AUTHOR’S NOTE: Who’s the wizard behind the curtain on USDA’s last-minute milk pricing surprise, the splitting of the Class I baby to favor ESL? Vilsack, of course, with a little help from his checkoff cronies at Midwest Dairy and DMI — masquerading as ‘dairy farmers.’

By Sherry Bunting

USDA’s recommended decision on Federal Milk Marketing Order Class I (fluid milk) formulas brought a big surprise getting very little attention. That surprise: “splitting the Class I baby” and adding what constitutes a “fifth Class” of milk — TWO Class I movers announced each month.

ZERO proposals to divide Class I into a two-mover system were aired at the national hearing. Even USDA’s analysis shows the two movers would differ by as much as $1 apart — or more — in any given month.

The hearing record is woefully inadequate, indeed completely void of testimony for a second Class I mover. No proposal. No evidence. No testimony. No analysis. No parameters. No definition.

What does this surprise two-mover decision mean?

Fresh, conventionally processed (HTST) milk would go back to being priced by the prior method, using the higher of the Class III or IV advance pricing factors to determine the Class I skim milk base price portion of the mover.

On the other hand, milk used to make extended shelf life (ESL) fluid milk products, defined only as “good for 60 days or more,” would continue to be priced using the average of these two pricing factors, plus-or-minus a rolling adjuster of the difference between the higher-of and average-of for 24 months, with a 12-month lag.

Confused yet?

The industry is calling this surprise two-mover twist ‘innovative’ and ‘creative’, even ‘brilliant.’ But let’s hold the horses a moment.

With two movers, fluid milk costs could be different for plants in the same location based on shelf life. Could processors change the label to move between the movers and pay whichever mover was lower? Who knows? There is no clear definition for the new class, and the parameters to qualify are non-existent.

ESL processors will know the rolling adjuster 12 months in advance, due to the “lag.” They will know the two advance-priced movers a month in advance. They will have it charted in an algorithm no doubt, and make decisions accordingly.

Dairy farmers, on the other hand, will find out how their milk was used and priced two weeks after all their milk for the month was trucked off the farm. If the two-price Class I system becomes law, dairy producers’ milk checks will be even less transparent than they are now!

Not only does the USDA hearing record and decision fail to clearly define ESL, the industry doesn’t even have an exact and generally-accepted definition or standard for ESL.

ESL is both a loose and specific term.

Generally speaking, ESL is a term covering a broad range of products — ranging from UHT (ultra high temperature) or ultra pasteurization, aseptic packaging, to the inclusion of a process that combines microfiltration, skim separation, and indirect heating (in stages). These processes yield what is more specifically referred to as ESL fresh milk with a longer shelf life in refrigeration, but is not shelf-stable.

What’s at the root here?

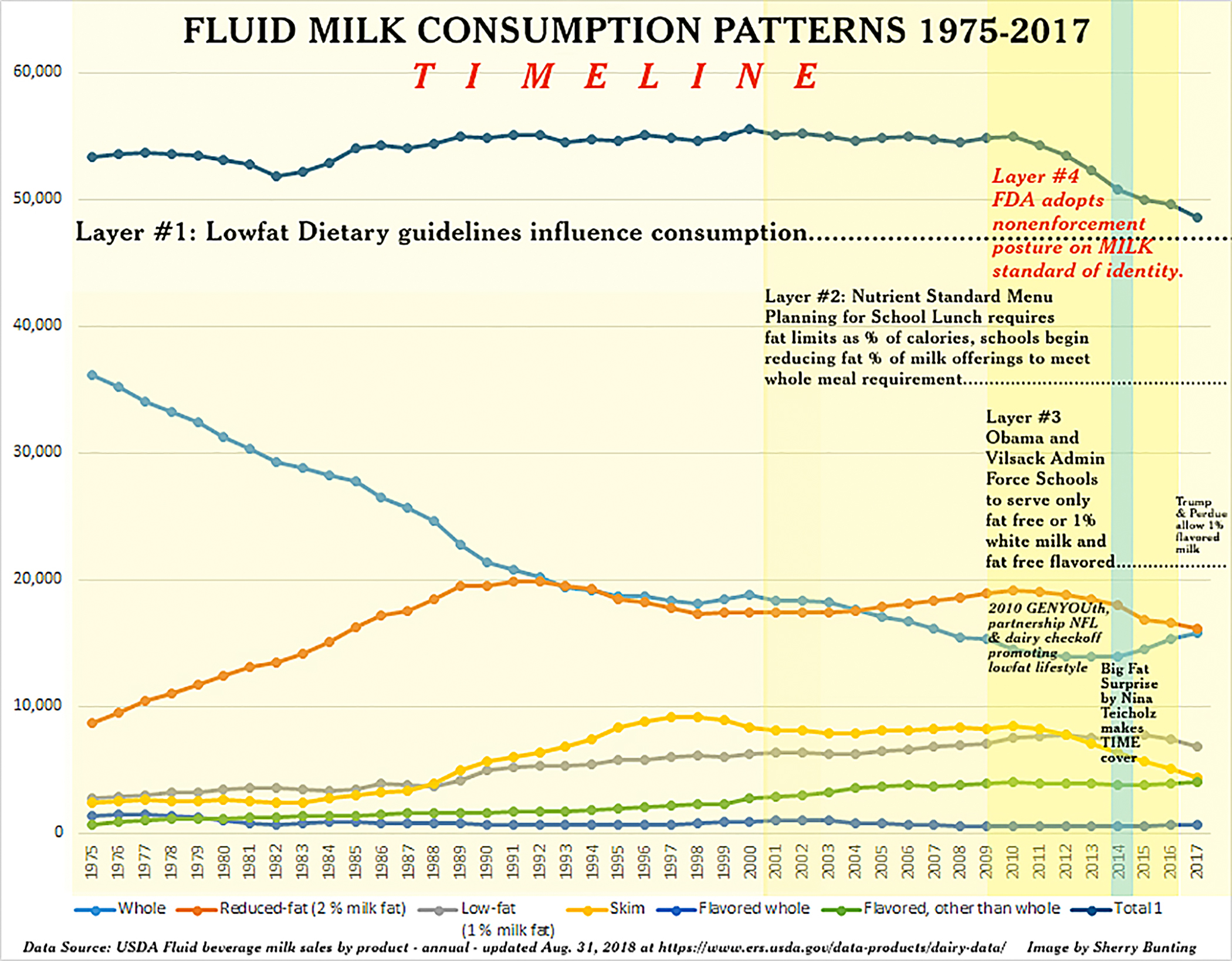

Dairy checkoff personnel have openly identified ESL — especially shelf stable aseptically packaged milk — as its “new milk beverage platform.” Dairy farmers’ promotion funds are being used to research and promote ESL milk, as well as studying and showing how consumers can be “taught” to accept it.

For the past few years, the four research centers supported by the checkoff have been drilling into milk’s elements to sift, sort, and test different combinations to reinvent milk as new beverages.

In 2023, North Carolina State researcher Dr. MaryAnne Drake —speaking at the 2023 Georgia Dairy Conference — talked about this “new milk beverage platform. We are after a shelf-stable milk that tastes great and meets our consumer’s sensory needs and our industry’s sustainability needs,” she said.

Bingo. Dairy checkoff funds for ESL are being driven by the net-zero sustainability targets. And now USDA’s federal milk order changes are proposing to lower dairy farmers’ Class I income and/or competitively favor, and in a way subsidize, ESL processors over fresh HTST fluid milk processors. Follow the money.

Dr. Michael Dykes of IDFA, at the Georgia Dairy Conference in January 2024, told dairy producers that “this is the direction we (processors) are moving… to get to some economies of scale and bring margin back to the business.” He said the planned new fluid milk processing capacity investments are largely ultra-filtered, aseptic, and ESL — 10 of the 11 new fluid plants on the IDFA map he displayed are ESL. Some will also make ultrafiltered milk and plant-based beverages too.

The linchpin to regional dairy systems and markets for milk from farms that fit USDA’s description of small businesses is the processing of fresh, conventionally pasteurized (HTST) fluid milk.

Meanwhile, dairy checkoff overseers, in cahoots with processors, are making big bets that consumers will embrace the obvious conversion underway to the consolidating shelf stable ESL milk, emboldened by the average-of pricing that has failed farmers miserably over the past five years and is now part of the proposed two-price Class I system mysteriously added to the USDA recommended decision when a two-price Class I system was never noticed as part of the hearing scope.

In the recommended decision, USDA notes that ESL currently represents 8 to 10% of total fluid milk sales but does not present the full picture of how the industry began aggressively converting to ESL since 2019 when Class I average-of was implemented. More of these accelerated investments will become operational in 2024-26.

Before we know it, the industry will have converted to ESL, and dairy farmers will once again experience disorderly marketing, depooling, and the basis risk of the mysterious average-of mover.

Dairy farmers have seen this movie before.

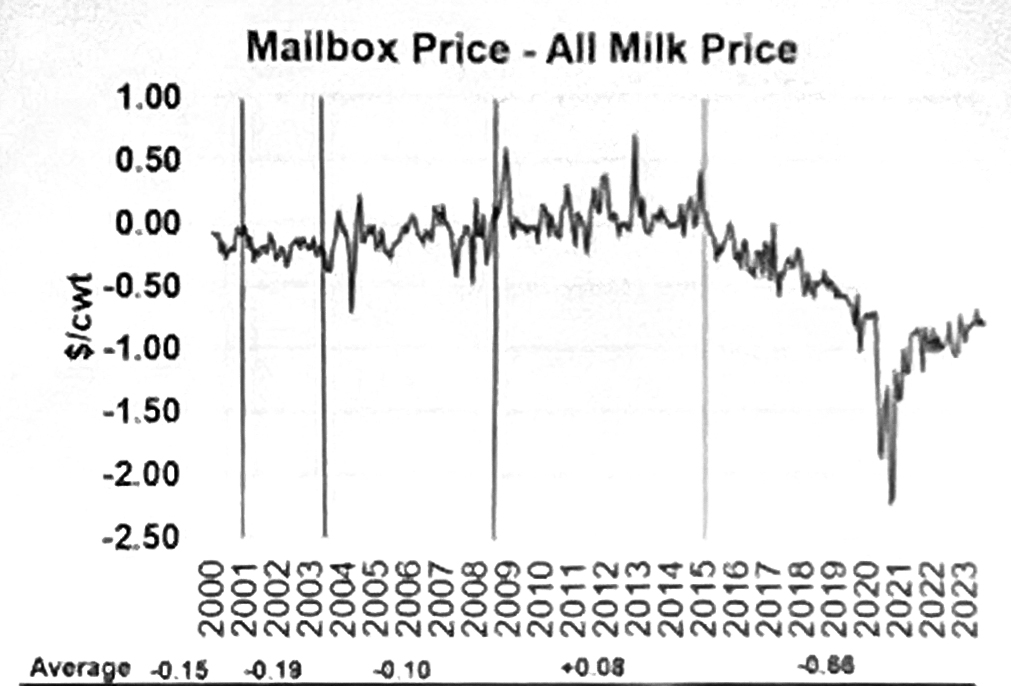

In 2018, the average-of method — which changed how the Class I base was calculated — was portrayed by National Milk and the IDFA as “revenue neutral.” But at the recent national milk order hearing, testimony revealed that farmers experienced Class I revenue losses totaling nearly $1.25 billion from May 2019 through July 2024… and other impacts.

Disorderly markets via the ‘average-of’ continue to result in losses and disrupt performance of risk management tools that fail to protect farmers against the intervals of extreme basis risk.

Proponents say the proposed rolling 36-to-13-month ESL adjuster on the second mover in USDA’s decision provides compensation to farmers for the difference between average-of and higher-of. However, that occurs gradually — over time — with a lagged interval. If tight milk supplies boost commodity prices and drive up all classes of milk, then dairy farmers’ incomes will at least partially lag years behind real-time markets!

ESL processors like Nestle and fairlife testified that the average-of method over the past five years allowed them to use Class III and IV hedges on the CME to offer flat 9- to-12-month pricing to wholesale customers and increase their sales. Nice to know the big corporations made money on that inequitable Class I pricing system.

Would a two-mover system ultimately reduce farmers’ access to milk markets in some regions and diminish the food security of those consumers? Watch the impact of a new, unregulated ESL plant now being built in Idaho!

Many legitimate questions lack answers

Milk is commonly prized as the freshest, least processed, most regionally local food at the supermarket. Will the USDA recommended decision accelerate consolidation and a reduction in fresh fluid milk availability for consumers?

Has USDA considered the purpose of the FMMO system is to promote orderly marketing and the adequate supply of fresh fluid milk? Will consumers accept the taste of the not-so-fresh ESL, or migrate faster to other beverages if fresh fluid milk is less available to them?

How will the two-mover system impact dairy farms located outside of the industry’s very specific identified growth centers?

Will this perpetuate the wide divergence between Classes III and IV that has been an issue since 2019, further punishing dairy farmers with disorderly marketing and opportunistic depooling?

Who knows? The hearing failed to define, examine, or obtain evidence on any such questions… or any other questions that the hearing process is meant to be open to because this decision falls outside of the hearing scope!

Vilsack strikes again?

This proposal — a price break favoring ESL milk — fits the climate and export goals set forth by Ag-Secretary-then-DMI-executive-then-Secretary-again, Tom Vilsack. The pathway to rapidly consolidate the dairy industry to meet those goals is to tilt the table against fresh fluid milk. This is something Vilsack already put a big dent in by removing whole milk from schools.

It’s like one well respected veterinarian in the industry observed recently in conversation: “Someone decided: Thou shalt drink low-fat milk and like it.”

That “someone” is apparently equally convinced that the industry shall move to ESL and aseptic milk processing… while using dairy farmers’ checkoff funds to figure out how to get consumers to like that too.

-30-