By Sherry Bunting, Milk Market Moos column in Farmshine, July 5, 2024 (with updates)

USDA issued a 332-page recommended decision on July 1 for changes to pricing formulas in all 11 Federal Milk Marketing Orders, which was later published in the Federal Register July 15.

The bottom line is a mixed bag of positives, negatives, and questions requiring further study.

USDA AMS professionals did yeoman’s work with the 49 hearing days across five months of proceedings on 21 proposals, yielding 500 exhibits; more than 12,000 pages of transcripts of testimony from farmers, cooperatives, processors and others, along with cross-examination; and over 30 post hearing briefs and correspondence.

Once the draft decision is officially published in the Federal Register in the coming weeks, the 60-day public comment period begins, followed by 60 days of USDA evaluation of the feedback, followed by a final rule, followed by a producer referendum.

According to the FAQ section at the USDA AMS national hearing website, only producers who are pooled in the selected representative month in each Federal Order will be eligible to vote. Each of the 11 Orders votes separately.

If two-thirds of those eligible dairy farmers OR two-thirds of the pooled volume they represent in an Order vote “yes,” then that Order continues, as amended. If neither two-thirds threshold is met, then that Order is terminated. *AMS answered our question on the two-thirds determination that it is determined by the number of eligible (pooled) producers who actually participate in the vote, stating: “If a producer receives a ballot but does not return it, the producer is not included in either the numerator or the denominator of the two-thirds calculation.”

Here’s what’s in the USDA recommended decision package:

1) Milk Composition Factors: USDA recommends updating the milk composition factors to 3.3% true protein, 6.0% other solids, and 9.3% nonfat solids. This would mainly affect Class I in all Orders and the other Class prices in the fat/skim priced Orders.

2) Surveyed Commodity Products: The recommendation here is to remove the 500-pound barrel cheese prices from the Dairy Product Mandatory Reporting Program survey and rely solely on the 40-pound block cheddar cheese price to determine the monthly average cheese price used in the Class III and protein formulas. National Milk Producers Federation (NMPF) proposed this and International Dairy Foods Association (IDFA) opposed it. American Farm Bureau Federation (AFBF) had proposed adding unsalted butter and 640-lb block cheddar to the survey, and California Dairy Campaign had proposed adding bulk mozzarella. Neither of these proposals were included in USDA’s recommended decision.

AFBF chief economist Roger Cryan discussed this recently on Farm Bureau Newsline, where he also talked about USDA decision not to include AFBF’s proposal to raise the Class II differential.

3) Class III and Class IV Formula Factors: USDA chose to recommend make allowance increases that fall in between the lower increase proposed by NMPF and the higher increase proposed by IDFA and Wisconsin Cheesemakers. The USDA recommendation is to raise these manufacturing allowances from current levels to these new levels: Cheese: $0.2504; Butter: $0.2257; NFDM: $0.2268; and Dry Whey: $0.2653. The recommended decision also proposes updating the butterfat recovery factor to 91%.

By our calculations, the proposed make allowance increase would equate to roughly an additional 80 cents per hundredweight deduction from milk checks embedded in the pricing formulas. Current make allowances total up to about $2.75 to $3.60 per hundredweight, depending on product mix. New make allowances would total up to about $3.25 to $4.50 per hundredweight, depending on product mix.

AFBF economist Danny Munch was interviewed by Brownfield Ag on July 2, noting the increase is 5 to 7 cents per pound. “When we loop that into a per-hundredweight value, that means farmers will be seeing 75 cents to 87 cents less per hundredweight on their milk checks because of the increased make allowance.” He says the data used for the make allowances was based on voluntary cost of production surveys.

Farm Bureau president Zippy Duvall did not mince words: “We strongly believe make allowances should not be changed without a mandatory, audited survey of processors’ costs. Our dairy farmers deserve fairness in their milk checks and transparency in the formula, but the milk marketing order system can’t deliver that unless make allowances are based on accurate and unbiased data,” he said in an AFBF news release.

American Dairy Coalition CEO Laurie Fischer also weighed in: “We are disappointed that USDA has proposed higher make allowance credits for processors, which are — in effect — deductions from farmer milk checks that are embedded within the pricing formulas. The industry does not yet have mandatory, audited cost surveys, and there is no connection between increased processor credits and a transparent, adequate price paid to farmers,” she said in an ADC news release, adding that these two elements have been key policy priorities for ADC since January of 2022.

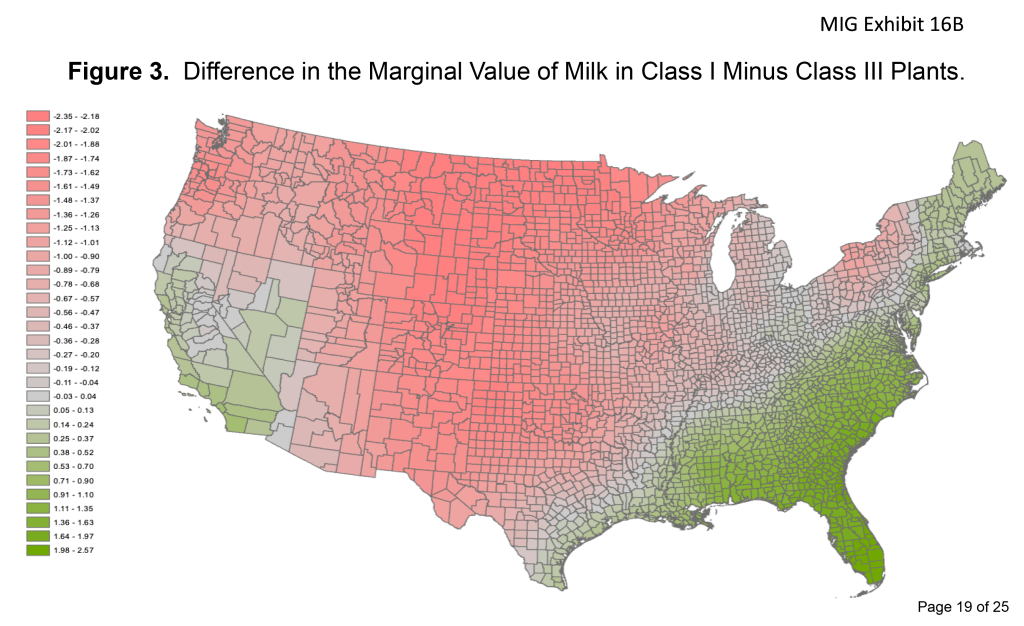

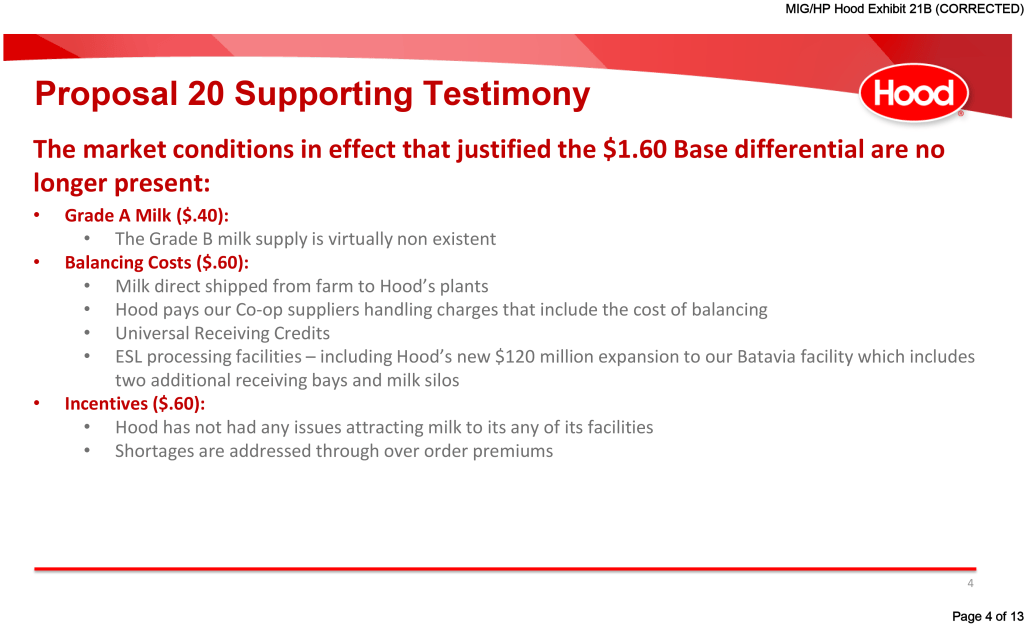

4) Class I differentials: USDA recommends updating Class I differential values to reflect the increased cost of servicing the Class I market. The base differential for all counties stays at $1.60, and the county-specific Class I differentials are specified in the decision at levels higher than they are currently, but by less than the increases that had been proposed by NMPF.

5) Base Class I Skim Milk Price: USDA recommends going back to the higher-of the advanced Class III or Class IV skim milk prices to set the Class I mover each month. However, the Department did not go with Farm Bureau’s request to do this on an emergency expedited basis.

And, here’s where it gets tricky, the higher-of method would only apply to fresh fluid milk, while adopting a rolling monthly adjuster that incorporates the average-of for milk that is used to make extended shelf life (ESL) fluid products, including shelf-stable milk.

This means ESL milk would be priced differently from conventional fresh fluid milk within the same Class I category. A simple averaging method would be used as part of this special ESL adjuster, which would incorporate a 24-month rolling average (with a 12-month lag) of the difference between the higher-of minus the average-of, which is added to the current month simple average-of, and then the current month higher-of is subtracted from that sum. This adjuster could be either a positive or negative number.

In fact, we’ve learned that this ESL adjuster, using months 13 through 36 counting backward from the implementation date, would allow milk for ESL products to recoup, over time, some of the very large prior losses experienced by all dairy farmers during the average-of method that has been in place since May 2019. Because a simple average is used for the adjuster calculation, without the 74 cents, more would be recouped than the actual loss difference experienced under the years of the average plus 74 cents method. On the other hand, the rolling adjuster look back will include months in which a smaller make allowance was in effect than could be the case in the future if USDA’s make allowance recommendation becomes final.

Meanwhile, producers of milk bottled as ‘regular’ fresh fluid milk would start right out of the implementation gate at the higher-of and recoup zero prior loss endured under the current form of average-of, and be subjected to the higher make allowance, which is built into the advance pricing factors. (More on this feature of the USDA recommended decision in a future article.)

In its ‘notice to trade,’ USDA states that the ESL adjuster was developed to “provide for better price equity for ESL products whose marketing characteristics are distinct from other Class I products.”

Meanwhile, in his July 3rd CEO’s Corner, NMPF’s Gregg Doud appears to embrace what is essentially a fifth milk class given the different pricing methods proposed in the recommended decision for Class I — depending on shelf-life classification.

Doud writes: “Recognizing the need to restore orderly milk marketing, USDA decided to go back to the higher-of, with an accommodation for extended shelf-life milk, thus granting NMPF’s request for the vast majority of U.S. fluid milk. USDA’s solution is, frankly, as innovative as it is fair – a classic case of two sides not getting all that everyone wanted, but everyone getting what they most needed.”

Splitting the baby was not part of any hearing proposal that we could find; apparently processors made their case with USDA as to needing the average-of method (with calculated adjuster) to sell ESL milk products deemed the new milk beverage platform.

During the national hearing in Carmel, Indiana, representatives from Nestle, a major maker of ESL fluid milk products, said their sales increased once the average-of method was implemented in May 2019 through legislative language in the 2018 farm bill. They testified that they could manage risk when providing 9 to 12 month future pricing on shelf-stable fluid products to foodservice and convenience stores. They lamented that losing the average-of would hurt their sales.

Representatives for fairlife testified that forward pricing of their ESL products was critical to their ability to grow sales and that losing the average-of would impact future plans, including the size of the new plant being planned for New York State and other expansions elsewhere in the future.

However, since this bifurcation of Class I was not a proposal subject to vetting, no one had the opportunity to present evidence on future impacts.

Public comments on the recommended proposals will be accepted for 60 calendar days after the decision is published in the Federal Register. Comments should be submitted at the Federal eRulemaking portal: http://www.regulations.gov or the Office of the Hearing Clerk, U.S. Department of Agriculture, 1400 Independence Ave., SW, Stop 9203, Room 1031, Washington, DC 20250-9203; Fax: (844) 325-6940.

OTHER MOOS — July 3, 2024

Milk futures swap trends: Cl. IV up, III down

Class III milk futures moved lower this week especially on August and Sept. 2024 contracts; while Class IV milk futures were higher on 2024 contracts, steady to firm for 2025. On Tues., July 2, Class III milk futures for the next 12 months averaged $19.28, down 24 cents from the previous Wednesday. The 12-month lass IV milk futures average was $21.19, up 14 cents. This put the spread between Class IV over III at nearly $2.00 per cwt.

Block cheese, whey higher

Pre-holiday trade was firm to higher with little volume moved on most products. But nonfat dry milk lost ground, and the 500-lb barrel cheese trade was active at lower prices.

The 40-lb block Cheddar price was pegged at $1.90/lb on Tues., July 2, up 2 cents from the previous Wednesday, with just 2 loads trading the first 2 days. The 500-lb barrel cheese market lost 2 cents, pegged at $1.88/lb Tuesday with 12 loads trading the first two days. (Update gained it back July 3 at $1.9025/lb with 2 loads trading). Dry whey gained a half-penny on the week at 49 cents/lb; one load traded.

Butter higher, powder weak

The butter market saw no trades the first two days this week. By Tues., July 2, the daily CME spot price was pegged nearly a nickel higher at $3.1375/lb. Grade A nonfat dry milk lost a penny and a half at $1.17/lb Tuesday with 4 loads changing hands. (Update, NFDM up July 3 at $1.18/lb, 2 loads traded)

May All-Milk $22.00, DMC margin $10.52

USDA announced the All-Milk price for May at $22.00, up $1.50 from April and $2.90 higher than a year ago. The national average fat test was 4.17, up 0.02 from the previous month and up 0.11 from a year ago. The Pennsylvania All-Milk price for May, at $22.50, was just 70 cents higher than for April, and fat test fell by 0.10 from April to May.

USDA announced the May Dairy Margin Coverage (DMC) margin at $10.52/cwt, up 92 cents from April and up a whopping $5.69 per cwt from the May margin a year ago. This is the third consecutive month in which no DMC margin payments were triggered as the margin remains above the highest coverage level of $9.50/cwt. The $1.50/cwt gain in the national average All-Milk price in May outpaced the 58 cents/cwt increase in feed cost.

H5N1 detections fall to 57 in just 7 states

As of July 2, 2024, the confirmed cases of H5N1 in dairy cows decreased to 57 herds in now just 7 states as South Dakota moved past the 30-day window and off the active map. Colorado has the most detections at 23 in the past 30 days, 27 cumulatively since April 25. This has created some questions as it represents 20 to 25% of the 110 herds in the 13th largest milk-producing state. Colorado is followed by Iowa (12), Idaho (9), Minnesota (6), Texas (5), while Michigan’s previously high numbers over 25 have dropped to one, and Wyoming still has just one. Michigan and Wyoming will be past their 30 days on July 7 and 12, respectively, if no new detections are confirmed.