Vilsack lays out plan for USDA to partner in ‘Net Zero’ pilot farms, using results to set governmental policies and incentives

By Sherry Bunting, Farmshine, May 24, 2019

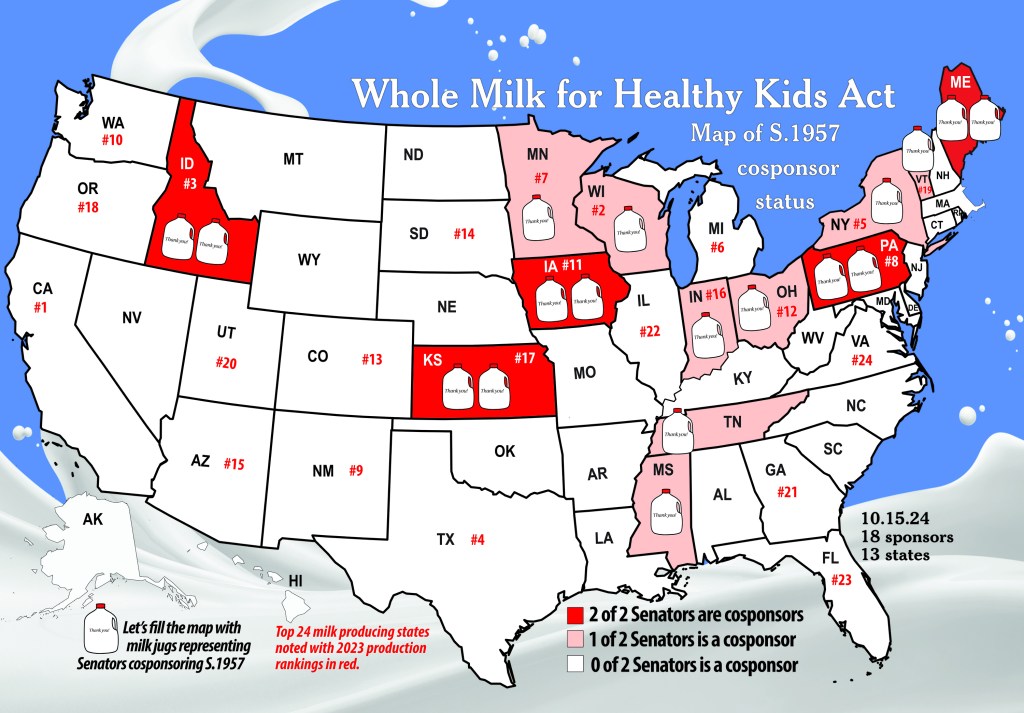

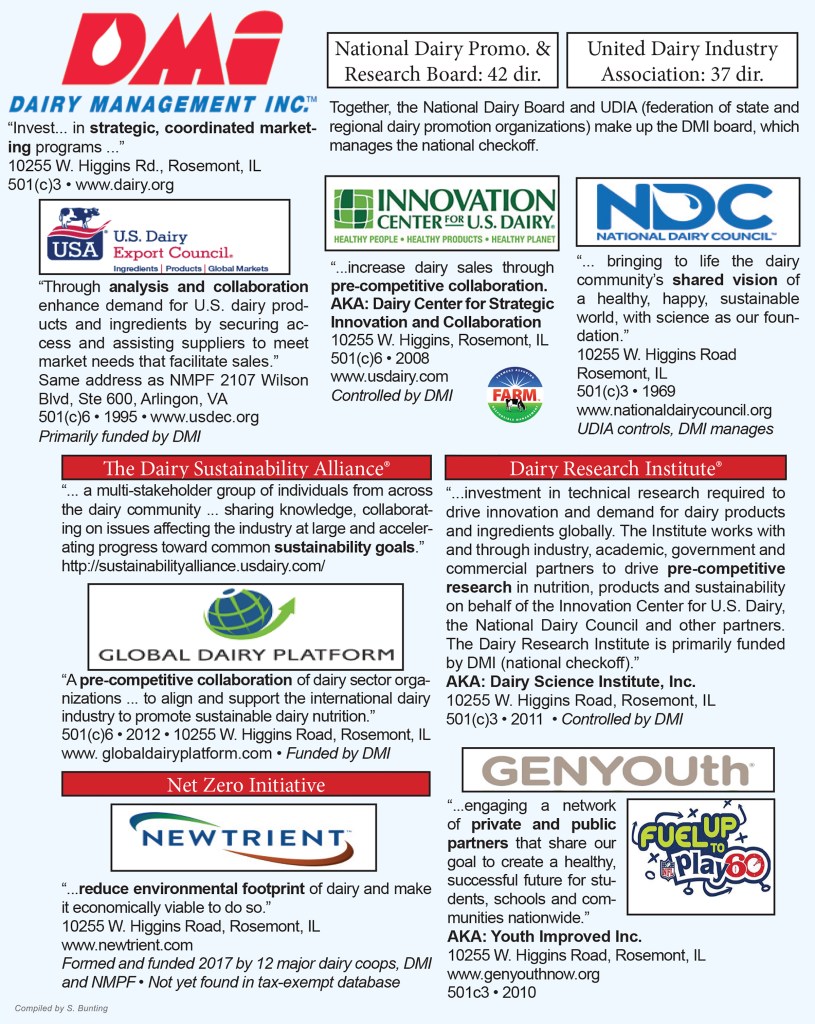

(Above) DMI’s checkoff-funded Innovation Center for U.S. Dairy was formed in 2008, the year Tom Vilsack became U.S. Secretary of Agriculture. This timeline shows the events from 2008 to 2019 around the Innovation Center, sustainability programs, FARM program and various MOU’s with USDA while Vilsack was Secretary and after he became president and CEO of U.S. Dairy Export Council in 2017.

WASHINGTON, D.C. — FARM program evaluations over the past few months have yielded reports from dairy producers on new questions they are being asked about their feeding practices and usage, nutrient management plans, manure management systems and cropping practices, feed rations by class of cattle, livestock and feed inventories on the farm and heifer inventories raised off the farm, milk receipts and receipts for cattle sold for beef purposes, energy and fuel usage and costs, specific questions about wetlands on farm properties as well as new questions about human resources.

Over the past two years, the National Dairy Farmers Assuring Responsible Management (FARM) has added new ‘silos’ to the 4-part program. In addition to Animal Care, the newer portions are Environmental Stewardship, Antibiotic Stewardship, and Workforce Development. With all four in place, virtually every management aspect of a dairy farm falls under the FARM umbrella.

The FARM program is funded by the mandatory dairy checkoff through DMI’s Innovation Center for U.S. Dairy. FARM is administrated by National Milk Producers Federation (NMPF).

98% of milk enrolled

According to its 2018 Report, 98% of the milk produced in the U.S. is enrolled in FARM. The Animal Care silo is mandatory for all 115 participating cooperatives and processors, and 20 of the 115 adopted the Environmental Stewardship module by the beginning of this year.

Development of the Environmental Stewardship (ES) module began at FARM’s inception in 2009 but did not become a ‘silo’ in FARM until 2017. The FARM website states that this portion is currently “voluntary for program participants.”

This simply means that the 115 cooperatives and processors that are participating in FARM can voluntarily add the ES module. When added by the participating cooperative or processor, the components of the module become — in effect — mandatory for the farms.

The FARM materials clearly state that FARM is not a legal document. And yet, its modules have expanding levels of authority beyond a milk shipper’s legal milk contract obligations, without expanding compensation.

FARM’s Environmental module was developed, according to the 2018 annual report, as “a tool participants (co-ops and processors) can use to communicate progress towards reducing their carbon and energy footprint.”

The report says further that the Environmental portion of FARM is geared toward assuring dairy customers and consumers of the dairy industry’s commitment to “ongoing environmental progress (by) asking a set of questions to assess a farm’s carbon and energy footprint and then providing farmers with reliable, statistically robust estimates.” It also “tracks advances in dairy production efficiency.”

The questions and data are evaluated based on a life-cycle assessment (LCA) of fluid milk conducted by the Applied Sustainability Center at the University of Arkansas, incorporating modeling piloted on 500 example dairy farms across the country.

Checkoff-funded GHG calculator

This LCA development was launched in 2009 at the inception of FARM. By 2010, the greenhouse gas (GHG) LCA was completed, and by 2012, the comprehensive environmental LCA was completed. The program’s ‘Farm Smart’ tracking tool was piloted on the ‘model’ farms in 2013-14.

Farm Smart became a transitional tool in 2016 during a period of analysis, replication, system testing and piloting. In 2017, the FARM program added the Environmental module and began using this ‘Farm Smart science’ to establish the GHG calculator.

FARM environmental audits

For those producers who are being asked these new questions during their FARM evaluations in the past few months, their answers are recorded, and farm data are entered into a spreadsheet, from which annual Environmental audits will be randomly selected.

A video at the FARM website explains the process evaluators use to enter the farm name, zipcode and most recent daily milk shipment in pounds of fat and energy-corrected milk.

The spreadsheet automatically groups these farms by 3-digit zipcode and automatically ranks them within their geographic area by production quartiles — the top 25% of farms with the largest daily milk shipments are in quartile 1 and the smallest 25% are in quartile 4 with the other two quartiles automatically segregated.

Another built-in formula then sorts the farms by 3-digit zipcode and then by production quartile to break out ‘subset’ lists from which 33% of each subset will be randomly selected for annual audits.

Evaluators are told in this training video that the information they are collecting is “purely informational and will be used by National Milk Producers Federation (NMPF) at a later time.”

So, as FARM evaluators come to the dairy farm, ask new questions and record new information to develop profiles of farms to run through a Farm Smart GHG calculator, the tracking of the milk supply is well on its way.

This tracking eventually becomes a point of oversight and internal regulation to reach the goals set by the checkoff-funded DMI Innovation Center for U.S. Dairy.

Checkoff sets GHG goals

During a Senate hearing on Agriculture and Climate Change this week (May 21), former USDA Secretary and current president and CEO of the checkoff-funded U.S. Dairy Export Council stated that “U.S. Dairy” is “on pace” to meet its goal (set while he was Secretary in 2009) of reducing GHG by 25% by 2020.

Vilsack also announced that the new benchmark set by DMI’s Innovation Center for U.S. Dairy is net-zero emissions (by 2030).

When introducing Vilsack at the hearing, the Senate Ag Committee leadership referred to him not only as the honorable Secretary, but as president and CEO of the dairy “exports and innovation.”

The former Ag Secretary in his current role is instrumental in DMI’s Innovation Center for U.S. Dairy as this entity partners with multi-national corporations operating global supply chains sourcing dairy products and ingredients.

In fact, Vilsack spent much of his time in front of the Senate Ag Committee Tuesday pressing for government support and partnership in setting up pilot farms where all technologies for meeting the net-zero benchmark can be “measured, verified, cost-assessed and then marketed.”

He said the dairy industry needs a “showcase” of pilot farms and ecosystem markets, and he said business opportunities and jobs will follow. Vilsack also indicated that a net-zero achievement is necessary so “U.S. Dairy has a marketing advantage to be competitive in global markets.”

In the past, the ‘showcase’ dairies for the various pursuits of DMI’s Innovation Center for U.S. Dairy, have included Fair Oaks, and Mike McCloskey of Fair Oaks, based in northern Indiana has been a key driver in DMI’s Innovation Center for U.S. Dairy, headquartered an hour or so north in Chicago. The Innovation Center also provided funding for fairlife as a startup over the past decade of these developments.

Vilsack involved from inception

The Innovation Center for U.S. Dairy was implemented by DMI in 2008. The FARM program came under that umbrella in 2009. Both the GENYOUth and the Sustainability Memorandums of Understanding (MOU) were signed by DMI and USDA in 2009 and 2010 near the beginning of Vilsack’s 8-year tenure as Secretary. And, in 2010, DMI’s Innovation Center set a goal to reduce the already tiny carbon footprint of dairy by 25% by 2020. As now DMI employee Vilsack testified Tuesday, the Innovation Center’s new goal is net-zero by 2030.

In fact, in the final days of the Obama administration, on January 13, 2017, former Secretary Vilsack stepped from the office of the USDA Secretary on Independence Avenue, Washington D.C., and just 11 days and 4 miles later on January 24, 2017 stepped into his current office as president and CEO of the checkoff-funded U.S. Dairy Export Council, sharing offices with National Milk Producers Federation (NMPF) on Wilson Boulevard, Arlington, Virginia.

As noted, the dairy checkoff — under the increased guidance of the Edelman public relations and marketing firm — started down this road in 2008 with the formation of the Innovation Center for U.S. Dairy and the close working relationship with Vilsack while he was Secretary of Agriculture.

Through the MOU’s signed with USDA at that time, it is clear that DMI and its fledgling Innovation Center for U.S. Dairy was working closely with the USDA for all eight years Vilsack was Secretary and has carried the same direction and workload over to his employment with DMI in continuing to set benchmarks for dairy ahead of the current anti-cow discussions that have percolated over that same time within federal agencies through the influence of activist non-governmental organizations.

The DMI Innovation Center partnership with World Wildlife Fund became solidified in 2016, as Vilsack’s term as Ag Secretary was expiring.

Barely two years into his employment through dairy checkoff, Vilsack is back before the Senate Ag Committee talking about net-zero emissions, pilot farms, ecosystem markets and other concepts that align with the Green New Deal outlook on cows as a problem that needs to be solved by meatless Monday and have its methane button turned off in order to be acceptable in the EAT Lancet world where billionaires have invested in the replacement technologies of fake meat and fake dairy while simultaneously investing in U.S. global policy initiatives that were initiated while Vilsack was Secretary and were referenced by Senator Bob Casey (D-Pa.) during Tuesday’s hearing (that’s another story).

Again, instead of partnering with the private sector and organizations that understand the already small emissions of cattle when looking at the complete carbon cycle, dairy checkoff has aligned with groups like the World Wildlife Fund (WWF) and companies with technologies that are geared toward capturing methane and achieving net-zero GHG emissions.

This all sounds good, right? But what does it really amount to?

Net-zero by the numbers

The current benchmark set by DMI and USDA via the MOU in 2009-10 set the goal of reducing U.S. Dairy’s GHG by 25% by 2020. U.S. GHG inventories — according to the Environmental Protection Agency (EPA) — show that total agriculture accounts for 9%. Dairy and livestock, combined, account for half of agriculture’s contribution at 3.9%. Dairy, alone, is at 1.9% on its way, presumably, to 1.5% by 2020.

Even at that point, 25% of 2 is a savings of 0.5% of total U.S. GHG. Part of the FARM program’s tracking of GHG is to look at the number of animals culled for beef so that a portion of their GHG calculation can be pushed over onto the beef footprint and out of the dairy footprint. Can we see how the minutia goes on and on over tiny fractions of impact vs. standing tall to tell the true story about how small the cow’s impact really is?

Vilsack (above): ‘It’s time to get to net-zero’. Mitloehner (below): ‘Cattle do not increase global warming’.

Methane facts vs. fiction

Scientists are pointing out how the methane focus on cattle is being misplaced, or at least not evaluated properly. They point out in a new report that methane is a ‘flow’ emission, not a ‘stock’ emission. In other words, it doesn’t stick around or build up.

Slightly muted Tuesday was the expert testimony given by Dr. Frank Mitloehner, world renowned GHG expert and professor at University of California – Davis. He separated fact from fiction on the carbon footprint of livestock and dairy.

More importantly, he described methane, which is the main GHG of concern for agriculture and especially livestock and dairy. He explained how methane differs from the other two greenhouse gases – carbon dioxide and nitrous oxide – that together make up total GHG.

“For example, carbon dioxide lives for 1000 years, once we emit CO2 with our vehicles, let’s say, it stays there for 1000 years, same for nitrous oxide,” Mitloehner testified. “But methane is very different… with a lifespan of only 10 years.”

He described how a 1000-cow dairy after 10 years, for example, is no longer an emitter of new methane because the methane emitted is also being destroyed at the same rate, becoming part of the carbon cycle through plant photosynthesis, ruminant consumption of these plants and so forth on a continuum.

He explained this destruction process – hydroxyl oxidation – that “occurs constantly,” saying that, “Any kind of discussions that I am part of is a discussion where that fact is left out, and it shouldn’t be left out because it’s critical.”

In fact, Senator Joni Ernst of Iowa said “Some of us are pretty struck today because we have heard that methane is horrible, we need to reduce our livestock herds, and we should have meatless Mondays. We’ve heard that time and time again. It’s been done in various federal agencies in past administrations.”

Mitloehner pointed out that while methane is an important climate pollutant and almost 30 times more potent than CO2, “If we maintain constant livestock herds and flocks, then we are not increasing methane and therefore not increasing global warming as a result of that.”

In that context, mitigating methane becomes a tool to counteract global warming, which is a different discussion and one that gives the methane mitigation a valuation for potential compensation.

Surprisingly, Mitloehner’s contribution received far fewer questions from Senators than one would expect. Most of the Senators gave Vilsack multiple opportunities to come back to his theme of driving dairy and agriculture to net-zero and the business opportunities and marketing advantages this would provide for “U.S. Dairy” in global markets.

Meanwhile, a growing number of scientists are agreeing with a more realistic perspective on methane, that a more ideal approach would be aimed at zero emissions for stock pollutants that are long-lived such as carbon dioxide (through a combination of energy efficiency, more food per lower energy inputs and carbon sequestration through crops, grasses and forages) while aiming for flow pollutants like methane to be low and stable instead of zero because methane is short-lived and part of a continuous sun-powered carbon cycle in which cows are already an integral part on the positive side.

GHG tracking

With dairy farms representing 1.9% of total U.S. GHG and the transportation sector representing 80%, who is then calculating the GHG impact of transportation in a consolidating industry where the new term coined by Vilsack of ‘ecosystem markets’ substitute on a larger scale for the ‘environmentally-friendly’ concepts of regional food systems and eating ‘local.’

On the methane tracking in this deal, a split in thought processes is beginning to emerge.

Meanwhile, the Innovation Center for U.S. Dairy — and its birthing of the FARM program — provide the vehicle to meet the net-zero benchmark this checkoff-funded entity has set. The pilot farms the former Secretary wants the government to partner in supporting would develop another template of practices and technologies farms can implement to meet new Environmental FARM criteria so the net-zero benchmark can be met and marketed over the next 10 years.

While achieving, marketing and capitalizing on net-zero emissions sounds great, what does it mean for all of the farms being forced to pay into the dairy checkoff with expectations that this money is for promotion and research of the milk they produce and the care they have always taken of the resources they steward?

When benchmarks, streamlining vehicles, government cross-over specialists, evolving science, assumed needs and fuzzy baselines, converge and align, where does this leave the single-family farm of 50 to 200 cows or multi-generational dairy farm of 300 to 1500 cows?

Will they be credited for destroying as much methane as they produce by keeping their herds fairly stable in size?

Without the financial incentives or compensation to implement template technologies to achieve net-zero, how will their tiny profiled-and-tracked GHG emissions be handled in FARM Environmental Stewardship audits and mandatory correction plans in 2020, 2025, 2030?

The drive toward installation of methane digesters to actually capture the methane is great science, and it works for some farms, but not others. It’s a pathway to net-zero, and yet it is unclear whether these other factors regarding methane will be highlighted in the Farm Smart GHG calculator developed by the DMI Innovation Center for the NMPF FARM implementation. Once in place, this GHG calculator will track dairy farm GHG progress as their cooperatives and processors add the Environmental ‘silo’ to the FARM requirements of shippers.

From Innovation Center documents and USDA MOU’s and WWF partnerships documents, the descriptions of the work done between 2010 and 2016 on the GHG calculator have a tracking focus on the same thing the anti-cow folks are focusing on, and that is methane’s 30-times greater heat-trapping capabilities compared with carbon dioxide, and totally ignoring the fact that the methane is short-lived at 10 years vs. carbon at 1000 years so the livestock and dairy industries have already dramatically reduced methane by having fewer animals producing more food today than 30 and 40 years ago.

Will appropriate credit be given to small and mid-sized dairy farms that have had modest growth rates over decades or generations putting them in a place of zero new methane? Or will they need to capture methane to satisfy the net-zero benchmark their checkoff program has set in order to make space for new cows to be added in the rapid growth and industry consolidation areas of the country?

In fact, as part of a flow pattern that involves plants (feed) and cows in reducing the GHG heat-trapping potential of carbon dioxide and methane, combined (see fig. 2), what’s newsworthy is science does support more accurate modeling to credit the sequestration of long-lasting carbon and accounting for short-lived methane destruction.

On methane, Dr. Mitloehner stated that the mere fact that there are 9 million dairy cattle today compared with 24 million in 1960 and producing three times more milk shows that dairy producers are collectively not only emitting zero new methane, they are reducing total methane as old methane and carbon are eradicated by the carbon cycle and less new replacement methane is emitted.

The problem may be this: Year-over-year cow numbers for the U.S. creeped higher from 2014 to 2018 before backing off a bit in 2019. While still much lower than three or four decades ago, the issue emerging for DMI’s Innovation Center for U.S. Dairy is how to accommodate growth of the new and consolidating dairy structures to attain the expanded global export goal if dairy farms in other areas remain virtually constant in size or are grow modestly by comparison.

To reach the Innovation Center’s new net-zero goal, cows would have to leave one area in order to be added in another area, or they will all have to have their methane buttons turned off or the methane captured because now the emissions are being tracked in order to meet one collective “U.S. Dairy” unit goal under the DMI Innovation Center and NMPF / FARM. Dr. Frank Mitloehner testified that dairies already create zero new methane but this can be tricky when cattle move from one area to another (as we see in the industry’s consolidation).

Will all dairy farms have to get to net-zero to survive over the next 10 years under the GHG calculator developed by the checkoff-funded Innovation Center, which has now been added to the FARM program? That’s the big question.

Before the Senate, Vilsack repeatedly went back to his main premise that the Net Zero Project is “critical for U.S. dairy.” His written testimony specified that the Net Zero Project comes out of the collaborative work of several dairy checkoff-funded entities along with various global dairy food companies, including DMI’s Innovation Center for U.S. Dairy in combination with DMI-funded U.S. Dairy Export Council, and checkoff-supported Newtrient LLC, as well as an industry consortium called the Global Dairy Platform.

According to Vilsack, the Net Zero Project presents a “global marketing advantage for U.S. dairy,” he said. “This is how U.S. Dairy will compete.”

-30-