By Sherry Bunting, Farmshine, August 23, 2023

CARMEL, Ind. — USDA’s much anticipated national public hearing of 21 proposals on amendments to uniform pricing formulas for all 11 Federal Milk Marketing Orders (FMMO) had a rocky start on Wednesday, Aug. 23 in Carmel, Indiana. The first day kicked off amid objections to the hearing scope as fluid milk processors were seeking to get their excluded Class I proposals onto the docket.

The presiding administrative law judge set the stage for what he said will be an estimated 7-week hearing, held 8 to 5 ET every weekday with virtual farmer testimony on Fridays. (It is being livestreamed for watching by zoom or listening by phone. Look for that information in the graphic above, or find the links and numbers at the end of this article or at the hearing webpage).

The judge stated his authority to interrupt for comments or testimony outside of the hearing scope. “I will not issue a decision,” he said. “USDA will take the information to render a decision.”

Once a recommended decision is put forward by USDA, expected in February or March 2024, a comment period follows before the final decision is issued in June or July and made fully effective in the fall of 2024. Some proposals call for a 12-month delay in implementation, so the full effect of potential decisions could be delayed until fall of 2025.

Given the rocky start to the hearing, even this timetable could be prolonged, but USDA is under a Congressional mandate to render decisions within 18 months of a petition it agrees to hear.

Immediately following the setting of the stage, Chip English, attorney for the Milk Innovation Group (MIG) put forward an objection and a motion seeking reversal of USDA’s decision that excluded two of its Class I pricing proposals from the hearing announcement. One of the excluded proposals would exempt organic milk from FMMO pools and the other deals with ‘shrink’ in the extended shelf life category.

“It’s all coming in whether you like it or not,” said English, “because at the end of the hearing, we’re going to be talking about raising Class I, and these are issues that have to be part of that.”

Attorney John Vetne for National All Jersey joined in the objection on procedural grounds because NAJ also had its proposal to make all 11 FMMOs use multiple component pricing was rejected from the hearing. Currently, the 3 southern marketing areas and Arizona are fat/skim priced, whereas the other 7 marketing areas use multiple component pricing (MCP). USDA excluded this proposal since the 4 fat/skim priced marketing areas must regionally call for the change to MCP pricing.

Within the first hour and a half of the first day, the hearing went “off record” into private discussion about handling the objections and handling the exhibits.

In addition to the hearing scope objections, there was extensive cross-examination of USDA AMS Dairy Program staff on its fulfillment of data requests and various exhibits provided by USDA — in some cases calling into question the comparability or reliability of some of the data.

For example, much was made of the differences between the USDA mailbox milk price report as compared to the Federal Order price announcement. Mr. English probed USDA staff on how these reports are audited, how the data is collected, what is included and what it is based on. He did what he has done in Pennsylvania Milk Marketing Board (PMMB) hearings in the past to discredit the comparability of the mailbox price report to state or federal “announced price” reports — because of the differences in the “auditing”.

As each exhibit on pooling figures and other data was put under the cross-examination microscope, the issue of “restricted” data came up due to “confidentiality,” which USDA staff explained is necessary when 2 or fewer companies are in a marketing area — be they plants or farms. In the rapidly consolidating dairy industry, what does this foretell of future market transparency if data are not available for price discovery and market transparency because of too few operators in a region?

There were attempts to keep some exhibits from being included in the hearing record. Most of these discussions were put on hold to be explored through further cross-examination at a later time with future witnesses.

In many ways the sense of this round of cross-examination on exhibits felt a bit like cutting the legs out from under future presentation of proposal testimony even before they get to the floor. Basically, much legal maneuvering on data before the first proposal is even heard and testified to.

If the first day is any indication of what is in store, expect to see many attempts to push the scope boundaries, and expect the judge to err on the side of making sure USDA has all of the information it needs to render decisions, so some latitude will likely be given for these boundary explorations by attorneys.

Attorney English, is well known to any Pennsylvania dairy farmer who has ever sat in on a PMMB hearing in Harrisburg. He has represented Dean Foods and the Pennsylvania Milk Dealers in past years on the price-setting hearings conducted by the PMMB. In fact, the esteemed milk accountants of Herbein and Co. in Pennsylvania are providing material for some of the MIG opposition arguments to come. Cheap Class I milk is the name of the current game.

The MIG will be working overtime through Mr. English to make sure Class I prices are not raised, and in fact are lowered at the farm level since one of their proposals that WAS accepted by USDA is to remove the base Class I price differential of $1.60/cwt from every FMMO — across the board.

Who is the MIG? The Milk Innovation Group members include Anderson Erickson Dairy Co., Inc.; Aurora Organic Dairy; Crystal Creamery; Danone North America; Fairlife; HP Hood LLC; Organic Valley/CROPP Cooperative; Shamrock Foods Company; Shehadey Family Foods, LLC (Producers Dairy Foods, Inc.; Model Dairy, LLC; Umpqua Dairy Products Co.); and Turner Dairy Farms.

After lunch, some high points of the first day included Dr. Roger Cryan for American Farm Bureau Federation requesting volume data on all of the salted and unsalted butter that is graded by USDA AMS for retail. This, he said, is four numbers and should be readily available. It is germane to AFBF’s proposal to include unsalted butter in the product price survey used in the Class IV pricing formula.

Testimony began late in the afternoon on the first proposal from NMPF to raise component levels in the uniform pricing formulas to more accurately reflect today’s protein and other solids levels.

Peter Vitaliano, NMPF’s vice president for economic policy and market research, laid out the proposal and was subjected to intense cross-examination with the promise of hours more of cross examination on the second day by Mr. English before even getting to the first expert fact witness — Calvin Covington, for Southeast Milk and NMPF.

While NMPF witnesses will show the outdated component levels are giving a ‘deal’ to Class I processors paying less for skim that is more valuable today in terms of components, IDFA’s attorney Steven Rosenbaum grilled Vitaliano on this. He tried on seven attempts to establish that the fat/skim orders in the Southeast don’t have component levels as high as the national average by asking for this breakout in seven differently-phrased questions, all the while discreetly suggesting that this change would “overpay” producers in fat/skim orders.

He also questioned how fluid milk processors are supposed to recoup that value if it doesn’t “fill more jugs of milk”. Vitaliano responded to say that protein beverages are a big deal to consumers, and some milk marketing is being done on a protein basis. Rosenbaum asked for a study showing how many fluid processors are doing that, and then basically said, in lawyer speak, the equivalent of ‘never mind,’ as Vitaliano interjected that it’s more valuable to consumers.

In this reporter’s mind, the thought that kept popping up during that exchange was this: If IDFA and MIG are so intent on suppressing the Class I price to avoid paying for the improved value of milk, then maybe they should then start forking over their cost data in audited surveys to the USDA to justify the $3.60 per hundredweight they are getting subtracted from the base Class I price in the form of Class III and IV make allowances that do not even apply to them, but they get that deal anyway.

These are just a few thoughts from an intense first day of the national FMMO hearing that NMPF is calling the “first in a generation opportunity” to make key adjustments to the milk pricing formulas to reflect a changing dairy industry. It appears that many of their proposals will help farmers… We’ll see over the next 6 to 8 weeks where it’s all going.

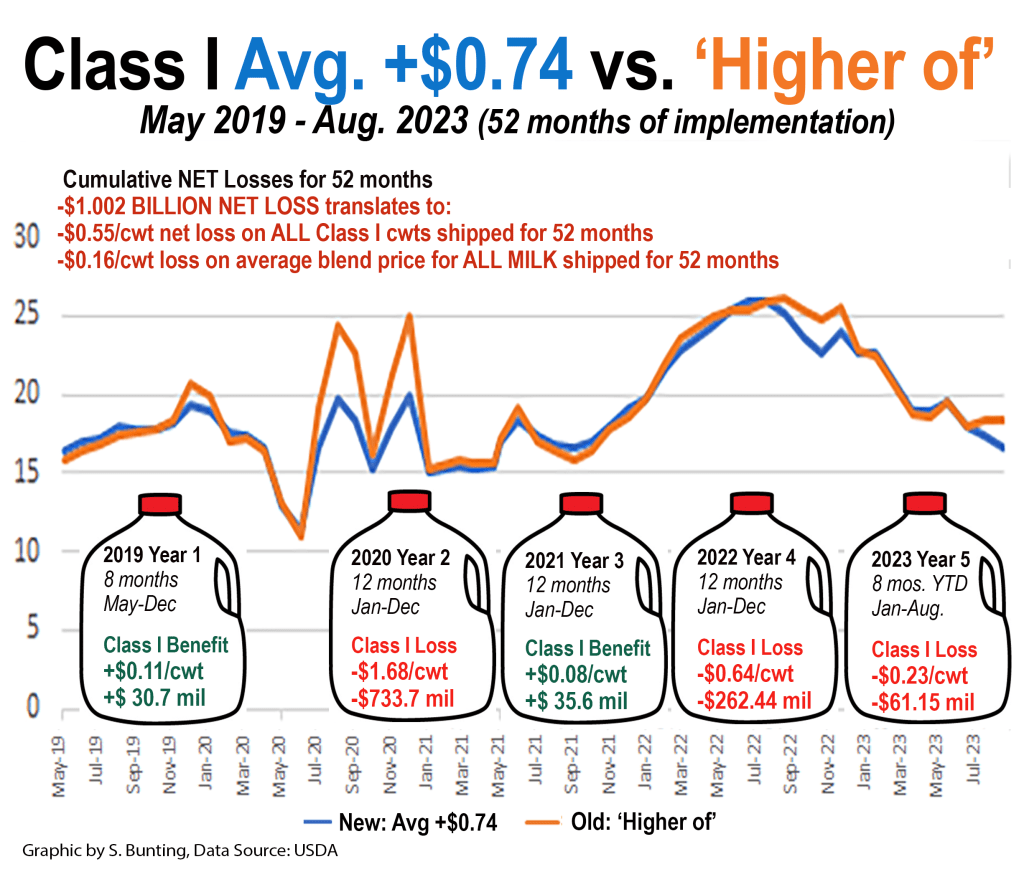

In the meantime, Congress may want to think about fixing the Class I mistake it made in the 2018 farm bill by changing four simple words from ‘average plus 74 cents’ to ‘higher of’ and at least get that done timely.

This hearing could leave that objective in the dust if the first day is an indication of what is to come.

Information to tune in by livestream through zoom or to dial-in and listen from a cell phone or landline has just been announced.

View the hearing at this link: https://www.zoomgov.com/j/1604805748 and enter Webinar ID 160 480 5748

Or listen via one tap mobile: +1.646.828.7666, using ID 1604805748#

Or listen via landline telephone: +1.669.254.5252 and enter ID 160 480 5748

The hearing schedule will proceed in this order to consider accepted proposals under these categories, according to USDA:

1. Milk Composition (component yield) proposals.

2. Surveyed Commodity Prices (removing or adding commodities to the weekly price surveys used in the class and component pricing formulas).

3. Class III and IV Formula Factors, which includes various ‘make allowance’ proposals as well as butterfat recovery factors, and farm-to-plant shrink.

4. The Base Class I Skim Price (Mover) Formula (6 proposals, 3 favoring return to ‘higher of’, including 2 that also favor eliminating ‘advanced pricing’ of Class I. )

5. Class I and II Differentials.

Copies of the notice, a list of proposals being considered, guidelines for how to participate, the hearing schedule, and corresponding hearing record can be found and followed on the Hearing Website at https://www.ams.usda.gov/rules-regulations/moa/dairy/hearings/national-fmmo-pricing-hearing

For technical difficulties, please email FMMOHearing@usda.gov

-30-