Education Chair Virginia Foxx: ‘Let’s end the war on milk. Pass the bill!’

Ag Chair G.T. Thompson praised as champion who doesn’t give up

Bill mooves on to U.S. Senate

By Sherry Bunting, Farmshine, December 15, 2023

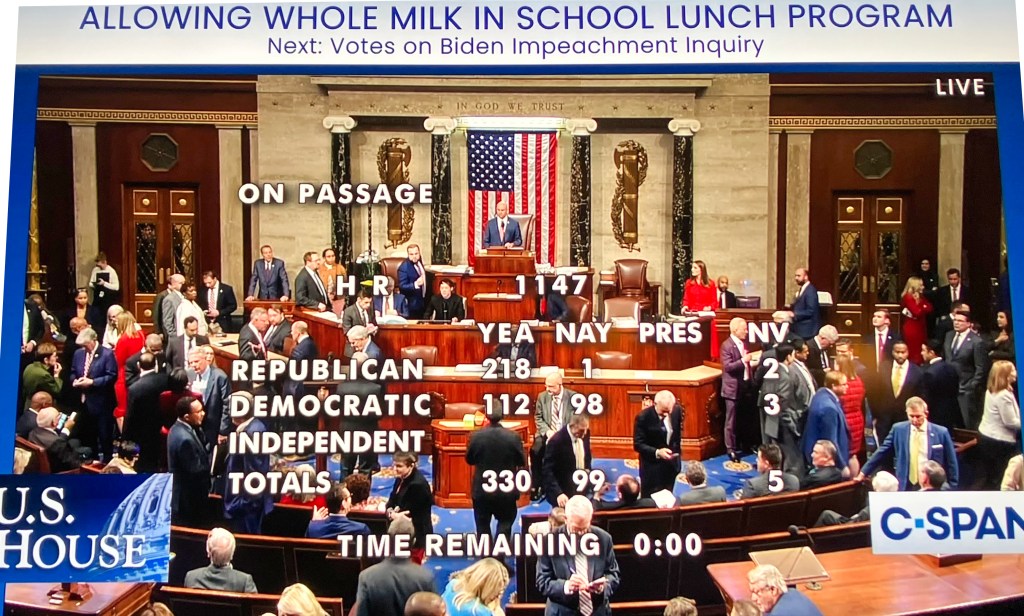

WASHINGTON — Wednesday, December 13th was a big day for dairy farmers and schoolchildren! After clearing the House Rules Committee Mon., Dec. 11, the Whole Milk for Healthy Kids Act, H.R. 1147, passed overwhelmingly in the U.S. House of Representatives.

The strong bipartisan 330 to 99 vote moves the choice of whole milk closer to school cafeterias across the nation with momentum for the next stop: the U.S. Senate, where S. 1957 has 12 bipartisan sponsors from 10 states – and more are needed.

“Students across the nation deserve school lunches that are both enjoyable and nutritious, and this legislation achieves these goals,” said Whole Milk for Healthy Kids Act champion Glenn ‘G.T.’ Thompson (R-PA-15), Chairman of the House Agriculture Committee and senior member of the Education and Workforce Committee as he testified before the Rules Committee Monday.

“Milk is an essential building block for a well-rounded and balanced diet, offering 13 essential nutrients and numerous health benefits. However, outdated and out-of-touch federal regulations have imposed restrictions … Students are not able to access any of the milk’s essential nutrients if they won’t drink the milk being served to them. As we have seen over the last decade, there has been a steady decline in school milk consumption. This bill does not mandate anything. It gives schools, parents, and students the option of whole milk,” said Thompson.

Education Committee Chairwoman Virginia Foxx (R-NC-5) was blunt on the House floor: “Whole milk isn’t just a beverage; it’s a vital source of nutrients essential for children’s growth. Denying access to its calcium, vitamin D, and protein threatens to inhibit their development. To the anti-milk advocates, I have one thing to ask of you: What do you have against milk? Let’s end this war on milk. Pass the bill!”

And they did. Resoundingly, the People’s House sent a strong message to the opposition that hung their hats on the flawed Dietary Guidelines for Americans (DGAs) as the end-all, be-all.

Education Committee Ranking Member Bobby Scott (D-VA-3rd) re-litigated his argument that was previously defeated in bipartisan Committee passage of H.R. 1147 in June. He kept referring to the DGAs. He insisted skim milk is the same as whole milk, nutritionally, but disregarded the roles of milkfat in key vitamin absorption and flavor to keep those nutrients from going down the drain.

Congress tied school meals closer to the DGAs in 2010, and the Obama-era USDA developed beverage rules in 2012 that banned whole milk — leading to the loss of a generation of milk drinkers and unprecedented increases in childhood obesity and diabetes — to the point where an April 2019 U.S. Senate hearing noted concern from U.S. military generals on fitness of recruits.

The Rules Committee asked why whole milk is being handled as a separate bill instead of within a Childhood Nutrition Reauthorization package. Thompson explained that the reauthorization has not occurred since the 2010 Healthy Hunger Free Kids Act created the issue.

“There is widespread bipartisan support in the Education and Workforce Committee, on the beverage part of this, milk in particular, because studies have shown the BMIs have gone up from what was a baseline prior to removing whole milk. Part of the urgency here is the significant impact that has had on the health of our youths,” he said.

Thompson cited the case study analysis of annual body mass index (BMI) data aggregated by Christine Ebersole RN, BSN, CSN, a school nurse from Martinsburg, Pennsylvania. She shared her data on 7th to 12th graders in a 97 Milk / Grassroots Pennsylvania Dairy Advisory Committee education session in Washington in June 2023 and in a State Senate hearing in Harrisburg in 2021.

Her data showed the percentage of students in the overweight and obese categories, combined, grew from 39% in 2008 to 52% in 2021. This mirrors national trends demonstrating the anti-milkfat approach has not helped and may have harmed. The trends in fact have worsened ever since DGAs were created to infiltrate institutional feeding programs.

According to the latest National Survey of Children’s Health at the CDC website, the percentage of 10- to 17-year-olds with BMI in the obese category, alone, increased nationally from 15.4% in 2006 to 19.7% in 2018. In 1970 to 1980, it was 5%. This doubled eight years after the DGAs were born to 10% in 1988, then rose to 15.4% by 2006 after six years of USDA school lunch saturated fat caps were implemented, then stabilized at just over 15% from 2008 to 2012, then grew to 19.7% by 2018 — six years into the USDA ban on whole milk in schools.

The big milestone for whole milk in schools comes on the 5-year anniversary of Berks County, Pennsylvania dairyman Nelson Troutman placing his first painted roundbale “Drink Whole Milk (virtually) 97% Fat Free” in a pasture by a crossroads, which led to questions, publicity, and the creation of 97 Milk.

The 97 Milk educational organization has worked alongside the Grassroots Pennsylvania Dairy Advisory Committee on the legislative side. As a team, they continue to lead the charge for children to have the choice of whole milk once again at school. They are pleased to have worked with the Nutrition Coalition, founded by Nina Teicholz, author of Big Fat Surprise, and to see other national dairy and farm organizations join in support in recent years — from the American Dairy Coalition and Farm Bureau to National Milk Producers Federation and International Dairy Foods Association.

“We are grateful for this bill’s champion, the honorable G.T. Thompson. We thank him for not giving up,” said 97 Milk Baleboard originator Nelson Troutman in a Farmshine phone interview about the bill. “So many legislators get pounded from the top down, and they give up… and really, G.T. didn’t have a lot to gain out of this except helping the people. He did this for the kids, for the people, for the farmers. This is not a mandate. This is a choice, and I cannot emphasize the word choice enough.”

“The reason we got here is G.T.’s dedication to children having nutritious and delicious milk choices, and he brought it to the finish line in the House,” said Bernie Morrissey, chairman of the Grassroots PA Dairy Advisory Committee. “We have to keep working on the Senate, and 97 Milk has been a major part of educating people about this choice kids will have when the Whole Milk for Healthy Kids Act becomes law. The people on our grassroots committee and 97 Milk – we are a team. Our teams help each other. When you have a great team and teamwork, that’s how things get done.”

“This is a strong step in the right direction, and we have to keep going to our total destination,” said G.N. Hursh, Lancaster County, Pa. dairy farmer and chairman of 97 Milk. “We at 97 Milk totally support this bill. Whole milk choice in schools is clearly a national improvement for our future leaders. This is a win for good taste and excellent nutrition!”

Dale Hoffman and his daughter Tricia Adams, also members of the Grassroots Pennsylvania Dairy Advisory Committee expressed their gratitude. Three generations operate Hoffman Farms in Potter County, Pa.

“G.T. has really fought for this and put a lot of work into this. We appreciate what he has done in helping out the kids and the farmers,” said Dale in a phone interview. “When you look at the health situation, the trends have gone the other way without whole milk in the schools. Kids are dumping the milk, and you can’t blame them. They need those nutrients physically and mentally. Milk is one of nature’s most perfect foods. We produce it and grew up with it. Children should be able to choose it.”

Grassroots committee member Krista Byler, of Spartansburg, Pa. is a Union City school foodservice director and head chef. She said the Whole Milk for Healthy Kids Act “is huge for me because I have seen this from the startup, and I finally seeing movement in the school nutrition organizations. I see the whole picture coming together. I am amazed to see it reach this point that now students are much closer to having a milk choice that meets their nutritional needs,” she said.

Byler notes that the milk carton shortage affecting school districts this year has been a catalyst for support among her peers for the expansion of choices in milkfat levels.

“It’s sad to say, but as we struggle on the milk carton shortage, it forces people in my position to think outside the box and look at alternative service methods,” said Byler. “We are seeing students asking for other milkfat options, such as whole milk.”

She says she sees more of her peers today are excited about this bill and how it is worded in a way that makes it possible for them, as school foodservice directors, to implement — to actually offer whole milk as an option for students and not be financially penalized by the federal government for exceeding arbitrary and outdated fat percentages on the meal.

“I’m excited to be closer to having this choice to meet students’ needs in a way that is nutritious and that they find delicious. My students will be so excited,” said Byler. “When it becomes law, it will be a huge win for kids everywhere, and our waste will certainly go down.”

Look for more in Farmshine about this milestone, what’s next, and the three amendments that were offered and approved along with the bill. They are: 1) allowing school milk to be either organic or non-organic, 2) preventing school milk from Chinese state-owned enterprises, and 3) prohibiting USDA from doing its proposed elementary school ban on flavored milk.