By Sherry Bunting, Farmshine July 26, 2024

‘Wouldn’t it be great if we could unite the country with whole milk?”

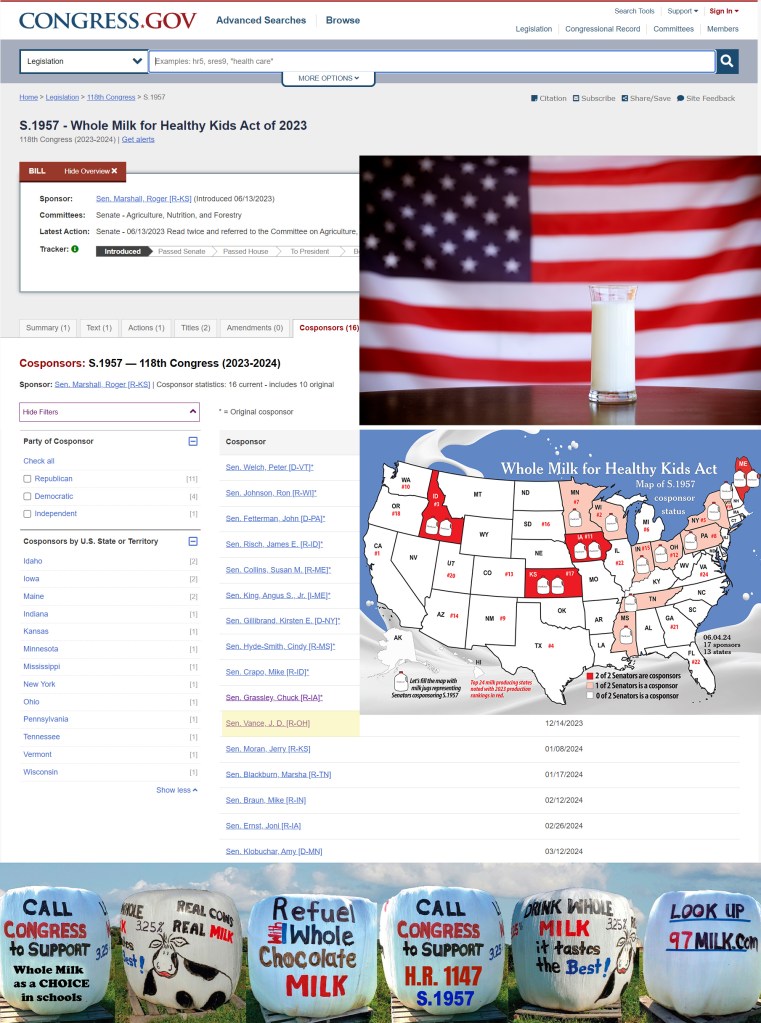

Those words were messaged to me by a friend and colleague a year ago, right after the Whole Milk for Healthy Kids Act had passed the House Education Committee in bipartisan fashion before the overwhelming passage on the House floor Dec. 13, 2023 and before Senate Ag Chair Debbie Stabenow (D-Mich.) blocked it the next day, Dec. 14, 2023.

This was my first thought, when former President Donald Trump announced Senator J.D. Vance of Ohio as his running mate in the Republican campaign. (Vance is an early cosponsor of S. 1957, the Senate’s whole milk bill.)

Like others, I’ve been involved in the effort to bring the choice of whole milk back to schools for more than a decade. It’s about natural, simple goodness — to simply strip away the federal ban and allow hungry, learning children to be nourished by milk they will love.

Looking back at the years of this long fight, I realize that if it’s so painstakingly hard to get something so simple and so right accomplished for America’s children and farmers, we’ve got problems in this country.

With President Joe Biden now withdrawing from the campaign for a second term, and Vice President Kamala Harris as presumptive nominee launching her campaign this week in the Dairyland State, I’m reminded of where she stands on such things.

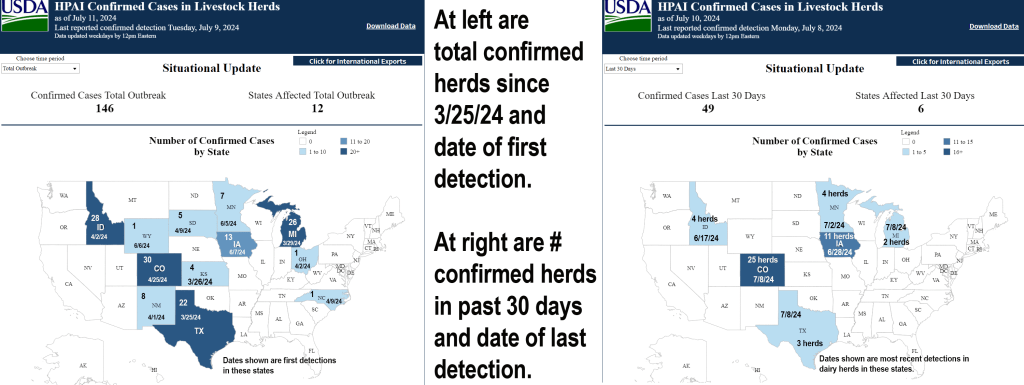

Harris is no friend to livestock agriculture. She was an original cosponsor of the Senate version of “The Green New Deal.” She has strong positions on climate change that may lead to harsher rules on methane emissions and water consumption in the dairy industry, while perhaps promoting methane digesters, which are not an equitable nor necessary solution. Cows are NOT the problem!

Some in the dairy industry are on record stating that this would be good for dairy because the DMI Net Zero goals fall in-line and tout some of the same objectives. But no matter how you slice and dice all the fancy offsets, insets, innovations, grants, projects and the billions of dollars, the bottom line leaves cattle holding the bag.

Cattle are in the crosshairs of a very long game set to control land, food and people.

Harris has already indicated she would use the Dietary Guidelines to reduce red meat consumption on the basis of this erroneous climate impact claim about cattle that we are all being brainwashed to quite literally buy into.

As a presidential candidate in 2019, in a CNN town hall, she was specifically asked: “Would you support changing the Dietary Guidelines to reduce red meat specifically to reduce emissions?”

“Yes, I would,” Harris replied, with a burst of laughter.

It’s not funny.

Earlier, she had said she “enjoys a cheeseburger from time to time,” but the balance to be struck is “what government can and should do around creating incentives, and then banning certain behaviors… that we will eat in a healthy way, and that we will be educated about the effect of our eating habits on our environment. We have to do a much better job at that, and the government has to do a much better job at that.”

Read those words again: “creating incentives and then banning certain behaviors.” In plain English, that means dangling the carrot and then showing us the stick.

Harris joins Senators like Ag Chair Stabenow, as well as Bob Casey from Pennsylvania, as card-carrying members of perennial Ag Secretary Vilsack’s food and climate police.

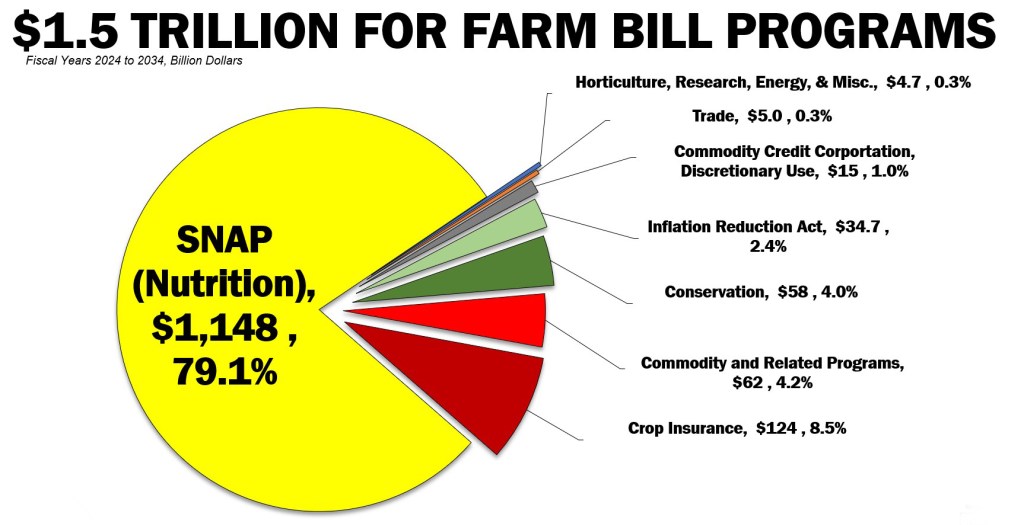

Not only is Ag Chair Stabenow blocking the whole milk bill in her Committee, she is dragging her feet on the critical farm bill.

As President Biden’s approval ratings fell, there were indications she would bring her side of the aisle to the table to negotiate a compromise to get the farm bill done this year.

Now that Biden has withdrawn from the race, and the pundits, media, and party organizers are breathless with excitement over Harris as presumptive nominee, it appears that the farm bill negotiations between the Committee-passed House version, the Republican Senate version and the Democrat Senate version have fallen apart.

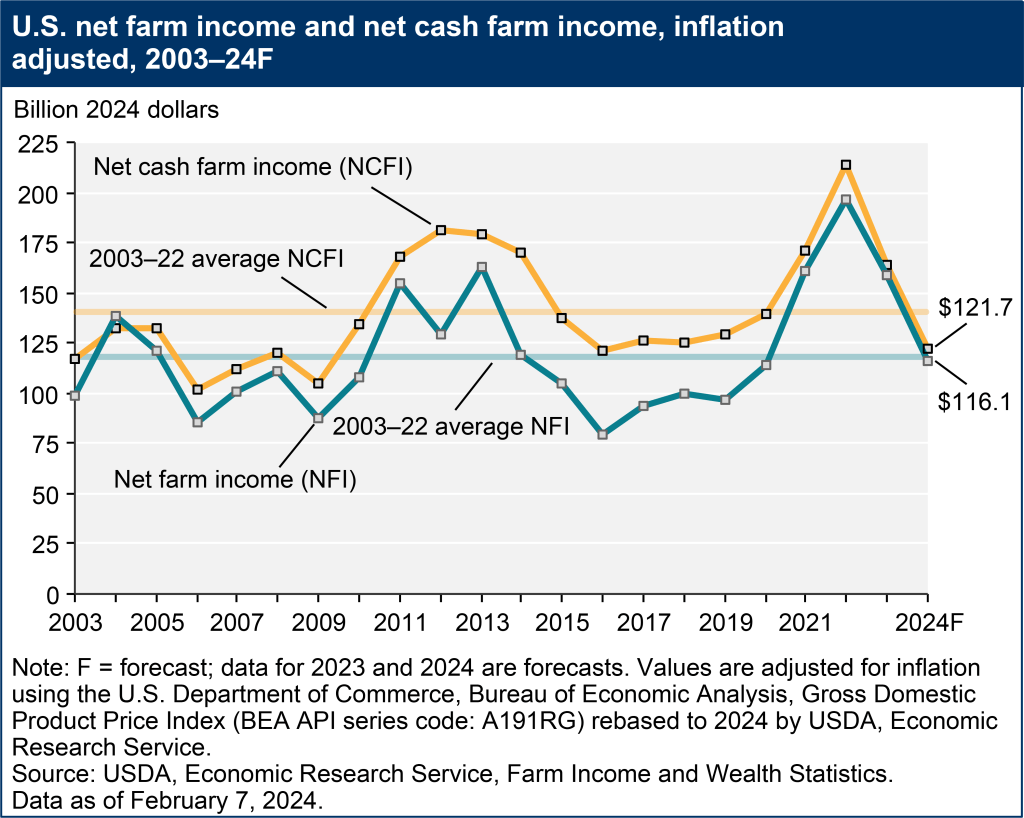

House Ag Chair G.T. Thompson (R-Pa.) has called upon his colleagues to get to the table and do the work because a perfect storm is brewing in Rural America as net farm income is forecast to fall by 27% this year on top of the 19% decline last year.

Meanwhile, there is political upheaval everywhere we look. Seeing Vance picked as Trump’s running mate and knowing he was among the early cosponsors of Senate Bill 1957 – The Whole Milk for Healthy Kids Act – offers some hope.

That bill — in true bipartisan spirit — was introduced in the U.S.Senate in June 2023 by Senator Dr. Roger Marshall (R-Kan.) with prime cosponsors Peter Welch (D-Vt.), Ron Johnson (R-Wis.), Kirsten Gillibrand (D-N.Y.), Chuck Grassley (R-Iowa), John Fetterman (D-Penna.), Mike Crapo and James Risch (R-Idaho), Susan Collins (R-Maine), Angus King (I-Maine), and Cindy Hyde-Smith (R-Miss.). The bill eventually earned cosponsorship from other Senators, including the influential Democrat from Minnesota, Amy Klobuchar.

Vance signed on as cosponsor on December 14, 2023, one day after the U.S. House of Representatives had passed their version of the bill by an overwhelming bipartisan majority of 330 to 99.

The Senate bill 1957 is identical to the successful House whole milk bill H.R. 1147, which was authored by Pennsylvania’s own Representative GT Thompson.

GT is a man of courage, conviction, compassion, of humility and humanity. I’ve heard him say more than once: “God gave us two ears and only one mouth for a reason.”

He is a determined man, doing the work. He included whole milk bill in the House Committee-passed farm bill. He’s standing firm on his pledge to put the farm back in the farm bill. He is concerned about the financial crisis in agriculture on the horizon, and held a hearing July 23 with witnesses from agriculture and banking giving stark warnings.

Even though whole milk choice in schools seems like a minor issue in the grand scheme of things today, it is really a linchpin. If we could just get something with broad bipartisan support accomplished, this could lead to other steps on common ground.

Cows are not the climate problem. Cows are a solution. Cows are part of a carbon cycle, they don’t take carbon out of the ground and put new carbon into the air.

Carbon is essential to life. It seems that those seeking full control of land, food, and people, are starting with carbon.

As the whole milk choice remains hung up in the Senate, let’s pause to think about how ridiculous it is that we adults get to choose, but our growing children do not. For them, whole milk is banned at two meals a day, five days a week, three-quarters of the year at school. (The federal government, via USDA school lunch rules, only allows fat-free and 1% milk to be offered with the meal or even a la carte.)

Maybe the Harris ticket would like to ban food choice behaviors for adults as well.

We have Republicans and Democrats supporting whole milk choice in schools. Both parties say they care about our nation’s farmers and ranchers who feed us and are the backbone of our national security.

Let’s take that and run with it.

-30-