By Sherry Bunting, Farmshine, May 14, 2021

GORDONVILLE, Pa. – “Beef it’s what’s for dinner.” Remember that line?

For school kids, it could soon be Impossible Meat for lunch. USDA just approved a nutrition label for K-12 schools to substitute beef with the billionaire-invested Impossible Meat. Never mind that a May 2020 Newsweek article reported Beyond Meat, Impossible Meat and their competitors source most of their concentrated pea- and soy-protein from extrusion factories in China, even if the crops were grown in North America.

School foodservice directors report a barrage of supply-chain influencers touting fake meat meal options to reduce carbon emissions on the heels of the USDA nutrition label approval.

A local restaurant discovered last month that their wholesale food vendor added textured vegetable protein (concentrated soy and other additives) to the wholesale ‘Classic Beef Burger’ without warning. It is apparently part of a ‘cutting edge’ menu remake at the wholesale level – not the restaurant’s choice. (This particular restaurant switched promptly to Certified Angus burgers guaranteed to remain 100% beef).

Children came home from school this week with Junior Scholastics declaring “This meat could help save the planet!” accompanied by a photo of fake-beef in grocery packaging.

These are just a few examples in the past three weeks of how rapidly the wheels set in motion a decade ago are hitting the pavement.

How did we get here? For 12 to 13 years, the World Economic Forum (WEF), World Wildlife Fund (WWF), Big Food, Big Tech and Big Ag have been coalescing around this idea of supply-chain “sustainability” leverage to steer global food transformation with cattle clearly in the crosshairs – especially for developed nations in Europe as well as the United States.

By partnering officially and unofficially with national dairy and beef checkoff boards on “precompetitive sustainability and innovation”, for example, WWF has — in effect — been channeling government-mandated producer checkoff dollars toward implementing WWF’s supply-chain strategy for impacting commodities WWF believes need intervention to improve biodiversity, water and climate. The global corporations behind ‘food transformation’ are laughing all the way to the bank while grassroots producers essentially fund their own demise.

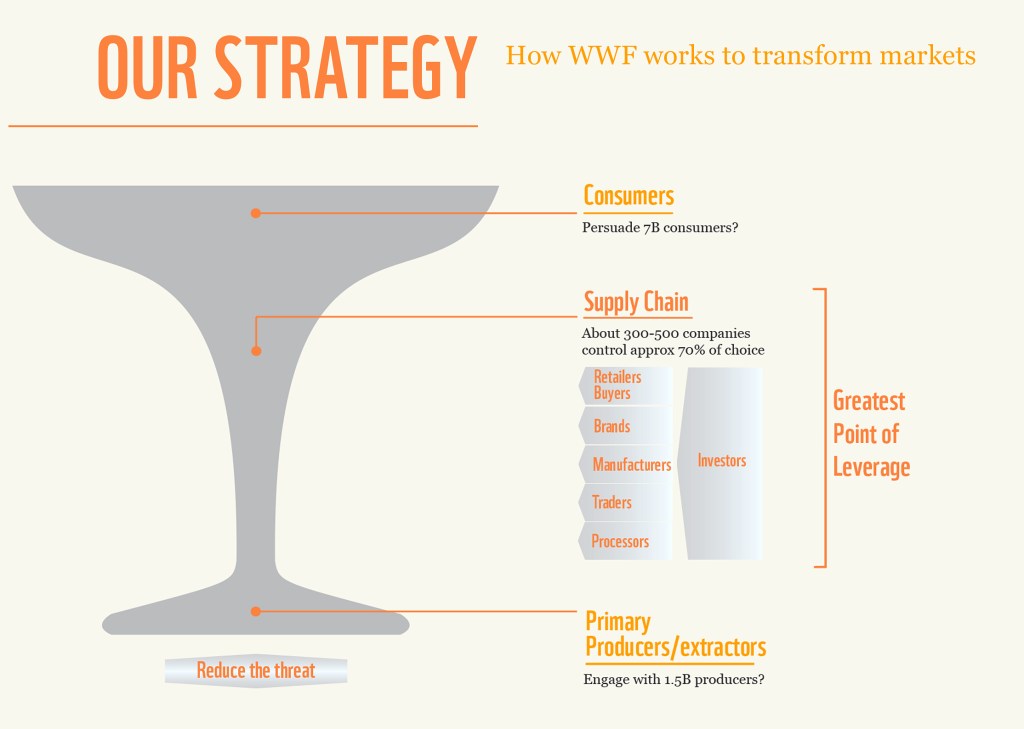

In the 44-page 2012 paper “Better Production for a Living Planet,” the WWF Market Transformation Initiative identified dairy and beef as two of the prime commodities they target through supply-chain companies controlling 70% of food choices.

The checkoff-funded sustainability materials coming out of the National Cattlemen’s Beef Board and Dairy Management Inc (DMI) show firsthand this relationship with WWF, by the use of the WWF logo, and in the case of dairy, the acknowledgment that a decade-long memorandum of understanding existed.

Add to this the government policies emerging that align directly with this global food, agriculture and land transformation, and the use of the vehicle of checkoff-funded “government speech,” becomes a bit clearer. It’s a clever way to leverage the supply chain and promote a message to consumers while pushing producers to align.

The WWF 2012 paper explains that in 2010, “WWF convened some of the biggest players in the beef industry to form the Global Roundtable for Sustainable Beef (GRSB). They included the world’s biggest beef buyer, McDonald’s; the biggest beef retailer, Walmart; and two of the largest beef traders, JBS and Cargill.”

While dairy and beef checkoff programs use government-mandated funds collected from producers for valuable local and state promotion programs linking producers to consumers, it is the direction of national checkoff programs – engaged with WWF and the largest processors and retailers in this way — that has producers like Karina Jones, a fifth generation Nebraska cattlewoman concerned.

Jones heads up the petition drive for a producer referendum on the $1/head beef checkoff. The effort began in South Dakota and is spreading nationwide via R-CALF and other national and state organizations.

During the farmer empowerment barn meeting hosted by Mike Eby of National Dairy Producers Organization (NDPO) and Organization for Competitive Markets (OCM) at his farm in Gordonville, Pennsylvania recently, two of the day’s speakers talked about the need for transparency and accountability in mandatory checkoff programs.

Marty Irby of OCM talked about the OFF Act, which is bipartisan legislation seeking to amend the checkoff laws to reaffirm that these programs may not contract with organizations that engage in policy advocacy, conflicts of interest, or anticompetitive activities. It would require publication of all budgets and disbursement of funds for the purpose of public inspection and submit to periodic audits by the USDA Inspector General.

“It’s not about taking those promotion dollars away, but to have a just system of checks and balances,” said Irby about the proposed legislation.

But others are taking a grassroots vote approach — concerned about government oversight of what is already determined to be ‘government speech’ funded by producer checkoff.

Jones talked at the barn meeting about the massive effort to gather over 100,000 signatures by July 2021 asking USDA to conduct a nationwide Beef Checkoff Referendum. A vote on the beef checkoff has not been conducted in 35 years. (See checkoffvote.com and the paper insert in the May 14, 2021 edition of Farmshine)

“It’s time to re-check the checkoff,” said Jones about the beef petition. “We want to signal to USDA that as cattle producers we are ready to vote again.”

She explained that in order for the Secretary of Agriculture to consider a referendum request, 10% of producers must sign the petition. This includes anyone who sold a beef animal and paid the $1/head checkoff, in the 12 months from July 2020 through July 2021, including beef cow-calf producers, seedstock producers, backgrounders, cattle feeders, dairy producers, and youth showing and selling livestock.

According to the 2017 Census, 10% of the beef producers would mean 89,000 signatures needed.

“But we don’t know the vetting process the Secretary will use to approve or deny the petition request, so we want to reach over 100,000 signatures by July 2021,” said Jones.

“The cattle landscape today is much different from 35 years ago,” she said. “Our checkoff does not support promotion of American-born-and-raised beef. We want to equalize the power for the grassroots U.S. cattle producer… the power and the dollars are falling into the hands of the few.”

According to Jones, the checkoff referendum petition seeks a return to balance as well as increased transparency and accountability, through the voting process. Proponents of the right to vote believe producers should be able to fund education and promotion that takes a stand for real, USA-produced beef, something the trends and supply chain partnerships emerging today – along with “government speech” rules — make difficult.

She talked about “mavericks” who were elected to the beef board in the past and tried to change the power structure of the lobbying groups and processing industry involvement. Jones said the current structure has gone on so long — uninterrupted — that a referendum petition is the only avenue many beef producers see today as a way to bring accountability back.

“This is a call to action. Many producers are still not aware of this beef checkoff referendum petition,” said Jones as she urged producers to be bold and harness the opportunities to set a direction that changes the balance of power.

To be continued