Opinion: Dean bankruptcy offers opportunity we should earnestly pursue

By Sherry Bunting, Farmshine, Friday, Nov. 29, 2019

If ever there was a time for state governments to sit down with their dairy farmers and agriculture infrastructure for a meeting of the minds… it is now.

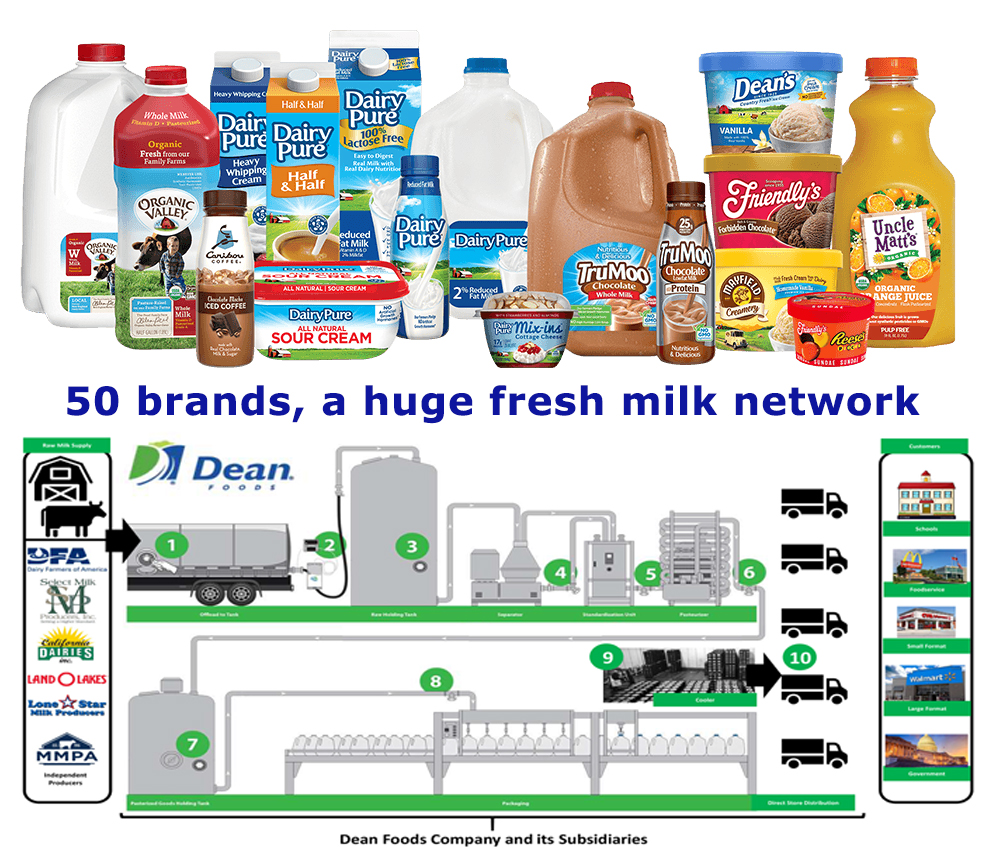

The future is very much at stake with Dean Foods – the nation’s largest milk bottler – in Chapter 11 bankruptcy and sale proceedings, as the industry is largely signaling the buyer should be DFA.

But not so fast.

This could be an opportunity to look at the strength of Dean’s holdings and consider a different path forward, one that returns some of the regional branding power to farmers and consumers in the regions served by Dean’s 60 milk processing plants.

Dean Foods accounts for one-third of the milk bottled in the U.S., and the roots of its holdings go back to family operations with brands that were once – and some still are – household names.

In focus groups and shopper surveys, consumers demonstrate they understand what it means to buy local. They understand that buying local – especially fresh staples like milk – means keeping their dollars working in their communities. Consumers also say they want to help local farms. And they want to see clear labeling to know where their milk comes from.

Meanwhile, surveys show the gallon and half-gallon jug are still the most popular packaging among real milk buyers. Even though the category as a whole is declining, it is still a huge category and one that has not been tended or nurtured or cared for in more than a decade. In fact, the category has seen the deck stacked against it by government rules and government speech.

Taste is also important to consumers, as is nutrition. Where fluid milk is concerned, these two areas have also been lacking because checkoff-funded promotion became government speech that pushed fat-free and low-fat milk to the point where consumers have no idea what real milk tastes like – until they switch to whole milk, and they are.

Folks, this is an opportunity to chart a new path for fresh fluid milk, to breathe some life into it. We see it in whole milk sales that are rising. Just think what could be accomplished if significant resources were devoted to truly revitalizing milk.

As the dairy industry streamlines behind innovation and checkoff-funded partnerships to disrupt the dairy case — to be more like the plant-based non-dairy disruptors — there is still a majority of consumers choosing real milk, and more of them are choosing real whole milk as whole milk today is the top seller in the category, and whole flavored milk is growing by double-digits.

Can we disrupt all the disruption with a disruptive back-to-the-future original? I think so. But now is the time to hit it hard. A few years from now will be too late.

Dean Foods has the network and the facilities and the history a savvy consortium of buyers could tap into for going back to local or regional emphasis with brands. The DairyPure national branding experiment started out strong, but in the past few years has been squeezed-out by large retailers – and notably Walmart — pushing their own store brands with loss-leading strategies while hoisting the price of Dean DairyPure much higher.

And that’s part of the problem. Stores think it’s okay to loss-lead with milk, but they are not willing to eat that loss themselves. We need them at the regional dairy future table as well.

In the bankruptcy proceedings at hand, some of Dean Foods’ unsecured bondholders are protesting a rapid sale of assets to DFA in what they say equates to a “fire sale” that doesn’t maximize value. Did Dean receive a proposal from them too before filing bankruptcy? Sources indicate bondholders offered restructuring terms before the bankruptcy filing that would have changed the current picture for Dean Foods.

Will these bondholders that are opposing sale to DFA make an offer now? Can Dean Foods’ assets be sold piece by piece to be broken up more regionally? These questions don’t have clear answers at this time.

What is clear is that payments for milk by Dean to DFA are being delayed five business days as bondholders want to be sure they are truly ‘critical vendor’ payments and that there are no shenanigans between the would-be buyer and seller.

What is also clear is that Dean and DFA have a history, and that history includes the good, the bad, and yes, the ugly.

DFA was there every step of the way as mergers and acquisitions led Dean Foods on its path to become the nation’s largest milk bottler. DFA is Dean’s largest supplier of milk, and DFA leaders are on record stating that Dean Foods is the largest buyer of DFA milk.

If DFA purchases “substantially all” of Dean’s assets, we know more rapid consolidation of the fluid milk market will occur. DFA’s leaders — as well as the leaders of all the prominent organizations in the dairy industry, including the dairy checkoff — have been clear if we’re paying attention. The future they see is in moving away from investing in fresh fluid milk and moving toward ultrafiltration and aseptic packaging and blending and innovating for beverages that can be supplied to anywhere from anywhere without transporting milk’s water-volume by tanker.

Those are more of the ingredients for a monopolization of milk that may not even be considered by the Department of Justice. Without another offer or series of regional offers on the table, DFA would stand as the only option — other than complete failure of the firm under bankruptcy. This, alone, could put the sale to DFA on the fast track as sources talk about bankruptcy clauses that allow purchases to occur — without DOJ approval — when failure is the only other option.

So while consumers are consciously being pursued by the industry and dairy checkoff to move them away from their habit of reaching for that jug of milk and toward new beverages that contain milk — or are innovated new varieties of milk, or are blended and diluted with plant-based alternatives — what happens to the dairy producers in communities whose relevance is tied closely with retaining fresh fluid milk as a nurtured market and being a producer of a ‘local’ and fresh product? These producers are also forced to pay into the dairy checkoff that is developing these alternatives, not promoting or educating about fresh whole milk, and in effect funding their own demise.

Who will tend this store, nurture these customers, satisfy consumer desires to buy-local and ‘help farmers’ and their new-found eagerness to learn more about real fresh whole milk nutrition?

If states and regions don’t work to keep fresh milk facilities in their midst, the global message on ‘sustainability’, ‘carbon footprint’, ‘flexitarian diets,’ and ‘planetary boundaries’ will overtake the public consciousness, and the choices disrupting and diluting the dairy case will overtake fresh fluid milk.

In business today, that’s all we hear: Innovate and disrupt. Maybe it’s time to disrupt the disruptors, to put together a fresh fluid milk branding and packaging campaign that makes milk new again.

-30-

(Incidentally, a billboard popped up recently on I-65 North outside of Louisville, Kentucky –picturing Holstein dairy cows grazing and proclaiming Kroger as “proud to support Kentucky farmers”. What could this mean? As noted in this report, requests to Kroger’s communications department — to understand what these billboards mean and what percentage of milk in Kentucky Kroger stores actually comes from Kentucky farms — have gone unanswered.)

(Incidentally, a billboard popped up recently on I-65 North outside of Louisville, Kentucky –picturing Holstein dairy cows grazing and proclaiming Kroger as “proud to support Kentucky farmers”. What could this mean? As noted in this report, requests to Kroger’s communications department — to understand what these billboards mean and what percentage of milk in Kentucky Kroger stores actually comes from Kentucky farms — have gone unanswered.) Follow up questions about how “excess milk” is determined to be a problem in a milk-deficit area, have not been answered. (Since publication, DFA’s John Wilson replied in an email that the “excess milk situation is really the region, not specifically Kentucky.” One can see why when comparing the

Follow up questions about how “excess milk” is determined to be a problem in a milk-deficit area, have not been answered. (Since publication, DFA’s John Wilson replied in an email that the “excess milk situation is really the region, not specifically Kentucky.” One can see why when comparing the  Meanwhile, of the

Meanwhile, of the  FORT WAYNE, Ind. — Bottling at Walmart’s first-of-its-kind milk plant in Fort Wayne, Indiana will be delayed.

FORT WAYNE, Ind. — Bottling at Walmart’s first-of-its-kind milk plant in Fort Wayne, Indiana will be delayed. Harrisburg Dairies, Schneider’s Dairy step up for milk from at least 9 of 42 dropped Pa. farms

Harrisburg Dairies, Schneider’s Dairy step up for milk from at least 9 of 42 dropped Pa. farms

Emotional town hall meeting in Lebanon, Pa. draws over 200 people urging contract extensions for Dean’s dropped dairies

Emotional town hall meeting in Lebanon, Pa. draws over 200 people urging contract extensions for Dean’s dropped dairies Indeed, a legacy is on the line in Lebanon and Lancaster Counties, as in other communities similarly affected.

Indeed, a legacy is on the line in Lebanon and Lancaster Counties, as in other communities similarly affected. Rick Stehr, a nutritionist and owner of R&J Consulting, directed some of his comments to the significant number of youth in the audience, saying that these farms are where the next generation learns morals, values, work ethic and the joys and failures of life.

Rick Stehr, a nutritionist and owner of R&J Consulting, directed some of his comments to the significant number of youth in the audience, saying that these farms are where the next generation learns morals, values, work ethic and the joys and failures of life. Brent Hostetter, Lebanon County dairy producer: “I am not sure how we are going to handle this going forward. We have put all we have into the farm. Nothing will settle like it should.”

Brent Hostetter, Lebanon County dairy producer: “I am not sure how we are going to handle this going forward. We have put all we have into the farm. Nothing will settle like it should.” Alisha Risser, Lebanon County dairy producer: “We are proud of our milk that we produce on our farm, and we are proud of the Swiss Premium milk in our community. We are just asking the community to support us with letters to Dean Foods to provide a contract extension until fall or winter.”

Alisha Risser, Lebanon County dairy producer: “We are proud of our milk that we produce on our farm, and we are proud of the Swiss Premium milk in our community. We are just asking the community to support us with letters to Dean Foods to provide a contract extension until fall or winter.” Kirby Horst, Lebanon County dairy producer: “The thought of looking out at the pastures and not seeing the cows … I don’t know if I can handle that.”

Kirby Horst, Lebanon County dairy producer: “The thought of looking out at the pastures and not seeing the cows … I don’t know if I can handle that.” Dr. Bruce Keck, Annville-Cleona Veterinary Service: “Without a contract extension…This is like asking a loaded tractor trailer to turn as fast as a speeding car. It’s not enough time.”

Dr. Bruce Keck, Annville-Cleona Veterinary Service: “Without a contract extension…This is like asking a loaded tractor trailer to turn as fast as a speeding car. It’s not enough time.” Rick Stehr, R&J Consulting: “This is worth fighting for…worth fighting all together for.”

Rick Stehr, R&J Consulting: “This is worth fighting for…worth fighting all together for.”

Rep. Sue Helm: “A group of representatives are writing a letter Dean Foods. We want farmers to stay in contact with us.”

Rep. Sue Helm: “A group of representatives are writing a letter Dean Foods. We want farmers to stay in contact with us.” Rep. Russ Diamond: “We wanted to get Pennsylvania milk into Pennsylvania schools but have been told that with the product stream in Pennsylvania, this is hard to do. This Pa. Milk Marketing Board issue is a hard issue to get to the bottom, and people get very protective of it.”

Rep. Russ Diamond: “We wanted to get Pennsylvania milk into Pennsylvania schools but have been told that with the product stream in Pennsylvania, this is hard to do. This Pa. Milk Marketing Board issue is a hard issue to get to the bottom, and people get very protective of it.” Rep. Frank Ryan: “Keep faith first and foremost and your sense of humor and talk with your bankers. This is emotionally draining and people want to run from it. There is a solution and we need to work together to find it.”

Rep. Frank Ryan: “Keep faith first and foremost and your sense of humor and talk with your bankers. This is emotionally draining and people want to run from it. There is a solution and we need to work together to find it.”

Mike Eby, chairman National Dairy Producers Organization and former Lancaster County dairy farmer: “The media are our friends. We can work with the media to advertise our product in ways the (check off) promotion programs can’t.”

Mike Eby, chairman National Dairy Producers Organization and former Lancaster County dairy farmer: “The media are our friends. We can work with the media to advertise our product in ways the (check off) promotion programs can’t.”

While the company will not provide a list of affected plants or a state by state break down in the number of farms or volume of milk affected, they have indicated that the state that may be hardest hit on a volume basis is Indiana.

While the company will not provide a list of affected plants or a state by state break down in the number of farms or volume of milk affected, they have indicated that the state that may be hardest hit on a volume basis is Indiana. In fact, the farm this reporter visited in Lancaster County Tuesday was already working to call every available market and neighbors who also lost their contracts were looking at everything they could think of. Four or five trucks go through the county picking up milk every day so they wonder if each one can find a market or if they are better off pulling their milk together to find a single-haul market.

In fact, the farm this reporter visited in Lancaster County Tuesday was already working to call every available market and neighbors who also lost their contracts were looking at everything they could think of. Four or five trucks go through the county picking up milk every day so they wonder if each one can find a market or if they are better off pulling their milk together to find a single-haul market.