Michigan issues emergency order and prohibits cow shows; now has HPAI detections in more dairies (14) than any of the other nine states.

By Sherry Bunting, May 17, 2024

WASHINGTON — The Biden Administration announced new actions and $200 million in funding on May 13th to “combat highly pathogenic avian influenza (HPAI).”

These announcements appear to be the start of incremental expansion of federal surveillance and control of dairy, livestock and food industries to a level not seen before, but apparently planned for over the past two decades.

USDA said it is separately taking steps to make funding available through the Emergency Livestock Assistance Program (ELAP) to compensate eligible producers with positive herds, who had milk production losses.

(Note after press: National Milk Producers Federation announced May 16 that it has been awarded funding by the USDA APHIS Disease Preparedness and Response Program supporting two NMPF and FARM projects advancing dairy cattle disease preparedness, but the press release did not provide a dollar amount.)

H5N1 was first detected in lactating dairy cows on March 25, 2024 in the Texas Panhandle, where a syndrome was noticed in February marked primarily by reduced feed intake, reduced rumination, 20% drop in herd level milk production, colostrum-like changes in milk appearance, and dry tacky manure.

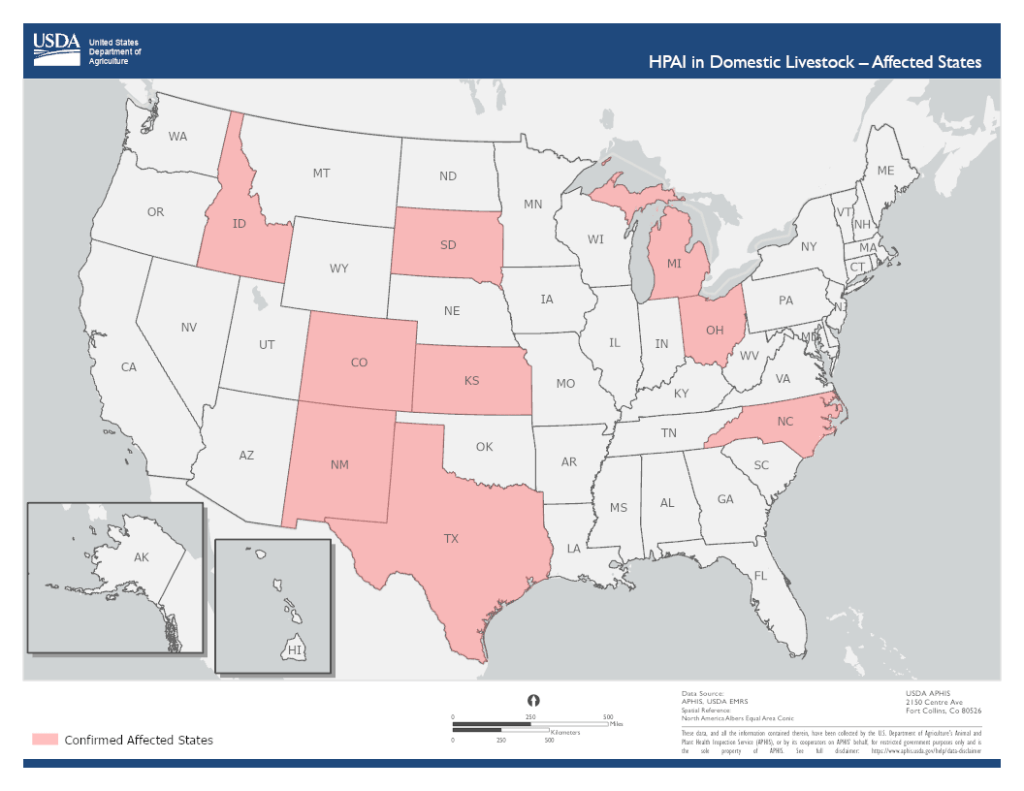

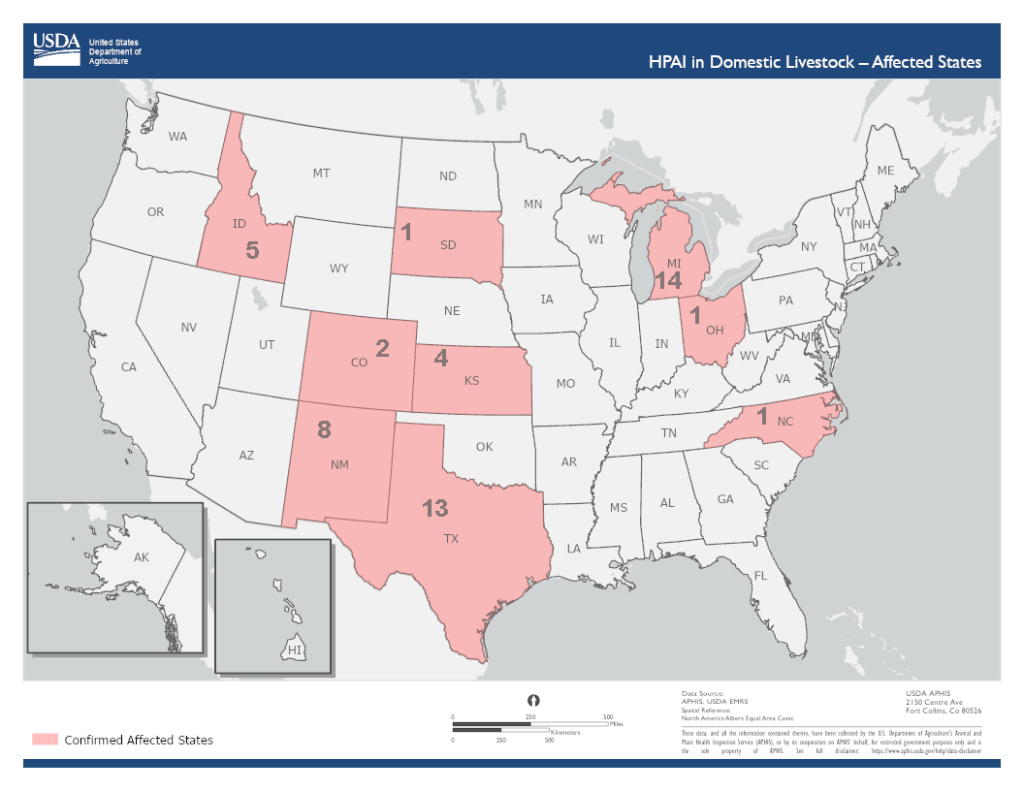

New detections have spread to 49 dairy herds in 9 states, as of May 15. They are: Michigan (14), Texas (13), New Mexico (8), Idaho (5), Kansas (4), Colorado (2), Ohio (1), North Carolina (1), and South Dakota (1).

Product testing continues to confirm that pasteurized retail milk and dairy products are safe, according to the CDC and FDA. In addition, as expected, meat tests show no trace of virus. The primary concern, especially for states with poultry and dairy farms, is the potential for spread from dairy to poultry. Cattle recover from the virus, poultry do not.

USDA will control approximately $98 million of the funding announced May 13th, and the Department of Health and Human Services (HHS) will oversee $101 million in funding from budgetary appropriations. The Administration says it plans to ask Congress for more.

According to HHS, “public and animal health experts and agencies have been preparing for avian influenza outbreak for 20 years.” The department said this funding “capitalizes on the influenza foundation that has been laid over the last two decades.”

Within the new funding structure, Centers for Disease Control (CDC) is monitoring the virus to detect changes that may increase human risk and releasing PPE from the “strategic stockpile.” The Food and Drug Administration (FDA) is working with USDA to sample-test retail milk and dairy products across the country and to evaluate vaccine platforms. The National Institutes of Health (NIH) is providing supportive science.

In short, the HHS funding will be used to expand testing capacity of the national laboratory system; scale up and expand surveillance among animal and human populations; release PPE for states to distribute to farmworkers and others; beef-up animal electronic identification systems; and streamline contact tracing, not just for cattle and poultry, but people too.

Funds are also being directed to make or procure over one million additional influenza tests, evaluate ‘candidate virus vaccines’ and develop new ones, continue testing retail milk and dairy product samples, evaluate vaccine platforms, and scale up community surveillance through testing of patients with respiratory symptoms in a variety of care environments as well as monitor public waste treatment systems for viral load.

On the USDA side, direct funding will be available to affected dairies (up to $28,000 per affected dairy) to prevent the spread in the following ways:

— Up to $2000 per month per affected premises for distribution of PPE, which includes agreeing to facilitate worker participation in surveillance studies and monitoring. Separate incentives up to $100 per employee will be paid for their participation.

— Up to $1500 per month per affected dairy to develop and implement ‘secure milk supply’ enhanced biosecurity plans that USDA APHIS has already developed as a framework for disease outbreak over the past 20 years.

— Up to $2000/month per affected premises to implement heat treatment of waste milk before disposal.

— Up to $10,000 per affected premises to compensate for veterinary treatment costs.

— Offset costs of shipping samples for testing (up to $50 per shipment and up to two shipments per affected premises per month). Funds will also be provided to farms that install inline milk testing and monitoring equipment.

Testing through National Animal Health Laboratory Network (NAHLN) Labs is already free of charge to both the unaffected dairies doing premovement testing and affected dairies testing samples from symptomatic and asymptomatic cows.

These announcements are detailed and available at the continually updated APHIS webpage devoted to HPAI in livestock: https://www.aphis.usda.gov/livestock-poultry-disease/avian/avian-influenza/hpai-detections/livestock

After a quiet 10 days in terms of new detections, APHIS added 10 new ones to the chart on the day before the Biden Administration announcements, backdated May 8-11, and three more on May 14, all in just four of the affected states: Michigan, Texas, Idaho and Colorado. No new states have emerged since April 25.

In addition to the April 25 Federal Order on pre-movement testing for interstate shipment of lactating dairy cows, reported previously in Farmshine, USDA is now urging states to take stronger action in restricting movement of dairy cattle within their state borders, especially states with positive HPAI herds.

The Michigan Department of Agriculture and Rural Development (MDARD) has already issued its “HPAI Risk Reduction Response Order” – designated as a “Determination of Extraordinary Emergency” Order.

Michigan now has the highest number of HPAI-detected dairies (14), surpassing Texas (13), where the first HPAI detections were reported. Michigan has also seen the highest number of poultry flock losses due to HPAI depopulations.

The Michigan Order mandates that, “All lactating dairy cattle, and those in the last two months of pregnancy, are prohibited from being exhibited until there are no new cases of HPAI in dairy cattle in the State of Michigan for at least 60 consecutive days.” In addition, no dairy cattle of any age may be exhibited from an infected premises until further notice.“

The Michigan Order also requires ALL dairy and poultry farms – whether or not they are confirmed HPAI detections — to designate a biosecurity manager, designate secure area perimeters that limit points of access, establish cleaning and disinfection practices for individuals and vehicles that include deliveries of feed and supplies, and provide training for employees.

Logbooks must be kept maintaining records of all vehicles and individuals who have gotten out of those vehicles and crossed identified access points on Michigan dairies – and their reason for doing so — which must be made available to examiners upon request.

-30-