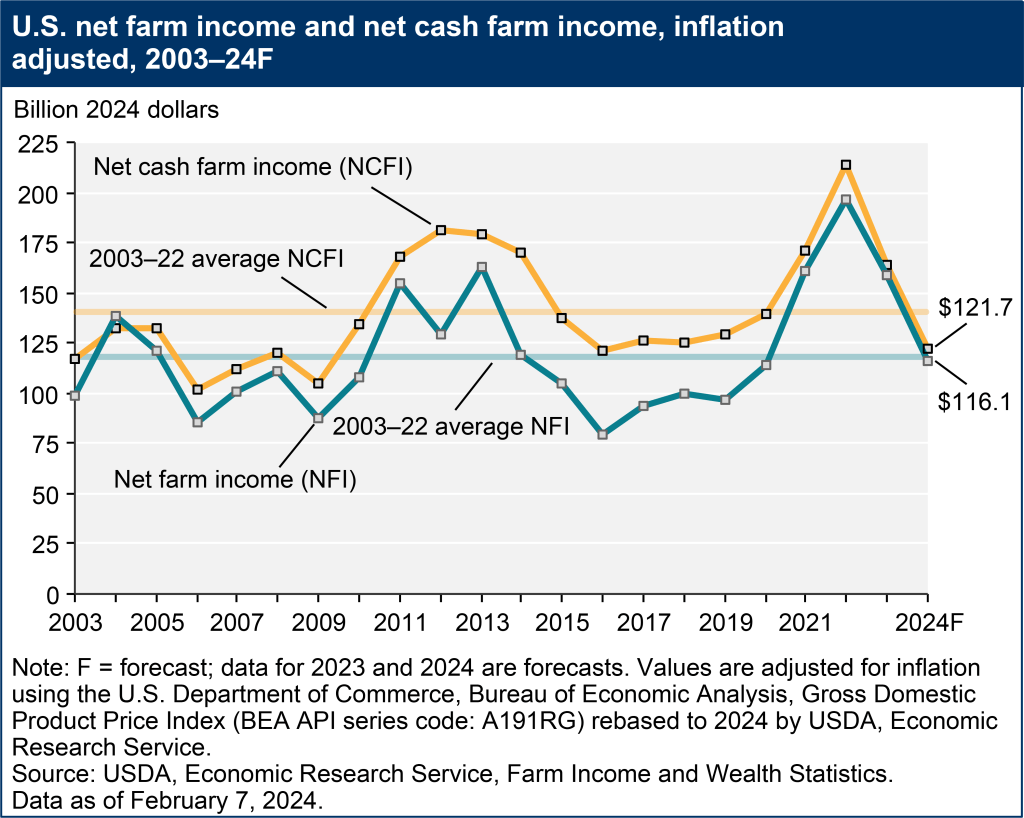

USDA estimates net farm income will see the steepest drop of $43 billion this year – down 27% from 2023 and down 40% from 2022. In its report, USDA notes that livestock farms will also see net cash farm income drop for 2024 across all specializations. Within the livestock sector, dairy farms are forecast to see the largest decrease in average net cash farm income in 2024.

“The impact won’t be fully understood until early next year when farmers are unable to secure operating loans because they can’t cash flow,” said Dr. Dana Allen-Tully, member of a diversified crop and dairy farming family near Eyota, testifying for Minnesota Corn Growers.

In addition to flooding in her region and drought elsewhere, crop producers face income losses of $150 to $233 per acre, she said, citing plummeting prices, high costs of production, doubling interest rates, natural disasters, and tightening credit.

Thompson said these factors create “a perfect storm that will compromise the foundation of our agricultural economy.”

He observed U.S. agriculture is in the largest two-year decline in farm income, and by the end of 2024, total farm sector debt will be the highest since 1970.

“Unfortunately, the farm safety net has not seen significant investment since 2002. The lack of support for those that feed the world is unacceptable,” the Chairman said, pointing to the many farm bill listening sessions across the country.

According to Thompson, the bipartisan House Committee-passed Farm, Food and National Security Act of 2024 represents the largest permanent farm bill investment in over two decades for the farm safety net, conservation, trade promotion, specialty crops, research, and livestock biosecurity.

“It will give renewed strength… just when producers need it most,” he declared, taking aim at “pundits spreading misinformation about this bill in order to sow division.”

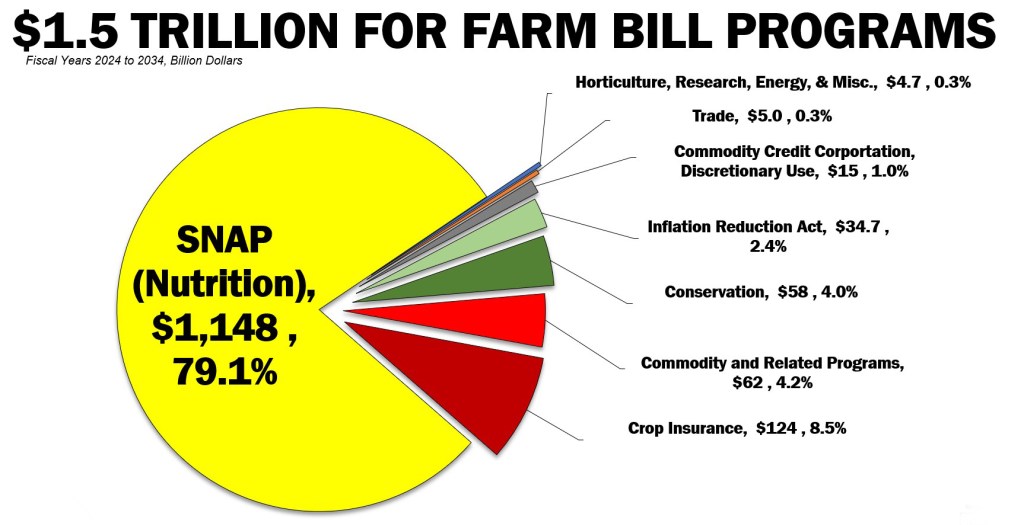

Thompson said Democrats in Congress have “unilaterally added billions to climate and conservation programs, and the current Administration added one-quarter of one trillion dollars to nutrition programs — all while ignoring the farm safety net.”

“I will not apologize for advancing a bill that seeks to put the farm back in the farm bill. I am tired of the politics and gamesmanship, and I know folks out in the countryside are too,” he said.

Thompson stated further that this work has been “saddled with a meddling Senate Democrat and others who do not seem to appreciate the dire circumstances in farm country.”

The “meddling Senate Democrat” is Ag Chairwoman Debbie Stabenow (D-Mich.), who is retiring at the end of 2024 and is also responsible for holding hostage the Whole Milk for Healthy Kids Act.

As recently as last week, some Ag Committee Democrats have expressed a preference to see a farm bill fail before engaging in the process, Thompson reported, adding that his door remains open “to renegotiation from any partner willing to come to the table with a serious proposal — not more red lines.”

He stressed the difficulty in reconciling a bipartisan 900-page House bill with a partisan 90-page Senate summary.

“For negotiation to be viable, Chairwoman Stabenow needs to unveil her bill text,” he challenged.

During the hearing, witnesses cited meaningful improvements to the safety net via updates to reference prices, crop insurance, and the conservation title.

Both the current 2018 law and the incomplete Senate summary do not meet the needs of farmers, witnesses indicated. Even the stronger safety net in the House bill is not enough, they said, but would help farmers weather the storm.

While pundits say the House bill cuts nutrition programs, Thompson has repeatedly demonstrated no program cuts in the bill, even though the Congressional Budget Office (CBO) score showed $30 billion in savings on the 10-year baseline compared with earlier scores.

Nutrition Title spending accounts for nearly 80% of the estimated $1.5 trillion total farm bill. Nutrition spending also increases by 73% ($484 billion) since the 2018 farm bill enactment.

“Quite frankly, we are not going to have nutrition, if we do not have farmers, so our investment here is in the farm safety net,” Thompson stated.

Ranking member David Scott (D-Ga.) emphasized in his remarks the Democrat position that CCC authority remains “exclusively in the hands of the Secretary of Agriculture,” without the congressional oversight proposed in the House bill.

The witnesses didn’t bite when asked about this. Several indicated it is more desirable to have a stronger safety net so the CCC does not have to be dipped into in the first place.

At the same time, witnesses indicated the need, now, for supplemental intervention under the current price squeeze.

To that point, Rep. Mark Alford (R-Mo.) asked: “Did you know we are losing 1000 farms every month in America right now? It’s a staggering number when we consider our food security and our national security.”

“Working capital is fast depleting,” Dr. Allen-Tully testified. She called John Deere’s layoffs “a canary in the coal mine” and warned against another farm bill extension because “it won’t stop the hemorrhaging. Even a new farm bill with a strong safety net may not be timely or sufficient, though I pray Congress will pass a new farm bill this year because it will help in the long run.

“We put everything on the line for a thin and often negative margin. Young people aren’t going into farming, and that’s why the average age of farmers is nearing 60… no parent wants their kids to go through life facing constant worry. We need our full-time farm and ranch families,” she said.

North Carolina farmer, David Dunlow testified for American Cotton Growers. He noted the size of operating loans farmers in all commodities take on every spring, and the lines of credit with input companies.

“That has to be paid back – every year — before we can go and get another operating loan,” he said. “The margins are very thin … under normal conditions, and with the economy now, nothing cash flows. It’s very difficult to get those loans paid and to move on to the next year.”

Testifying for the Ag and Rural Bankers, Tony Hotchkiss said lenders are seeing changes. Farmers are working through liquidity faster than anticipated and are now beginning to leverage equity through refinancing debt. This is further challenged by the cash flow needed for the refinancing payment.

“This has made ag bankers feel as though they are looking over the cliff,” Hotchkiss stated, stressing the need for ag policy changes, many of which are included in the 2024 House farm bill.

Joey Caldwell of GreenPoint Ag Holdings in the Southeast U.S., testified for the Ag Retailers Association. He said a strong farm bill safety net is critical to Rural America: “If the farmer is not successful, the supply chain is not successful, and this impacts the very fabric of our communities.”

University of Arkansas ag economist Dr. Ron Rainey also testified that farm debt levels are increasing as divergence between input costs over ag prices is widening, even if the overall price indices are higher.

He said more farmers need to be involved in using risk management, whether that is through better subsidy levels or technical assistance to enhance understanding and use of it.

“If they don’t have crop insurance, and if they are outside of the safety net, then they’re financing their risk on their balance sheets. The more we can move from ad hoc disaster assistance, the better off the farmers are,” said Dr. Rainey.

“But where we are now… that’s going to require some intervention. That’s just the bottom line,” he added.

Rep. Eric Sorenson (D-Ill.) brought up sustainable aviation fuel and the inequity in how current Energy Department tax credits are given for ethanol from Brazil and used cooking oil from China, while American farmers, who can serve this need, are getting nothing.

“Sustainable aviation fuel is one of the most exciting things coming as a corn farmer,” Dr. Allen-Tully replied. “But the way the Treasury Department has their guidance written excludes us. It is almost insulting to believe that we would bring in sugarcane ethanol in place of ethanol we can grow here.”

Rep. Mary Miller (R-Ill.) asked witnesses how the climate policies of the current administration are affecting farmers, and she gave her own opinion as a farmer: “It’s painful.”

Caldwell responded, pointing to energy and fertilizer as the largest costs, and they are much higher under these policies.

“Farmers need a strong farm bill,” said Caldwell. “When a farmer plants a crop, they put more than their job at risk. It is their home, their livelihood – a pillar of their community. For many, it is also their family legacy, passed down through generations that they hope to pass on to their kids… they risk losing it all.”

-30-

Pingback: Good news may trump bad nutrition policies for dairy and livestock | Ag Moos