By Sherry Bunting, Farmshine, Feb. 21, 2025 (with updates after print publication)

WASHINGTON – Upon reading the Feb. 14 news release about USDA’s 78 terminated contracts totaling $132 million, as identified in the ongoing review by the Department of Government Efficiency (DOGE), we noticed only 10 examples were given, totaling only $4.21 million. Reports had surfaced about Conservation Districts receiving project or program termination notices via email, and a few farmers communicated their concern about frozen funding for grant reimbursements.

So, we looked into it.

One email notice that Farmshine was able to view, dated Feb. 14, for a project in a Colorado Conservation District, stated the reason in the subject line: “The project no longer effectuates agency priorities regarding diversity, equity, and inclusion programs and activities.”

However, the notice also clearly stated that final payments would be made on work already conducted for the terminated project — as long as the final reports and final payment requests are submitted within 120 calendar days of the notice.

We emailed the USDA press office on Feb. 18, as follows:

“A few farmers have communicated about canceled contracts or frozen funds related to conservation projects, some in which projects were started or planned, and these farmers were expecting reimbursement through grants. The news release about the $132 million in canceled contracts lists 10 things as examples outside of the core mission of USDA, but these examples only total $4.21 million, not $132 million. Where can we find a list of the balance?”

The press office turned our request over to the Freedom of Information Act (FOIA) officer at the USDA Farm Production and Conservation Business Center, who promptly responded by email on the very same day, Feb. 18, directing us to a government information specialist who could help us file an official FOIA request.

The specialist answered our call on the first try that same day (Feb. 18). Our official FOIA request was modified to seek a listing of the 78 terminated contracts referenced in the USDA press release. This experience runs contrary to what some in the mainstream media have reported about FOIA officers being “gone.”

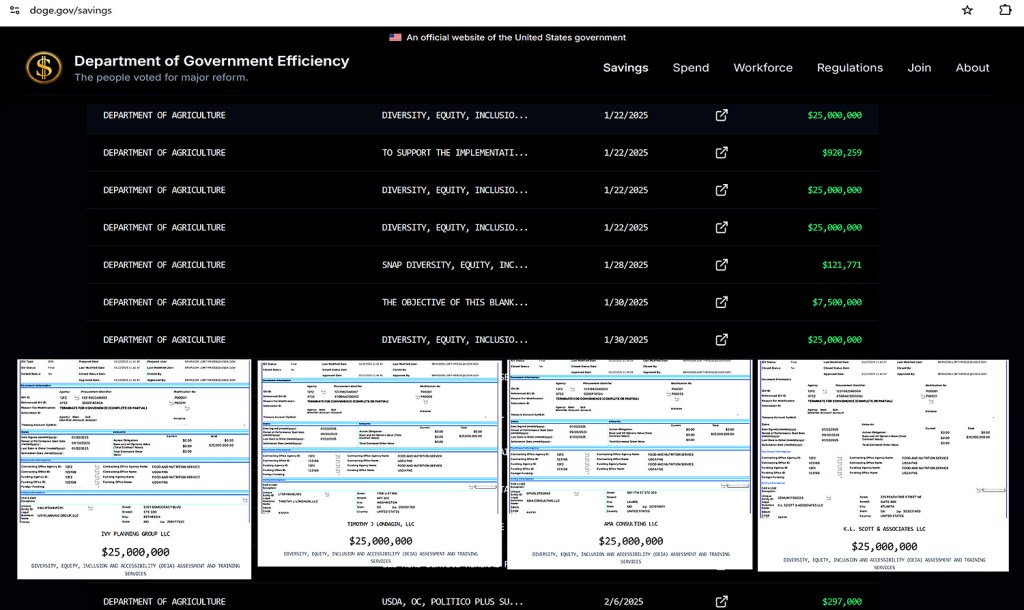

In fact, we received a follow up email the next morning (Feb. 19) with additional information and a link to https://doge.gov/savings, where all terminated contracts throughout all federal agencies will be updated twice a week. USDA ranks 5th in the top 10 federal agencies in amount of savings as of Feb. 18.

A look at the listing shows zero terminations of any on-farm conservation project contracts.

Furthermore, $100 million of the $132 million is accounted for in the four separate $25 million contracts with four separate consulting companies, mostly located in the Capitol region, for “Diversity, Equity, Inclusion and Accessibility (DEIA) Assessment and Training Services” within the USDA’s Food and Nutrition Service, or FNS.

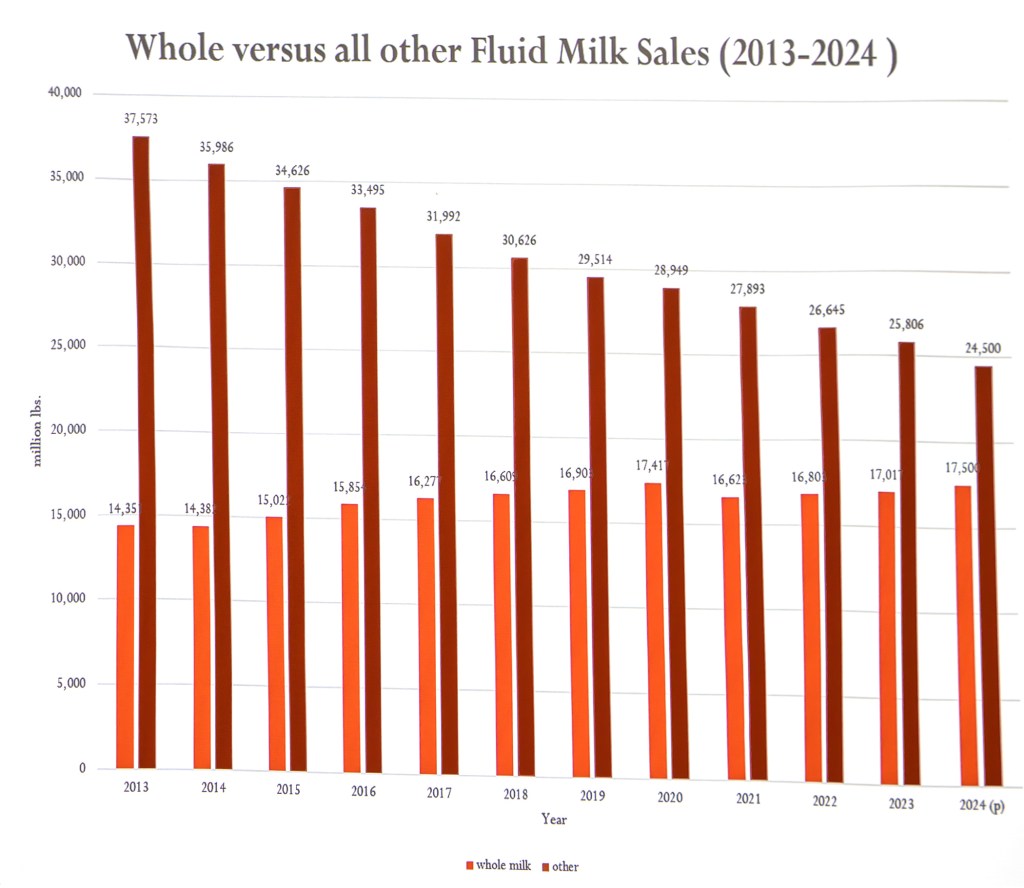

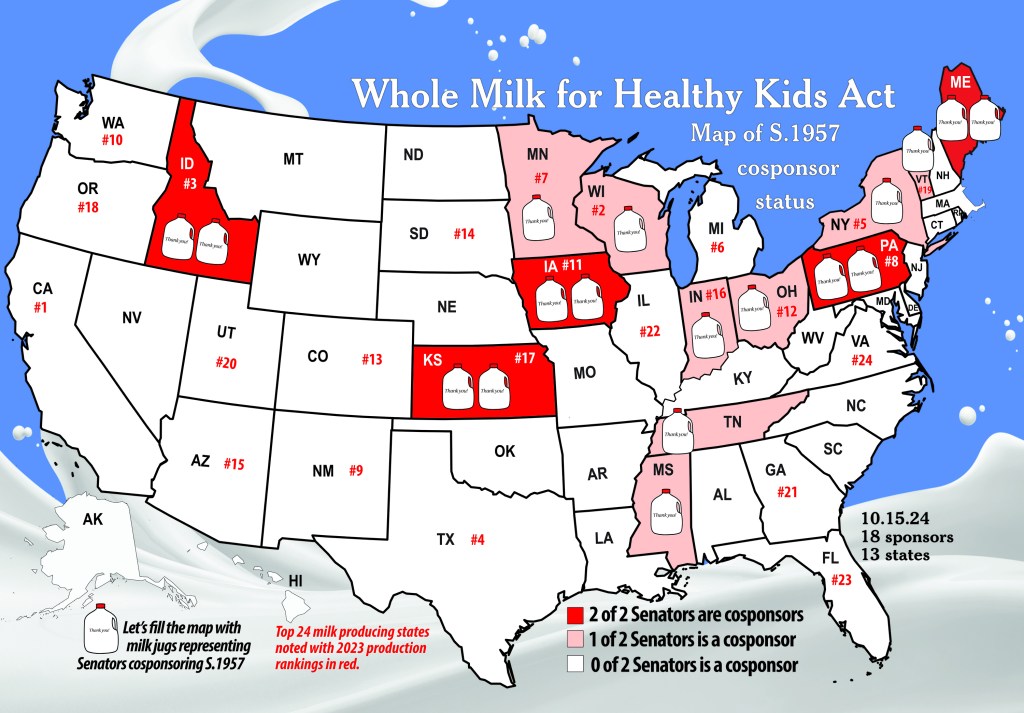

(Just think how much of the currently banned whole milk — which former Ag Sec. Vilsack said schools cannot afford anyway — could be purchased for the FNS-controlled National School Lunch Program with such savings!)

Also terminated was a contract with a Vermont consulting firm for “Environmental Compliance Services for the implementation of Partnership for Climate-Smart Commodities.” Even though this $8.2 million award had already been paid, the termination prevents additional orders.

While the government information specialist cannot answer abstract questions, she did indicate that conservation projects through EQIP and NRCS — that are attributed to the farm bill — are not included in the contract terminations. However, Climate Smart projects under the Inflation Reduction Act (IRA) were included in the funding that was ‘on hold’ for review.

Then USDA announced in a Feb. 20 press release that, “Secretary Rollins will honor contracts that were already made directly to farmers. Specifically, USDA is releasing approximately $20 million in contracts for the Environmental Quality Incentive Program, the Conservation Stewardship Program, and the Agricultural Conservation Easement Program.”

This is the first tranche released from the ‘pause’ as USDA continues to review IRA funding “to ensure that we honor our sacred obligation to American taxpayers—and to ensure that programs are focused on supporting farmers and ranchers, not DEIA programs or far-left climate programs,” the press release stated.

We also learned from other sources that commodity checkoff programs are part of the broader DOGE review of all USDA activities for the purpose of evaluating, and potentially reforming both spending and policy in agriculture.

The dairy promotion and research program, funded by the 15 cents per cwt checkoff, is one of 22 such mandatory commodity programs overseen by USDA AMS. According to repeated statements by dairy checkoff leaders over the past five years, this oversight involves USDA AMS reviewing all checkoff-funded activities, including for USDA staff attending all DMI meetings “even conference calls.”

This oversight comes at a cost. Of the 2022 and 2023 financial statements available for Dairy Management Inc (DMI), National Dairy Promotion and Research Board (NDB) and the consolidated United Dairy Industry Association (UDIA) and National Dairy Council (NDC), only the NDB listed USDA Oversight as a line item under its operating costs, totaling just under $1 million annually, along with a collections and compliance line item totaling just over $500,000.

How might the DOGE algorithms decipher these costs and engagements, given both USDA and DMI have contracted with NGOs like World Wildlife Fund (WWF)?

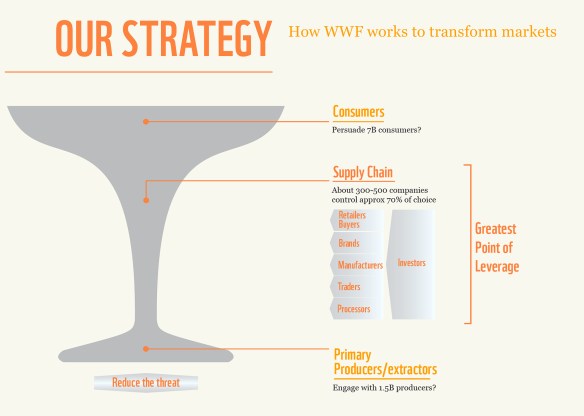

How might it interpret WWF’s published playbook of leveraging the supply-chain of 300 to 500 companies controlling 70% of consumer food choices?

WWF’s playbook uses the consolidation in the middle (above) to move the much larger number of food producers and food consumers toward implementing their sustainability goals, the so-called ESGs (Environmental, Social, Governance) that focus on DEI, biodiversity, and their particular take (and flawed math) on the climate impact of methane emissions from cattle, disregarding the carbon cycle that is the essence of life.

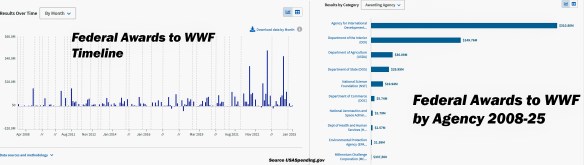

In fact, upon being provided with the link to USA Spending as part of the response we received from the current administration regarding our FOIA request, we found that the federal government has awarded the NGO World Wildlife Fund (WWF) more than $500 million since the start of the Obama administration in 2009. The bulk of the funds were awarded in 2022-24 during the Biden administration.

Of the over $500M, USAID awarded WWF $310M; the Department of Interior awarded WWF $149M; and USDA awarded WWF $36M, with other federal agencies rounding out the total. ($500M is a large sum that the mainstream media refer to as “merely a rounding error” next to the $36T (trillion) in national debt, but where else do these layers lead in terms of money and policy?)

We already know that the dairy and beef checkoffs began their alliances with WWF in the 2008 to 2010 time frame — when the work to develop their Net Zero and Sustainability platforms for dairy and beef producers began, and really ratcheted up by 2021.

Contracts with NGOs in other departments of the federal government have also been terminated through the DOGE reviews, especially via USAID, according to repeated press reports. What more may we learn from the DOGE review on potential entanglements between USDA, checkoff programs, NGO’s like WWF, and the food industry — that are not truly farmer-led but impact farmers?

To-date, there are no indications that the USDA AMS administration of the Federal Milk Marketing Orders are part of the DOGE review; however, it’s possible, depending on how these FMMO administration costs are allocated.

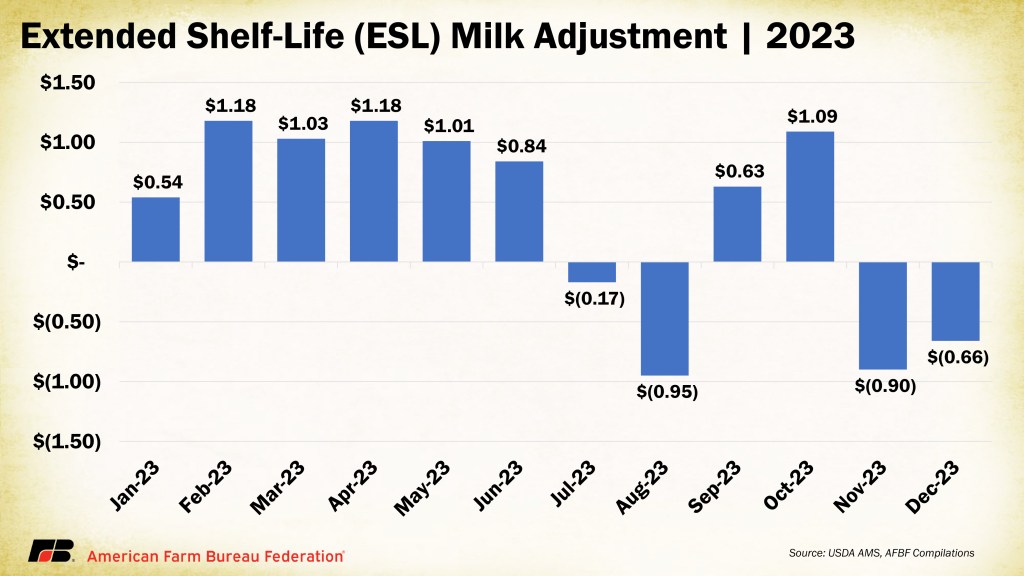

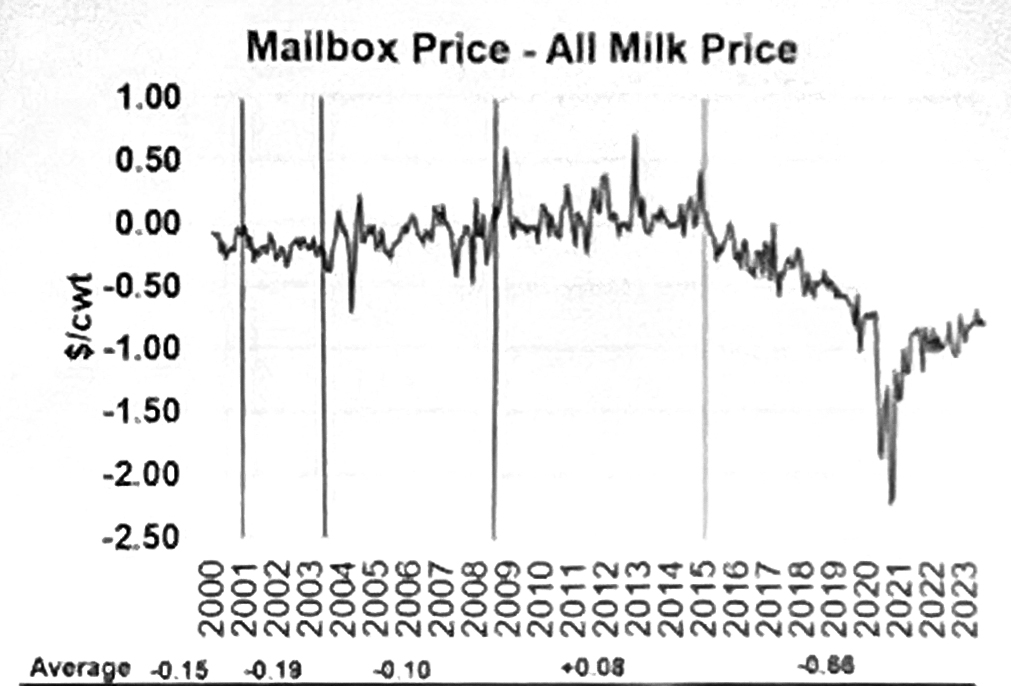

According to the Congressional Research Service (CRS), the 1937 Agricultural Marketing Agreement Act gives USDA several authorities in Federal Milk Marketing Orders (FMMO) that are administered through Dairy Programs under AMS. The associated costs of FMMO administration, according to the CRS “are partly covered by an assessment levied on handlers at no more than five cents per cwt., which is often passed on as deductions on farm milk checks.

-30-